Behavioral policy pricing analyzes individual policyholders' risk profiles using data from driving habits, health metrics, or lifestyle choices to tailor insurance premiums more accurately. Peer-to-peer pricing groups similar policyholders together, allowing shared risk and potential cost savings by rewarding low-claim groups with reduced rates. Explore how these innovative insurance models transform premium calculations and customer engagement.

Why it is important

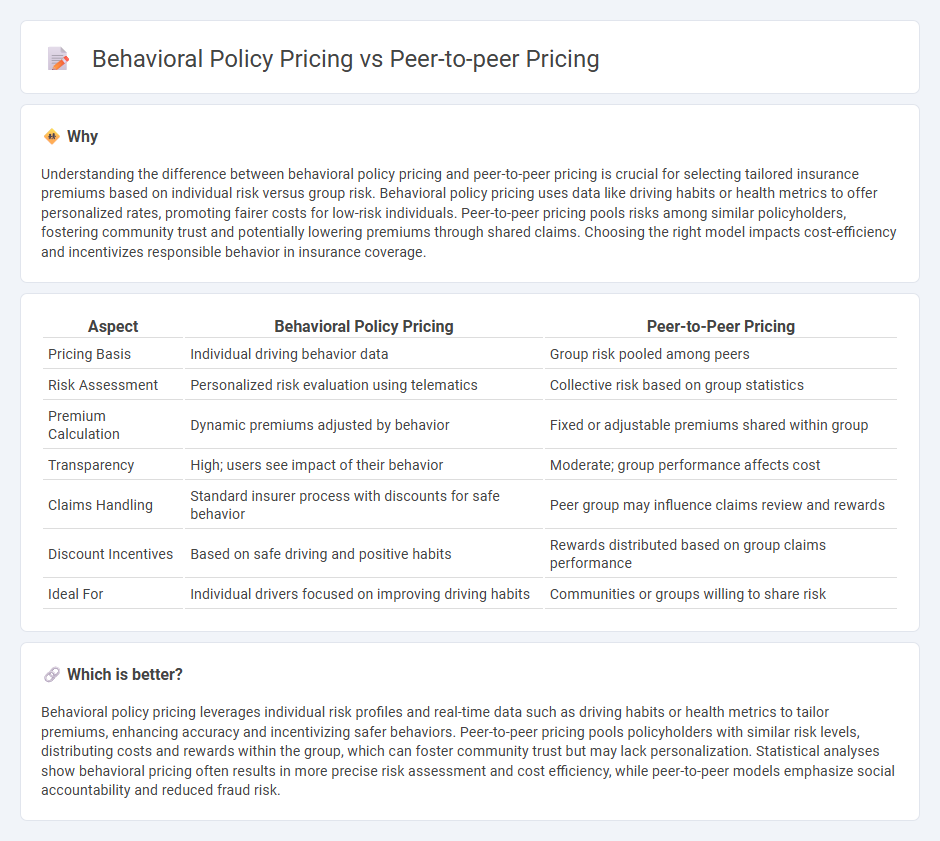

Understanding the difference between behavioral policy pricing and peer-to-peer pricing is crucial for selecting tailored insurance premiums based on individual risk versus group risk. Behavioral policy pricing uses data like driving habits or health metrics to offer personalized rates, promoting fairer costs for low-risk individuals. Peer-to-peer pricing pools risks among similar policyholders, fostering community trust and potentially lowering premiums through shared claims. Choosing the right model impacts cost-efficiency and incentivizes responsible behavior in insurance coverage.

Comparison Table

| Aspect | Behavioral Policy Pricing | Peer-to-Peer Pricing |

|---|---|---|

| Pricing Basis | Individual driving behavior data | Group risk pooled among peers |

| Risk Assessment | Personalized risk evaluation using telematics | Collective risk based on group statistics |

| Premium Calculation | Dynamic premiums adjusted by behavior | Fixed or adjustable premiums shared within group |

| Transparency | High; users see impact of their behavior | Moderate; group performance affects cost |

| Claims Handling | Standard insurer process with discounts for safe behavior | Peer group may influence claims review and rewards |

| Discount Incentives | Based on safe driving and positive habits | Rewards distributed based on group claims performance |

| Ideal For | Individual drivers focused on improving driving habits | Communities or groups willing to share risk |

Which is better?

Behavioral policy pricing leverages individual risk profiles and real-time data such as driving habits or health metrics to tailor premiums, enhancing accuracy and incentivizing safer behaviors. Peer-to-peer pricing pools policyholders with similar risk levels, distributing costs and rewards within the group, which can foster community trust but may lack personalization. Statistical analyses show behavioral pricing often results in more precise risk assessment and cost efficiency, while peer-to-peer models emphasize social accountability and reduced fraud risk.

Connection

Behavioral policy pricing leverages data on individual customer behaviors to customize insurance premiums, while peer-to-peer pricing pools similar policyholders to share risk and reduce costs collectively. Both approaches utilize real-time data analytics and machine learning to enhance risk assessment accuracy, driving personalized and competitive pricing models. This connection fosters improved transparency and incentivizes safer behaviors among policyholders within community-based insurance frameworks.

Key Terms

Risk Pooling

Peer-to-peer pricing leverages risk pooling by grouping individuals with similar risk profiles to share costs and reduce overall premiums, enhancing fairness and minimizing adverse selection. Behavioral policy pricing incorporates individual behavior data, such as driving habits or lifestyle choices, to dynamically adjust premiums and incentivize risk-reducing actions within the risk pool. Explore how these innovative pricing models transform risk management and optimize insurance outcomes.

Usage-Based Pricing

Usage-based pricing in peer-to-peer models enables direct cost allocation based on actual consumption, fostering transparency and fairness among users. Behavioral policy pricing leverages customer data and usage patterns to dynamically adjust prices, optimizing revenue while encouraging desired user behaviors. Explore how these pricing strategies transform value delivery and customer experience in modern marketplaces.

Premium Calculation

Peer-to-peer pricing calculates premiums by comparing risk profiles among similar individuals, fostering competitive rates through direct data sharing and risk matching. Behavioral policy pricing adjusts premiums based on individual policyholder behaviors, such as driving habits or payment history, leveraging detailed telematics or transactional data. Explore how these dynamic models transform premium calculation strategies and optimize insurance costs for consumers.

Source and External Links

Top 13+ Peer-to-Peer Fundraising Platforms for Nonprofits - Peer-to-peer fundraising platforms typically charge a monthly fee starting around $0 to $199 plus transaction fees, with platform fees varying from 2% to 8% depending on features and nonprofit verification status.

12 Popular Peer-to-Peer Fundraising Platforms - Neon One - Pricing models include tiered subscriptions from free with a small platform fee (around 1.75%) up to $139/month for advanced plans, plus transaction processing fees typically around 2.9% + $0.30 per transaction.

Exploring the world of P2P payment for business - Helcim - Basic P2P payments for individuals are often free but for business or instant transfers, fees usually apply around 1-3% of the transaction amount, similar to standard credit card processing fees.

dowidth.com

dowidth.com