Pet health insurance provides coverage for veterinary expenses, safeguarding your pet against unexpected medical costs and ensuring access to quality care. Medicare supplement insurance, also known as Medigap, helps cover out-of-pocket expenses not paid by Medicare Parts A and B, such as copayments, coinsurance, and deductibles. Explore detailed comparisons to determine which insurance best fits your health care needs and financial planning.

Why it is important

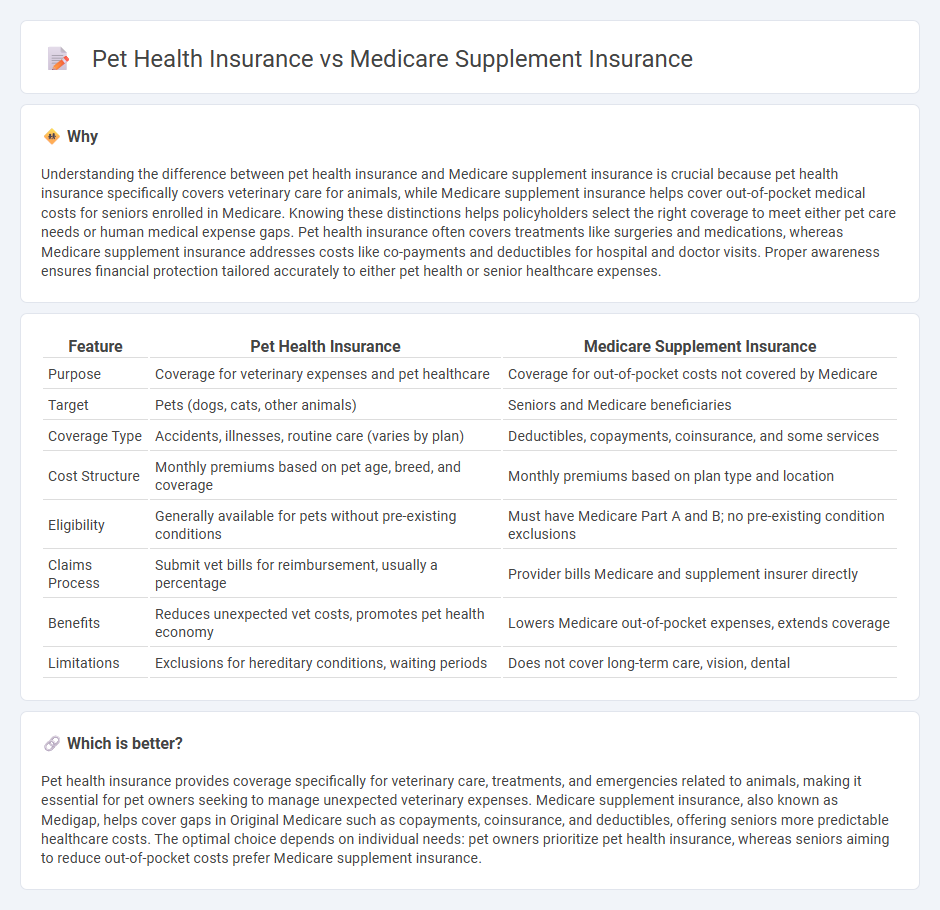

Understanding the difference between pet health insurance and Medicare supplement insurance is crucial because pet health insurance specifically covers veterinary care for animals, while Medicare supplement insurance helps cover out-of-pocket medical costs for seniors enrolled in Medicare. Knowing these distinctions helps policyholders select the right coverage to meet either pet care needs or human medical expense gaps. Pet health insurance often covers treatments like surgeries and medications, whereas Medicare supplement insurance addresses costs like co-payments and deductibles for hospital and doctor visits. Proper awareness ensures financial protection tailored accurately to either pet health or senior healthcare expenses.

