Crop yield insurance specifically safeguards farmers against losses in crop production due to natural disasters, pests, or adverse weather conditions, focusing on protecting expected harvest quantities. Multiple peril insurance offers broader coverage by insuring against a combination of risks including drought, flood, hail, and disease, thereby providing more comprehensive financial protection. Explore further to understand which insurance solution best secures agricultural investments and enhances farm resilience.

Why it is important

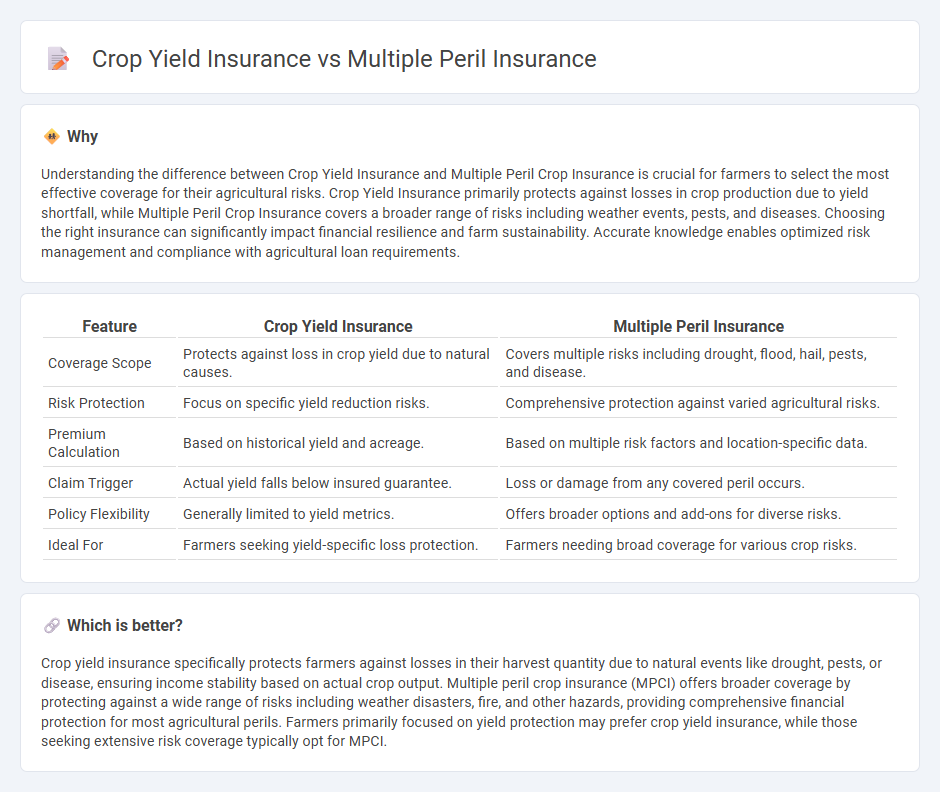

Understanding the difference between Crop Yield Insurance and Multiple Peril Crop Insurance is crucial for farmers to select the most effective coverage for their agricultural risks. Crop Yield Insurance primarily protects against losses in crop production due to yield shortfall, while Multiple Peril Crop Insurance covers a broader range of risks including weather events, pests, and diseases. Choosing the right insurance can significantly impact financial resilience and farm sustainability. Accurate knowledge enables optimized risk management and compliance with agricultural loan requirements.

Comparison Table

| Feature | Crop Yield Insurance | Multiple Peril Insurance |

|---|---|---|

| Coverage Scope | Protects against loss in crop yield due to natural causes. | Covers multiple risks including drought, flood, hail, pests, and disease. |

| Risk Protection | Focus on specific yield reduction risks. | Comprehensive protection against varied agricultural risks. |

| Premium Calculation | Based on historical yield and acreage. | Based on multiple risk factors and location-specific data. |

| Claim Trigger | Actual yield falls below insured guarantee. | Loss or damage from any covered peril occurs. |

| Policy Flexibility | Generally limited to yield metrics. | Offers broader options and add-ons for diverse risks. |

| Ideal For | Farmers seeking yield-specific loss protection. | Farmers needing broad coverage for various crop risks. |

Which is better?

Crop yield insurance specifically protects farmers against losses in their harvest quantity due to natural events like drought, pests, or disease, ensuring income stability based on actual crop output. Multiple peril crop insurance (MPCI) offers broader coverage by protecting against a wide range of risks including weather disasters, fire, and other hazards, providing comprehensive financial protection for most agricultural perils. Farmers primarily focused on yield protection may prefer crop yield insurance, while those seeking extensive risk coverage typically opt for MPCI.

Connection

Crop yield insurance and multiple peril insurance are interconnected as both policies protect farmers against financial losses due to adverse weather conditions, pests, and diseases. Crop yield insurance specifically guarantees a minimum harvest quantity, while multiple peril insurance covers a wide range of risks including drought, flood, hail, and other natural disasters affecting overall crop production. Together, they provide comprehensive risk management for agricultural producers by safeguarding yields and income stability.

Key Terms

Perils Covered

Multiple peril insurance offers comprehensive protection by covering a broad range of risks including drought, hail, flood, and disease that can adversely affect crops. Crop yield insurance specifically focuses on the quantifiable loss of crop production due to these perils, offering payouts based on actual yield reductions rather than the occurrence of individual events. Explore how these insurance options can safeguard agricultural investments and improve risk management strategies.

Indemnity Basis

Multiple peril insurance provides indemnity based on actual losses from covered perils like drought, flood, or hail, offering comprehensive protection against a range of risks affecting crops. Crop yield insurance focuses specifically on compensating farmers for reduced crop yields due to insured events, calculating indemnity by comparing expected and actual production levels. Explore detailed comparisons to understand how indemnity structures impact risk management strategies.

Coverage Scope

Multiple peril insurance covers a broad range of risks including natural disasters, pests, and disease affecting crops, providing comprehensive protection for farmers against unexpected events. Crop yield insurance specifically guarantees a minimum crop output, offering financial compensation only when yields fall below a predetermined threshold. Explore detailed comparisons to understand which insurance type best safeguards your agricultural investments.

Source and External Links

Multiple-peril insurance (Wikipedia) - Bundles several types of coverage--like business crime, auto, marine, or farm--into one policy, often resulting in lower premiums and broader protection for losses that typically occur together.

What is a Multi-peril Policy? (Insuranceopedia) - Covers multiple causes of loss (such as fire, theft, or water damage) under a single policy, eliminating the need for separate, individual insurance plans for each risk.

Multiple Peril Crop Insurance Coverage Options (ProAg) - Federally subsidized insurance that protects farmers from a wide range of natural causes of loss, including drought, excessive moisture, freeze, disease, and more, with customizable endorsements for different crops and regions.

dowidth.com

dowidth.com