Pre-existing condition coverage in insurance policies provides protection for medical conditions diagnosed before the policy start date, ensuring treatment expenses are covered without waiting periods. Exclusion periods refer to the specified time frames during which claims related to pre-existing conditions are not payable, often leading to delayed benefits for policyholders. Explore the differences between these terms to make well-informed insurance decisions.

Why it is important

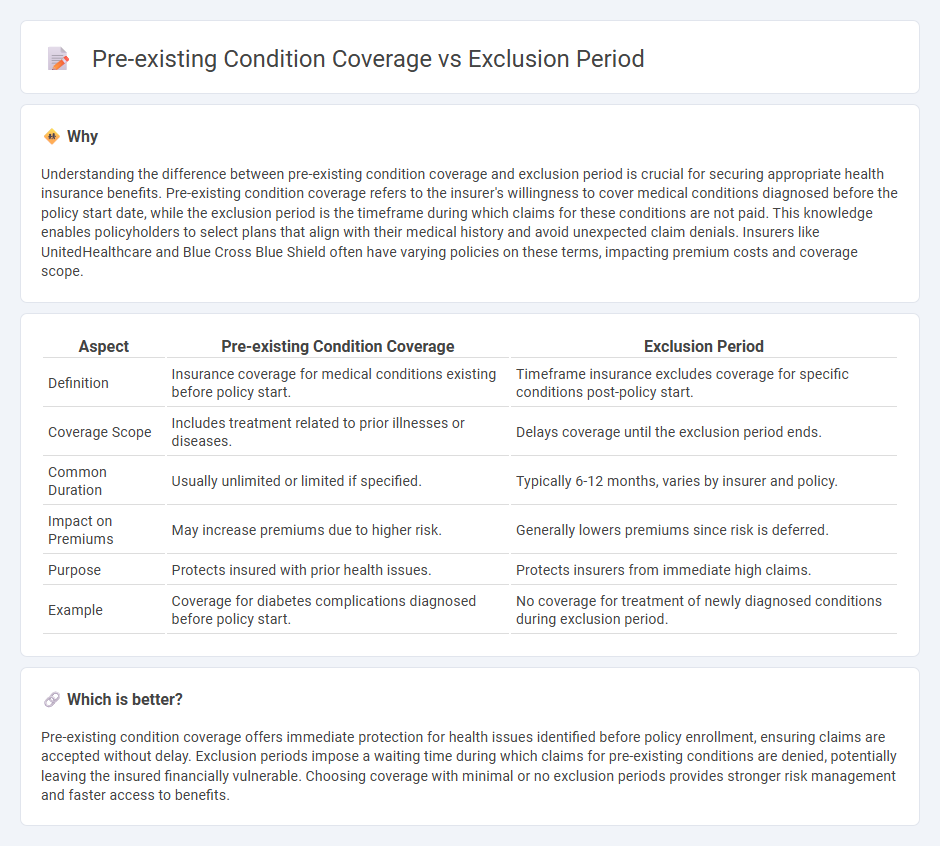

Understanding the difference between pre-existing condition coverage and exclusion period is crucial for securing appropriate health insurance benefits. Pre-existing condition coverage refers to the insurer's willingness to cover medical conditions diagnosed before the policy start date, while the exclusion period is the timeframe during which claims for these conditions are not paid. This knowledge enables policyholders to select plans that align with their medical history and avoid unexpected claim denials. Insurers like UnitedHealthcare and Blue Cross Blue Shield often have varying policies on these terms, impacting premium costs and coverage scope.

Comparison Table

| Aspect | Pre-existing Condition Coverage | Exclusion Period |

|---|---|---|

| Definition | Insurance coverage for medical conditions existing before policy start. | Timeframe insurance excludes coverage for specific conditions post-policy start. |

| Coverage Scope | Includes treatment related to prior illnesses or diseases. | Delays coverage until the exclusion period ends. |

| Common Duration | Usually unlimited or limited if specified. | Typically 6-12 months, varies by insurer and policy. |

| Impact on Premiums | May increase premiums due to higher risk. | Generally lowers premiums since risk is deferred. |

| Purpose | Protects insured with prior health issues. | Protects insurers from immediate high claims. |

| Example | Coverage for diabetes complications diagnosed before policy start. | No coverage for treatment of newly diagnosed conditions during exclusion period. |

Which is better?

Pre-existing condition coverage offers immediate protection for health issues identified before policy enrollment, ensuring claims are accepted without delay. Exclusion periods impose a waiting time during which claims for pre-existing conditions are denied, potentially leaving the insured financially vulnerable. Choosing coverage with minimal or no exclusion periods provides stronger risk management and faster access to benefits.

Connection

Pre-existing condition coverage determines whether an insurance policy will pay for illnesses or conditions diagnosed before the policy start date. The exclusion period is the specific time frame during which claims related to these pre-existing conditions are denied by the insurer. Understanding both terms is crucial for policyholders to avoid unexpected coverage gaps and financial liabilities.

Key Terms

Waiting Period

The exclusion period refers to the time during which insurance does not cover certain conditions, often linked to a waiting period before benefits commence. Pre-existing condition coverage typically involves limitations or exclusions for health issues that existed before the policy start date, with the waiting period determining when coverage for these conditions begins. To understand how these factors impact your insurance benefits, explore detailed guidelines on waiting periods and coverage policies.

Underwriting

Exclusion periods in underwriting refer to specific time frames during which claims for certain conditions are not payable, serving as a risk mitigation tool for insurers. Pre-existing condition coverage determines whether health issues present before policy initiation are covered, significantly influencing underwriting decisions and premium calculations. Explore the detailed underwriting practices and their impact on coverage for a comprehensive understanding.

Policy Limitations

Exclusion periods refer to the timeframe after policy activation during which certain conditions are not covered, while pre-existing condition coverage addresses illnesses or injuries existing before policy start, often subject to specific limits. Policy limitations on these terms vary widely, typically including waiting periods, caps on claim amounts, or outright exclusions impacting claims processing. Explore detailed guidelines on navigating exclusion periods and pre-existing condition coverage to optimize your insurance benefits.

Source and External Links

Exclusion from childcare, preschool, school and work - Describes the exclusion periods for various infectious diseases in South Australia, including considerations for childcare workers with gastroenteritis.

Children and young people settings: tools and resources - Offers guidance on exclusion periods for infectious diseases in UK schools and childcare facilities, including notifiable diseases like whooping cough.

Communicable Diseases and Exclusion Chart - Provides a chart for searching exclusion periods based on disease names or symptoms, including conditions like scarlet fever and strep throat.

dowidth.com

dowidth.com