NFT insurance provides tailored coverage for digital assets and blockchain-based tokens, protecting owners from risks like theft, fraud, and loss of access. Reinsurance involves insurance companies transferring portions of their risk portfolios to other insurers to increase capacity and stabilize financial outcomes. Explore further to understand how these distinct insurance models address evolving market challenges.

Why it is important

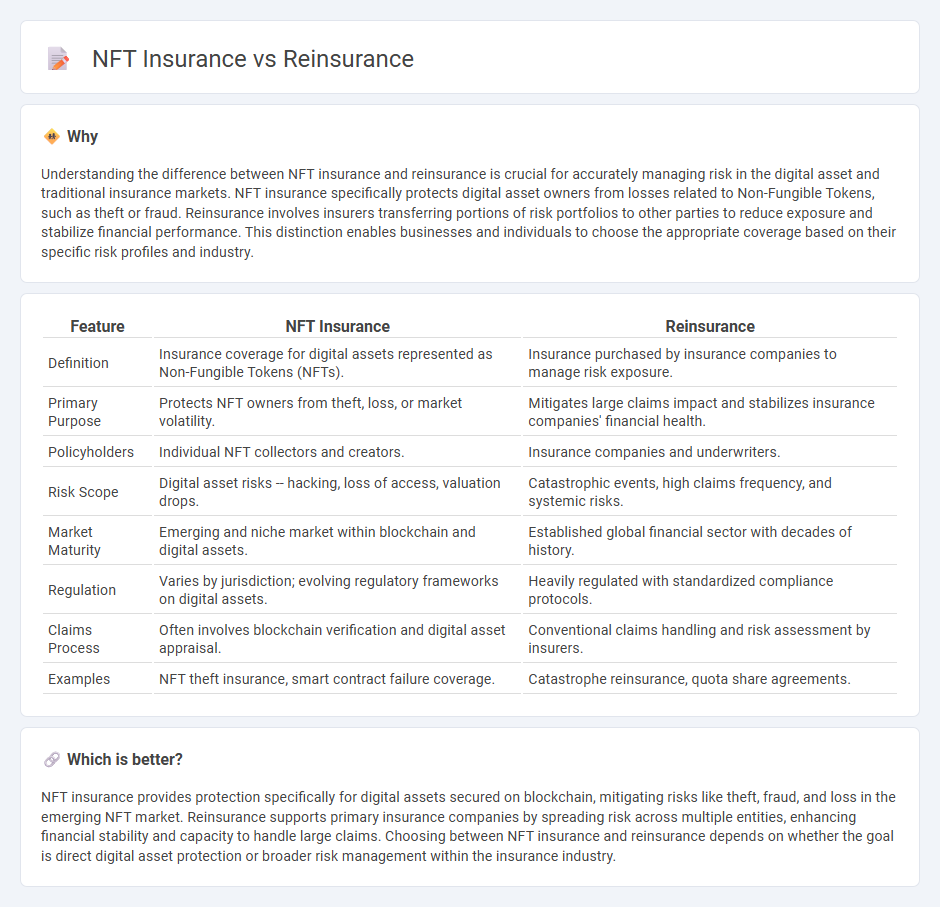

Understanding the difference between NFT insurance and reinsurance is crucial for accurately managing risk in the digital asset and traditional insurance markets. NFT insurance specifically protects digital asset owners from losses related to Non-Fungible Tokens, such as theft or fraud. Reinsurance involves insurers transferring portions of risk portfolios to other parties to reduce exposure and stabilize financial performance. This distinction enables businesses and individuals to choose the appropriate coverage based on their specific risk profiles and industry.

Comparison Table

| Feature | NFT Insurance | Reinsurance |

|---|---|---|

| Definition | Insurance coverage for digital assets represented as Non-Fungible Tokens (NFTs). | Insurance purchased by insurance companies to manage risk exposure. |

| Primary Purpose | Protects NFT owners from theft, loss, or market volatility. | Mitigates large claims impact and stabilizes insurance companies' financial health. |

| Policyholders | Individual NFT collectors and creators. | Insurance companies and underwriters. |

| Risk Scope | Digital asset risks -- hacking, loss of access, valuation drops. | Catastrophic events, high claims frequency, and systemic risks. |

| Market Maturity | Emerging and niche market within blockchain and digital assets. | Established global financial sector with decades of history. |

| Regulation | Varies by jurisdiction; evolving regulatory frameworks on digital assets. | Heavily regulated with standardized compliance protocols. |

| Claims Process | Often involves blockchain verification and digital asset appraisal. | Conventional claims handling and risk assessment by insurers. |

| Examples | NFT theft insurance, smart contract failure coverage. | Catastrophe reinsurance, quota share agreements. |

Which is better?

NFT insurance provides protection specifically for digital assets secured on blockchain, mitigating risks like theft, fraud, and loss in the emerging NFT market. Reinsurance supports primary insurance companies by spreading risk across multiple entities, enhancing financial stability and capacity to handle large claims. Choosing between NFT insurance and reinsurance depends on whether the goal is direct digital asset protection or broader risk management within the insurance industry.

Connection

NFT insurance leverages blockchain technology to provide secure, transparent coverage for digital assets, addressing unique risks associated with ownership and transfer of non-fungible tokens. Reinsurance plays a crucial role by enabling primary insurers to mitigate exposure from large or unpredictable NFT claims, enhancing financial stability in the emerging market. This interconnected framework supports risk distribution and fosters confidence in insuring high-value NFT portfolios.

Key Terms

Risk Transfer

Reinsurance facilitates risk transfer by allowing insurers to share potential losses with reinsurers, thereby stabilizing underwriting results and protecting capital reserves. NFT insurance offers specialized risk coverage by safeguarding digital assets from potential threats like hacks, fraud, or loss, ensuring secure ownership in the blockchain realm. Explore comprehensive insights on how these distinct forms of risk transfer can optimize your risk management strategy.

Smart Contracts

Reinsurance leverages traditional risk transfer mechanisms, while NFT insurance integrates blockchain technology and smart contracts to automate claims and enhance transparency. Smart contracts facilitate decentralized verification and payment processes, reducing administrative costs and fraud risks in NFT insurance. Explore how smart contracts revolutionize insurance models and reinsurance efficiency.

Underwriting

Reinsurance underwriting involves assessing large-scale risk portfolios to provide financial protection to primary insurers, emphasizing risk diversification and capital management. NFT insurance underwriting focuses on the unique valuation, provenance, and cybersecurity risks associated with digital assets on blockchain platforms. Explore the latest strategies shaping underwriting practices in both reinsurance and NFT insurance sectors.

Source and External Links

REINSURANCE - The American Council of Life Insurers - This document provides an overview of reinsurance as a risk management tool used by insurers to spread risk and manage capital.

Reinsurance - NAIC - Reinsurance is an essential tool for insurance companies to manage risks and reduce the capital required to support those risks.

Background on: Reinsurance | III - Insurance Information Institute - Reinsurance allows insurance companies to transfer financial risk to another insurance company, known as the reinsurer.

dowidth.com

dowidth.com