Mental health insurance provides coverage for therapy sessions, psychiatric care, and prescription medications, which are essential for managing mental wellness and illness. Auto insurance protects against financial loss due to vehicle accidents, theft, and liability claims, offering peace of mind on the road. Explore the differences and benefits of mental health insurance versus auto insurance to find the best coverage for your needs.

Why it is important

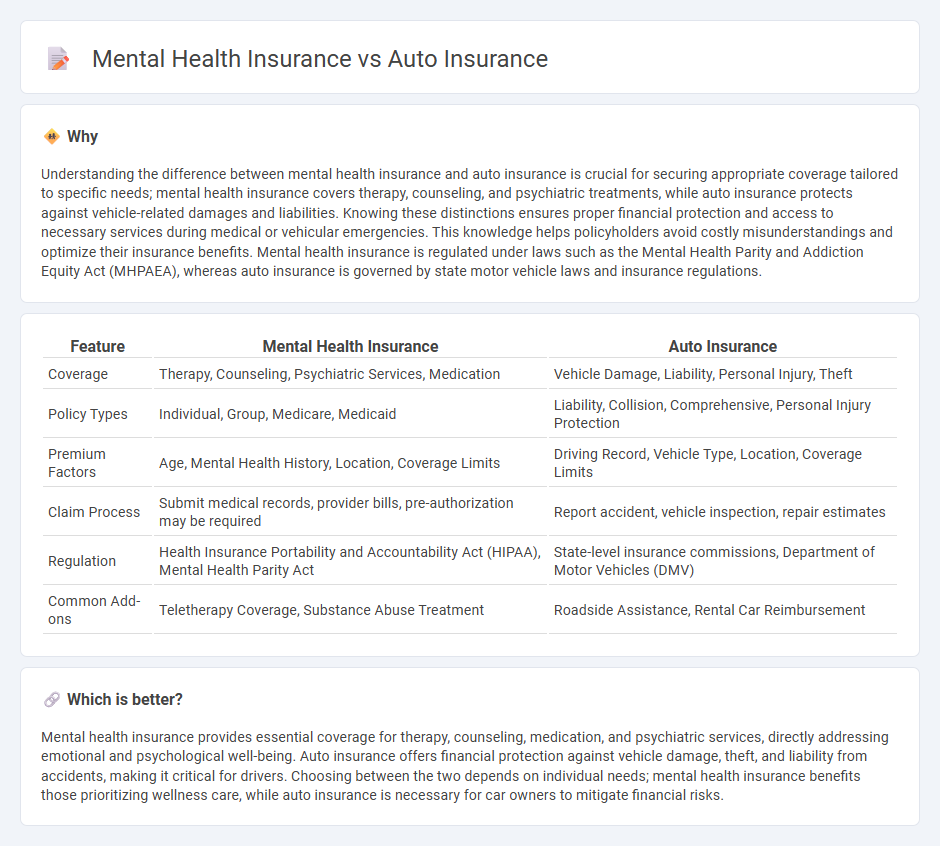

Understanding the difference between mental health insurance and auto insurance is crucial for securing appropriate coverage tailored to specific needs; mental health insurance covers therapy, counseling, and psychiatric treatments, while auto insurance protects against vehicle-related damages and liabilities. Knowing these distinctions ensures proper financial protection and access to necessary services during medical or vehicular emergencies. This knowledge helps policyholders avoid costly misunderstandings and optimize their insurance benefits. Mental health insurance is regulated under laws such as the Mental Health Parity and Addiction Equity Act (MHPAEA), whereas auto insurance is governed by state motor vehicle laws and insurance regulations.

Comparison Table

| Feature | Mental Health Insurance | Auto Insurance |

|---|---|---|

| Coverage | Therapy, Counseling, Psychiatric Services, Medication | Vehicle Damage, Liability, Personal Injury, Theft |

| Policy Types | Individual, Group, Medicare, Medicaid | Liability, Collision, Comprehensive, Personal Injury Protection |

| Premium Factors | Age, Mental Health History, Location, Coverage Limits | Driving Record, Vehicle Type, Location, Coverage Limits |

| Claim Process | Submit medical records, provider bills, pre-authorization may be required | Report accident, vehicle inspection, repair estimates |

| Regulation | Health Insurance Portability and Accountability Act (HIPAA), Mental Health Parity Act | State-level insurance commissions, Department of Motor Vehicles (DMV) |

| Common Add-ons | Teletherapy Coverage, Substance Abuse Treatment | Roadside Assistance, Rental Car Reimbursement |

Which is better?

Mental health insurance provides essential coverage for therapy, counseling, medication, and psychiatric services, directly addressing emotional and psychological well-being. Auto insurance offers financial protection against vehicle damage, theft, and liability from accidents, making it critical for drivers. Choosing between the two depends on individual needs; mental health insurance benefits those prioritizing wellness care, while auto insurance is necessary for car owners to mitigate financial risks.

Connection

Mental health insurance and auto insurance intersect primarily through coverage related to motor vehicle accidents causing psychological trauma, such as PTSD or anxiety disorders. Auto insurance policies increasingly include provisions for mental health treatment under bodily injury claims, ensuring victims receive comprehensive care beyond physical injuries. This integration highlights the growing recognition of mental health's impact on recovery and insurance claim settlements.

Key Terms

**Auto insurance:**

Auto insurance provides essential financial protection against vehicle-related damages, theft, and liabilities, covering repair costs, medical expenses, and third-party damages. Policies vary by state, typically including liability, collision, comprehensive, personal injury protection, and uninsured motorist coverage, tailored to individual driving habits and legal requirements. Explore how auto insurance safeguards your investments and ensures peace of mind on the road.

Collision Coverage

Collision coverage in auto insurance specifically protects vehicle owners from financial loss due to accidents involving their car, covering repairs regardless of fault. Mental health insurance, contrastingly, does not include collision coverage but provides benefits for counseling, therapy, and psychiatric services. Explore more to understand the distinct benefits and limitations of these insurance types.

Liability Coverage

Liability coverage in auto insurance protects you against financial losses from bodily injury or property damage caused by accidents, covering legal fees and settlements. Mental health insurance, conversely, does not include liability coverage but offers essential benefits for therapy, counseling, and psychiatric treatments to support emotional well-being. Explore the distinctions and benefits of each insurance type to ensure comprehensive protection for both physical and mental health needs.

Source and External Links

Car Insurance - Get A Free Auto Insurance Quote Online - Farmers Insurance offers customizable auto insurance coverage including comprehensive, collision, and liability options, helping protect against various risks like theft, accidents, and property damage.

Auto | Office of the Commissioner of Insurance and Safety Fire - Auto insurance rates are determined by underwriting and rating factors such as driving record, residence, age, vehicle type, and discounts; coverage varies between tort and no-fault state systems.

Direct Auto: Auto Insurance - Get a Free Quote Today - Direct Auto provides affordable auto insurance with liability, collision, comprehensive, uninsured motorist coverage, and personal injury protection, plus discounts and flexible payment plans.

dowidth.com

dowidth.com