Peer-to-peer insurance leverages a network of individuals who pool their resources to cover risks collectively, minimizing reliance on traditional insurers and often reducing premiums through shared responsibility. Mutual insurance companies operate by policyholders owning the company, allowing profits to be redistributed as dividends or reduced future premiums, aligning interests between insurer and insured. Explore the unique benefits and operational structures of peer-to-peer versus mutual insurance to determine which model suits your coverage needs best.

Why it is important

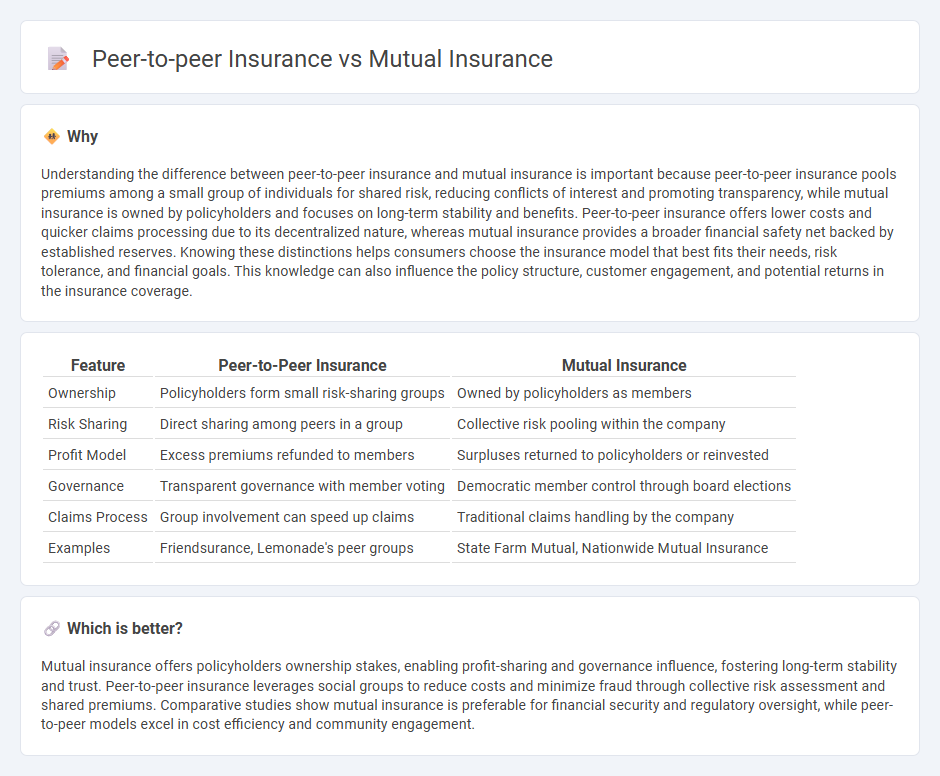

Understanding the difference between peer-to-peer insurance and mutual insurance is important because peer-to-peer insurance pools premiums among a small group of individuals for shared risk, reducing conflicts of interest and promoting transparency, while mutual insurance is owned by policyholders and focuses on long-term stability and benefits. Peer-to-peer insurance offers lower costs and quicker claims processing due to its decentralized nature, whereas mutual insurance provides a broader financial safety net backed by established reserves. Knowing these distinctions helps consumers choose the insurance model that best fits their needs, risk tolerance, and financial goals. This knowledge can also influence the policy structure, customer engagement, and potential returns in the insurance coverage.

Comparison Table

| Feature | Peer-to-Peer Insurance | Mutual Insurance |

|---|---|---|

| Ownership | Policyholders form small risk-sharing groups | Owned by policyholders as members |

| Risk Sharing | Direct sharing among peers in a group | Collective risk pooling within the company |

| Profit Model | Excess premiums refunded to members | Surpluses returned to policyholders or reinvested |

| Governance | Transparent governance with member voting | Democratic member control through board elections |

| Claims Process | Group involvement can speed up claims | Traditional claims handling by the company |

| Examples | Friendsurance, Lemonade's peer groups | State Farm Mutual, Nationwide Mutual Insurance |

Which is better?

Mutual insurance offers policyholders ownership stakes, enabling profit-sharing and governance influence, fostering long-term stability and trust. Peer-to-peer insurance leverages social groups to reduce costs and minimize fraud through collective risk assessment and shared premiums. Comparative studies show mutual insurance is preferable for financial security and regulatory oversight, while peer-to-peer models excel in cost efficiency and community engagement.

Connection

Peer-to-peer insurance and mutual insurance both operate on collective risk-sharing principles where members pool resources to cover losses, fostering a community-based approach. In peer-to-peer insurance, groups of individuals band together to insure each other directly, often using technology platforms to reduce administrative costs. Mutual insurance involves policyholders owning the company, sharing profits, and making decisions collectively, which aligns with the cooperative elements found in peer-to-peer models.

Key Terms

Ownership structure

Mutual insurance companies are owned by policyholders who have voting rights and share in profits, creating a cooperative structure that prioritizes member interests without external shareholders. Peer-to-peer insurance pools risk among groups of individuals who directly insure each other, often facilitated by a platform that provides transparency and reduces administrative costs. Explore the differences in ownership models to understand how each approach impacts policyholder control and financial benefits.

Risk sharing

Mutual insurance pools policyholders' premiums to collectively share risks, providing financial protection based on shared responsibility and ownership among members. Peer-to-peer insurance leverages smaller groups of individuals to directly share risks, often facilitated by digital platforms, resulting in increased transparency and potentially lower costs. Explore the nuances between these models to understand which risk-sharing approach best suits your insurance needs.

Profit distribution

Mutual insurance operates by redistributing profits among policyholders as dividends or reduced premiums, emphasizing collective benefit over shareholder gains. Peer-to-peer insurance pools premiums within a community, often returning surplus funds to participants, enhancing transparency and user control. Explore deeper insights into how profit distribution shapes customer value in these insurance models.

Source and External Links

Mutual insurance - Wikipedia - A mutual insurance company is owned entirely by its policyholders, functioning as a consumer cooperative where profits are either retained or rebated to members, originating in 17th century England and prevalent globally today.

Nationwide: Insurance and Financial Services Company - Nationwide started as a small mutual auto insurance company owned by policyholders and has grown into a major insurer offering a broad range of insurance and financial products nationwide while still operating as a mutual.

An Insurance Company Built on Empathy | Amica Mutual Insurance - Amica Mutual Insurance emphasizes customer service and financial stability, offering personalized auto, home, and life insurance with an empathetic approach as a mutual insurer.

dowidth.com

dowidth.com