Pay per mile insurance charges drivers based solely on the exact number of miles they drive, offering cost savings for low-mileage drivers by directly linking premiums to usage. Usage-based insurance (UBI) encompasses broader telematics, factoring in driving behavior, speed, acceleration, and time of day to assess risk and calculate premiums more precisely. Explore the differences in detail to determine which insurance model best suits your driving habits and financial goals.

Why it is important

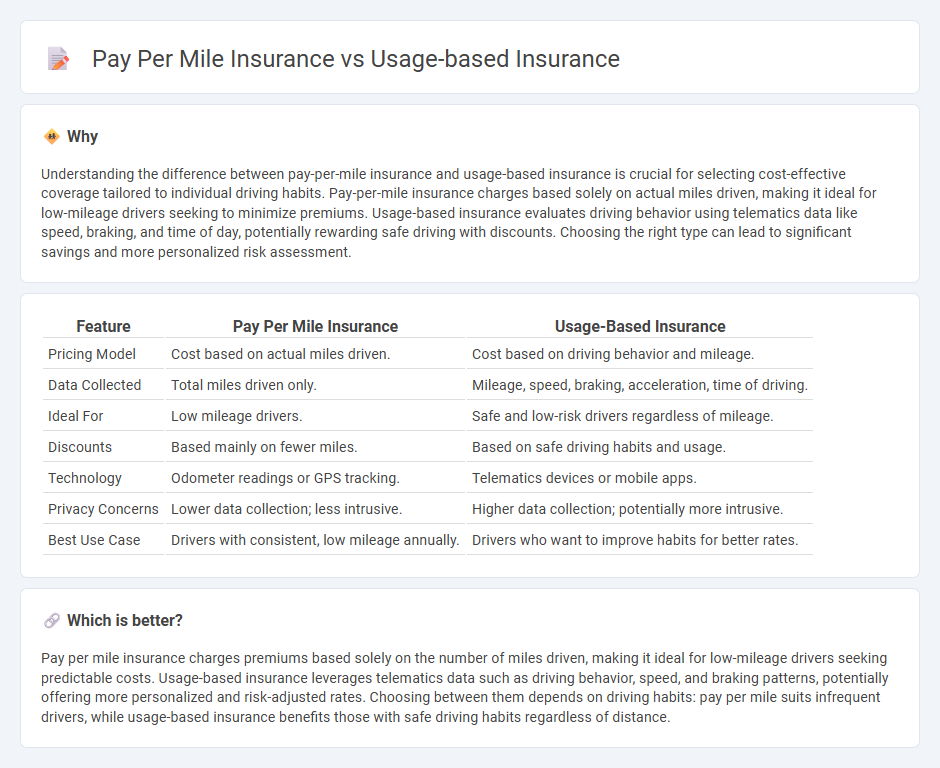

Understanding the difference between pay-per-mile insurance and usage-based insurance is crucial for selecting cost-effective coverage tailored to individual driving habits. Pay-per-mile insurance charges based solely on actual miles driven, making it ideal for low-mileage drivers seeking to minimize premiums. Usage-based insurance evaluates driving behavior using telematics data like speed, braking, and time of day, potentially rewarding safe driving with discounts. Choosing the right type can lead to significant savings and more personalized risk assessment.

Comparison Table

| Feature | Pay Per Mile Insurance | Usage-Based Insurance |

|---|---|---|

| Pricing Model | Cost based on actual miles driven. | Cost based on driving behavior and mileage. |

| Data Collected | Total miles driven only. | Mileage, speed, braking, acceleration, time of driving. |

| Ideal For | Low mileage drivers. | Safe and low-risk drivers regardless of mileage. |

| Discounts | Based mainly on fewer miles. | Based on safe driving habits and usage. |

| Technology | Odometer readings or GPS tracking. | Telematics devices or mobile apps. |

| Privacy Concerns | Lower data collection; less intrusive. | Higher data collection; potentially more intrusive. |

| Best Use Case | Drivers with consistent, low mileage annually. | Drivers who want to improve habits for better rates. |

Which is better?

Pay per mile insurance charges premiums based solely on the number of miles driven, making it ideal for low-mileage drivers seeking predictable costs. Usage-based insurance leverages telematics data such as driving behavior, speed, and braking patterns, potentially offering more personalized and risk-adjusted rates. Choosing between them depends on driving habits: pay per mile suits infrequent drivers, while usage-based insurance benefits those with safe driving habits regardless of distance.

Connection

Pay-per-mile insurance and usage-based insurance both leverage telematics technology to track driving behavior and mileage, enabling personalized premium calculations. These insurance models rely on real-time data collected from connected devices or smartphone apps to assess risk and charge customers based on actual road usage. The integration of GPS tracking and driver monitoring systems strengthens risk management and encourages safer driving habits through customized coverage plans.

Key Terms

Telematics

Usage-based insurance leverages telematics technology to monitor driving behavior, while pay-per-mile insurance strictly charges based on the number of miles driven, regardless of driving habits. Telematics devices collect data such as speed, braking patterns, and time of travel, enabling insurers to tailor premiums according to individual risk profiles. Explore the benefits of telematics in optimizing insurance costs and enhancing personalized coverage.

Mileage

Usage-based insurance calculates premiums based on various driving behaviors including mileage, speed, and braking patterns, providing a comprehensive risk assessment. Pay per mile insurance specifically bases costs solely on the number of miles driven, ideal for low-mileage drivers seeking cost efficiency. Explore the differences in mileage impact to determine the best insurance model for your driving habits.

Driving Behavior

Usage-based insurance (UBI) leverages telematics devices to monitor comprehensive driving behavior, including acceleration patterns, braking intensity, and cornering habits, enabling insurers to tailor premiums based on risk profiles. Pay-per-mile insurance specifically tracks the exact miles driven, offering cost-effective options for low-mileage drivers but lacks detailed behavior insights that affect risk assessment. Explore how these models impact premium calculations and driver benefits by learning more about their technology and data analysis.

Source and External Links

Usage-Based Car Insurance | Progressive - Usage-based insurance (UBI) uses telematics--either a plug-in device or mobile app--to analyze your driving habits, such as braking, acceleration, and mileage, to adjust your auto insurance premium, potentially rewarding safe drivers with discounts.

Usage-based insurance | Office of the Insurance Commissioner - UBI monitors and tracks your driving behavior (miles driven, time of day, speed, braking, etc.) via a device or app, then uses this data to calculate a customized premium, often lowering costs for safe and low-mileage drivers while raising privacy concerns for some.

Usage Based Insurance: Everything You Need To Know - There are two main types: mileage-based (pay per mile) and behavior-based (tracking driving habits), each offering the potential for discounted premiums--typically 10%-25%--for those who drive less or practice safer driving behaviors.

dowidth.com

dowidth.com