Mental health insurance specifically covers therapy, counseling, and psychiatric services, ensuring access to essential psychological care. Liability insurance protects individuals and businesses from legal claims and financial losses stemming from accidents, injuries, or negligence. Explore the differences and benefits of these insurance types to find the best coverage for your needs.

Why it is important

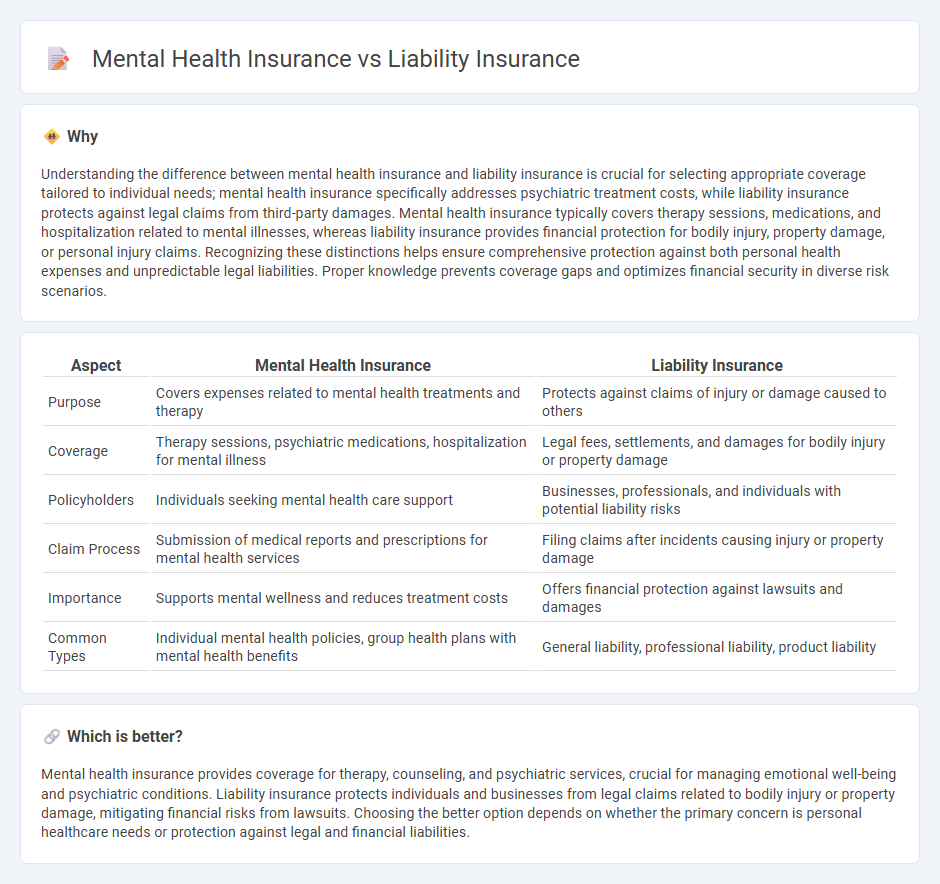

Understanding the difference between mental health insurance and liability insurance is crucial for selecting appropriate coverage tailored to individual needs; mental health insurance specifically addresses psychiatric treatment costs, while liability insurance protects against legal claims from third-party damages. Mental health insurance typically covers therapy sessions, medications, and hospitalization related to mental illnesses, whereas liability insurance provides financial protection for bodily injury, property damage, or personal injury claims. Recognizing these distinctions helps ensure comprehensive protection against both personal health expenses and unpredictable legal liabilities. Proper knowledge prevents coverage gaps and optimizes financial security in diverse risk scenarios.

Comparison Table

| Aspect | Mental Health Insurance | Liability Insurance |

|---|---|---|

| Purpose | Covers expenses related to mental health treatments and therapy | Protects against claims of injury or damage caused to others |

| Coverage | Therapy sessions, psychiatric medications, hospitalization for mental illness | Legal fees, settlements, and damages for bodily injury or property damage |

| Policyholders | Individuals seeking mental health care support | Businesses, professionals, and individuals with potential liability risks |

| Claim Process | Submission of medical reports and prescriptions for mental health services | Filing claims after incidents causing injury or property damage |

| Importance | Supports mental wellness and reduces treatment costs | Offers financial protection against lawsuits and damages |

| Common Types | Individual mental health policies, group health plans with mental health benefits | General liability, professional liability, product liability |

Which is better?

Mental health insurance provides coverage for therapy, counseling, and psychiatric services, crucial for managing emotional well-being and psychiatric conditions. Liability insurance protects individuals and businesses from legal claims related to bodily injury or property damage, mitigating financial risks from lawsuits. Choosing the better option depends on whether the primary concern is personal healthcare needs or protection against legal and financial liabilities.

Connection

Mental health insurance and liability insurance intersect in the context of professional liability for mental health practitioners, protecting providers against claims stemming from malpractice or negligence. Liability insurance covers legal fees and damages in cases where mental health services result in harm or alleged harm to patients. Comprehensive insurance strategies for mental health professionals combine these policies to mitigate financial risks associated with clinical practice.

Key Terms

Coverage Scope

Liability insurance primarily covers legal claims and financial losses arising from damages or injuries caused by the insured, while mental health insurance specifically offers coverage for psychotherapy, counseling, psychiatric treatments, and prescription medications related to mental health conditions. Liability insurance limits are determined by policy type and often exclude personal health expenses, whereas mental health insurance has sub-limits, copayments, and network restrictions tailored to mental healthcare services. Explore detailed plan comparisons and coverage nuances to fully understand which insurance best suits your needs.

Exclusions

Liability insurance often excludes coverage for intentional acts and mental health-related claims, whereas mental health insurance specifically covers treatments and services related to psychiatric conditions but may exclude certain experimental therapies or non-prescribed alternative treatments. Common exclusions in liability insurance include intentional harm and criminal acts, limiting claims related to mental health damages caused by policyholders. To understand the detailed exclusions and coverage nuances, explore comprehensive guides on liability and mental health insurance policies.

Claims Process

Liability insurance claims typically involve detailed incident reporting, thorough investigation, and legal assessment to determine fault and coverage, often requiring collaboration between policyholders, insurers, and legal teams. Mental health insurance claims focus on validating treatment necessity through medical documentation and provider networks, with expedited approvals aimed at ensuring timely patient care and confidentiality. Explore further to understand how each claims process impacts policyholder experience and coverage outcomes.

Source and External Links

General Liability Insurance - GEICO - Provides coverage for businesses against claims resulting from normal operations, including bodily injuries, property damage, and advertising injuries.

General Liability Insurance - Insureon - Offers protection for businesses against common risks like customer injuries, property damage, and advertising injuries, helping to manage legal costs.

Liability Insurance - The Hartford - Helps protect individuals and businesses financially if they are found legally responsible for damage or injury to third parties.

dowidth.com

dowidth.com