Cyber insurance protects businesses from financial losses related to data breaches, cyberattacks, and digital threats, covering costs like legal fees, notification expenses, and business interruption. Product liability insurance, on the other hand, safeguards manufacturers and sellers against claims arising from injuries or damages caused by defective products. Explore detailed comparisons and benefits of these policies to determine the best fit for your risk management strategy.

Why it is important

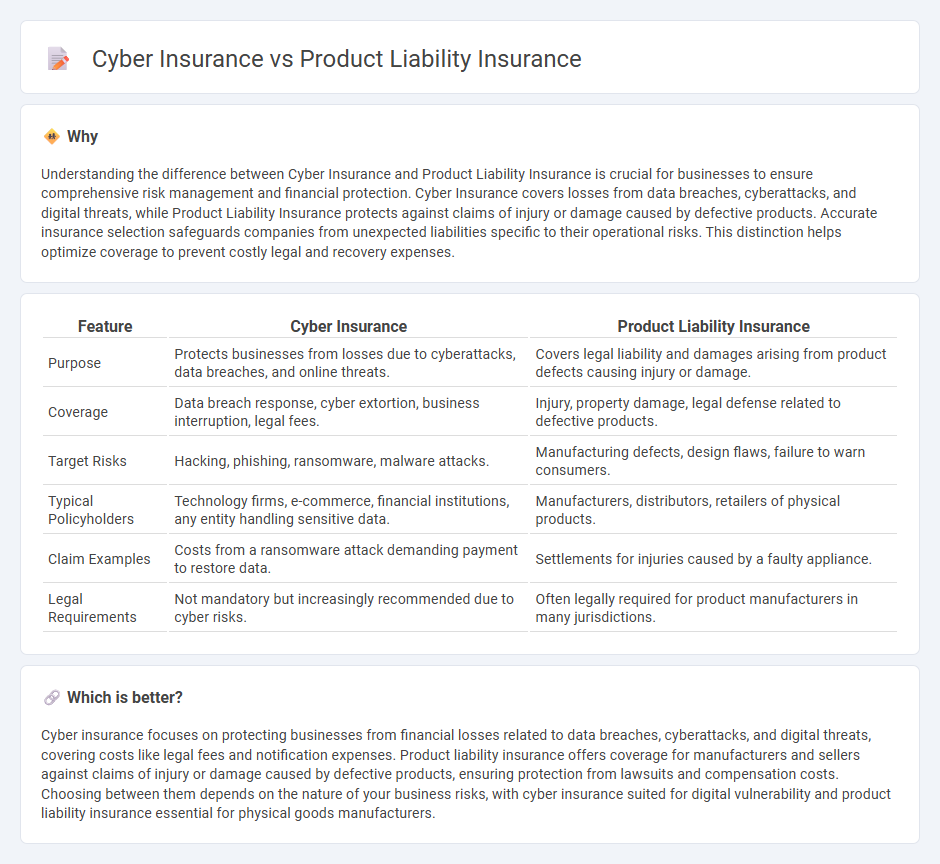

Understanding the difference between Cyber Insurance and Product Liability Insurance is crucial for businesses to ensure comprehensive risk management and financial protection. Cyber Insurance covers losses from data breaches, cyberattacks, and digital threats, while Product Liability Insurance protects against claims of injury or damage caused by defective products. Accurate insurance selection safeguards companies from unexpected liabilities specific to their operational risks. This distinction helps optimize coverage to prevent costly legal and recovery expenses.

Comparison Table

| Feature | Cyber Insurance | Product Liability Insurance |

|---|---|---|

| Purpose | Protects businesses from losses due to cyberattacks, data breaches, and online threats. | Covers legal liability and damages arising from product defects causing injury or damage. |

| Coverage | Data breach response, cyber extortion, business interruption, legal fees. | Injury, property damage, legal defense related to defective products. |

| Target Risks | Hacking, phishing, ransomware, malware attacks. | Manufacturing defects, design flaws, failure to warn consumers. |

| Typical Policyholders | Technology firms, e-commerce, financial institutions, any entity handling sensitive data. | Manufacturers, distributors, retailers of physical products. |

| Claim Examples | Costs from a ransomware attack demanding payment to restore data. | Settlements for injuries caused by a faulty appliance. |

| Legal Requirements | Not mandatory but increasingly recommended due to cyber risks. | Often legally required for product manufacturers in many jurisdictions. |

Which is better?

Cyber insurance focuses on protecting businesses from financial losses related to data breaches, cyberattacks, and digital threats, covering costs like legal fees and notification expenses. Product liability insurance offers coverage for manufacturers and sellers against claims of injury or damage caused by defective products, ensuring protection from lawsuits and compensation costs. Choosing between them depends on the nature of your business risks, with cyber insurance suited for digital vulnerability and product liability insurance essential for physical goods manufacturers.

Connection

Cyber insurance and product liability insurance intersect in addressing risks stemming from technology products and services, where cyber insurance covers data breaches and cyberattacks, while product liability insurance protects against claims related to defect or failure in physical or digital products causing harm. Both types of insurance are critical for companies that develop or distribute software, IoT devices, or connected systems, as cyber incidents can lead to product malfunctions or security vulnerabilities triggering liability claims. This connection highlights the growing need for comprehensive risk management strategies incorporating both cyber and product liability coverage to safeguard against financial losses from digital and product-related threats.

Key Terms

Coverage Scope

Product liability insurance primarily covers physical injury or property damage caused by defective products, protecting manufacturers, distributors, and retailers from claims. Cyber insurance focuses on risks related to data breaches, cyberattacks, and privacy violations, offering coverage for incident response, notification costs, and liability. Explore more about how these insurance types safeguard your business against distinct risks and legal exposures.

Exclusions

Product liability insurance typically excludes damages resulting from data breaches, cyber-attacks, and other technology-related incidents covered under cyber insurance. Cyber insurance excludes physical injury and property damage claims, which are generally covered by product liability policies. Explore detailed exclusions of both policies to ensure comprehensive risk protection tailored to your business needs.

Claims Process

Product liability insurance claims typically involve proving manufacturing defects, design flaws, or inadequate warnings that led to consumer harm, requiring detailed documentation and expert evaluations. Cyber insurance claims focus on data breaches, ransomware attacks, and system outages, demanding immediate incident reporting and collaboration with cybersecurity specialists to assess and contain damage. Explore more about how each claims process works to safeguard your business effectively.

Source and External Links

Product Liability Insurance Guide for Small Businesses - Product liability insurance protects businesses from legal claims for bodily injury or property damage caused by products they make, distribute, or repair, covering design defects, manufacturing defects, marketing errors, insufficient warnings, and strict liability risks.

Product Liability Insurance Explained - This insurance protects businesses from claims related to defects or malfunctions in products, including manufacturing flaws, design defects, and defective warnings, covering losses or injuries to buyers, users, or bystanders.

Product Liability Insurance - It covers businesses against claims that their products or services caused harm, illness, or property damage, including legal fees and reimbursement costs, and protects all parties in the supply chain including manufacturers, distributors, and installers.

dowidth.com

dowidth.com