Comparison Table

| Feature | Pet Health Insurance | Medicare Supplement Insurance |

|---|---|---|

| Purpose | Coverage for veterinary expenses and pet healthcare | Coverage for out-of-pocket costs not covered by Medicare |

| Target | Pets (dogs, cats, other animals) | Seniors and Medicare beneficiaries |

| Coverage Type | Accidents, illnesses, routine care (varies by plan) | Deductibles, copayments, coinsurance, and some services |

| Cost Structure | Monthly premiums based on pet age, breed, and coverage | Monthly premiums based on plan type and location |

| Eligibility | Generally available for pets without pre-existing conditions | Must have Medicare Part A and B; no pre-existing condition exclusions |

| Claims Process | Submit vet bills for reimbursement, usually a percentage | Provider bills Medicare and supplement insurer directly |

| Benefits | Reduces unexpected vet costs, promotes pet health economy | Lowers Medicare out-of-pocket expenses, extends coverage |

| Limitations | Exclusions for hereditary conditions, waiting periods | Does not cover long-term care, vision, dental |

Which is better?

Pet health insurance provides coverage specifically for veterinary care, treatments, and emergencies related to animals, making it essential for pet owners seeking to manage unexpected veterinary expenses. Medicare supplement insurance, also known as Medigap, helps cover gaps in Original Medicare such as copayments, coinsurance, and deductibles, offering seniors more predictable healthcare costs. The optimal choice depends on individual needs: pet owners prioritize pet health insurance, whereas seniors aiming to reduce out-of-pocket costs prefer Medicare supplement insurance.

Connection

Pet health insurance and Medicare supplement insurance both serve to reduce out-of-pocket expenses by covering costs not paid by primary plans. Medicare supplement insurance (Medigap) helps fill gaps in traditional Medicare coverage for seniors, while pet health insurance provides financial protection for veterinary care expenses. Both types of insurance aid in managing unexpected medical costs, ensuring affordability and access to necessary healthcare services.

Key Terms

**Medicare Supplement Insurance:**

Medicare Supplement Insurance, also known as Medigap, fills coverage gaps in Original Medicare by helping pay for out-of-pocket expenses such as copayments, coinsurance, and deductibles, ensuring predictable healthcare costs for seniors. It offers standardized plans regulated by the federal government, with benefits varying by plan type, allowing beneficiaries to customize coverage according to their medical needs and budget. Explore comprehensive comparisons and personalized options to find the best Medicare Supplement Insurance plan for your healthcare needs.

Medigap

Medigap, or Medicare Supplement Insurance, covers out-of-pocket costs not included in Original Medicare such as co-payments, coinsurance, and deductibles, providing seniors with financial protection and predictability in healthcare expenses. Unlike pet health insurance, which covers veterinary expenses for animals, Medigap is specifically designed for human healthcare needs under Medicare, offering standardized plans regulated by the federal government. Explore our comprehensive guide to understand the benefits and coverage options of Medigap to make informed healthcare decisions.

Original Medicare

Medicare Supplement Insurance, also known as Medigap, helps cover out-of-pocket costs like coinsurance, copayments, and deductibles associated with Original Medicare (Part A and Part B), enhancing access to hospital and medical services for seniors. Unlike Medicare Supplement, Pet Health Insurance provides coverage for veterinary expenses including accidents, illnesses, and sometimes preventive care, but it is unrelated to human health benefits. Explore detailed comparisons to understand how each insurance type supports different healthcare needs.

Source and External Links

Explore AARP Medicare Supplement Plans from UnitedHealthcare - Offers Medicare Supplement insurance plans that help cover out-of-pocket health care costs not covered by Original Medicare.

Medicare Supplement Insurance (Medigap) - Provides additional insurance to help pay for Medicare out-of-pocket costs such as copayments, coinsurance, and deductibles.

Medigap Insurance - Medicare Gap Supplement Policies - Offers plans from private insurance companies to assist with out-of-pocket costs not covered by Original Medicare.

dowidth.com

dowidth.com