Digital health insurance leverages telemedicine, wearable devices, and health data analytics to offer personalized coverage and proactive wellness incentives. Usage-based insurance (UBI) relies on real-time data collection from devices like telematics or health trackers to adjust premiums based on actual user behavior and risk levels. Discover how these innovative insurance models transform risk management and customer engagement in the healthcare sector.

Why it is important

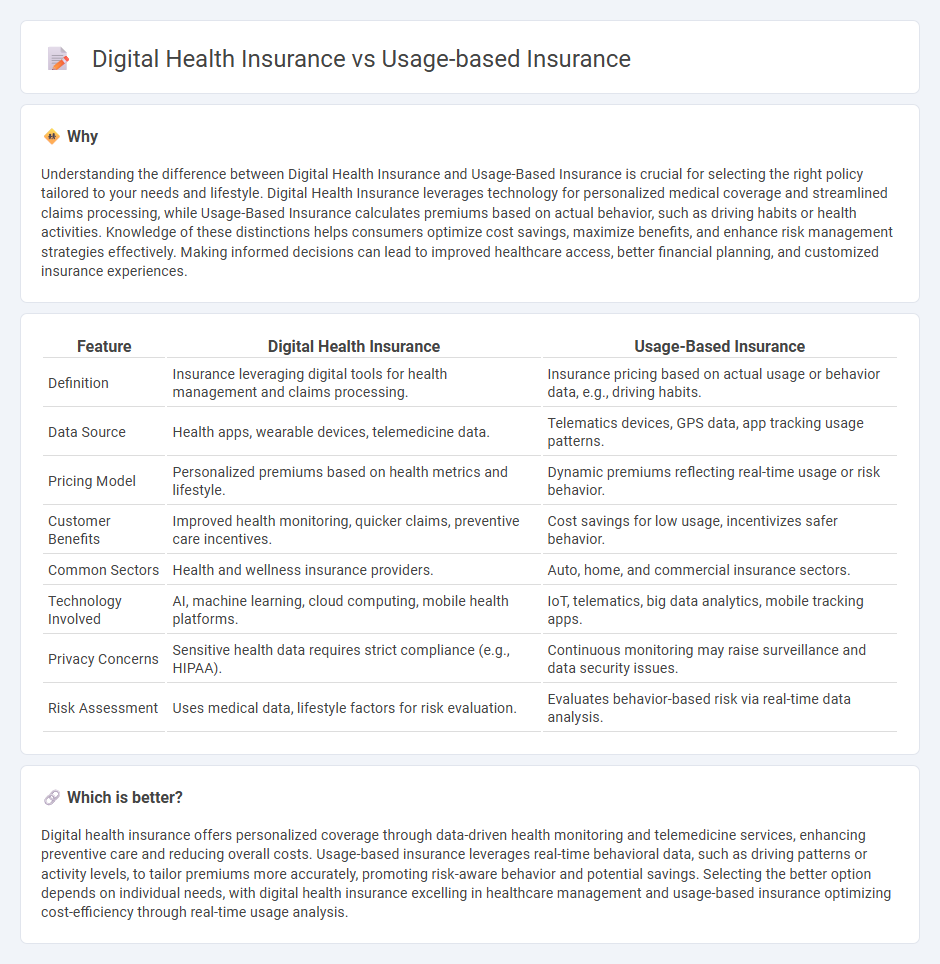

Understanding the difference between Digital Health Insurance and Usage-Based Insurance is crucial for selecting the right policy tailored to your needs and lifestyle. Digital Health Insurance leverages technology for personalized medical coverage and streamlined claims processing, while Usage-Based Insurance calculates premiums based on actual behavior, such as driving habits or health activities. Knowledge of these distinctions helps consumers optimize cost savings, maximize benefits, and enhance risk management strategies effectively. Making informed decisions can lead to improved healthcare access, better financial planning, and customized insurance experiences.

Comparison Table

| Feature | Digital Health Insurance | Usage-Based Insurance |

|---|---|---|

| Definition | Insurance leveraging digital tools for health management and claims processing. | Insurance pricing based on actual usage or behavior data, e.g., driving habits. |

| Data Source | Health apps, wearable devices, telemedicine data. | Telematics devices, GPS data, app tracking usage patterns. |

| Pricing Model | Personalized premiums based on health metrics and lifestyle. | Dynamic premiums reflecting real-time usage or risk behavior. |

| Customer Benefits | Improved health monitoring, quicker claims, preventive care incentives. | Cost savings for low usage, incentivizes safer behavior. |

| Common Sectors | Health and wellness insurance providers. | Auto, home, and commercial insurance sectors. |

| Technology Involved | AI, machine learning, cloud computing, mobile health platforms. | IoT, telematics, big data analytics, mobile tracking apps. |

| Privacy Concerns | Sensitive health data requires strict compliance (e.g., HIPAA). | Continuous monitoring may raise surveillance and data security issues. |

| Risk Assessment | Uses medical data, lifestyle factors for risk evaluation. | Evaluates behavior-based risk via real-time data analysis. |

Which is better?

Digital health insurance offers personalized coverage through data-driven health monitoring and telemedicine services, enhancing preventive care and reducing overall costs. Usage-based insurance leverages real-time behavioral data, such as driving patterns or activity levels, to tailor premiums more accurately, promoting risk-aware behavior and potential savings. Selecting the better option depends on individual needs, with digital health insurance excelling in healthcare management and usage-based insurance optimizing cost-efficiency through real-time usage analysis.

Connection

Digital health insurance leverages real-time data from wearable devices and health apps to personalize coverage and premiums, closely aligning with usage-based insurance principles that adjust rates based on actual policyholder behavior. Both models utilize advanced analytics and IoT technology to monitor individual risk factors, enhancing claim accuracy and fraud detection. This convergence enables insurers to offer dynamic, customized plans that improve customer engagement and optimize risk management.

Key Terms

Telematics

Usage-based insurance leverages telematics to monitor driving behavior in real-time, allowing insurers to offer personalized premiums based on actual risk levels. Digital health insurance integrates telematics devices to track health metrics such as heart rate and activity, promoting preventive care and dynamic policy adjustments. Explore the impact of telematics on transforming both automotive and health insurance models for more tailored coverage and enhanced customer engagement.

Wearables

Usage-based insurance leverages data collected from wearables to personalize premiums based on real-time health behaviors, promoting proactive wellness and risk reduction. Digital health insurance integrates these wearables for continuous monitoring, enabling early detection and personalized interventions that enhance policyholder outcomes. Explore how wearables are transforming insurance models by driving innovation and improving customer engagement.

Personalized Premiums

Usage-based insurance leverages telematics data such as driving behavior and mileage to calculate personalized premiums, tailoring costs to individual risk profiles. Digital health insurance integrates wearable devices and health apps to monitor real-time biometric data, enabling dynamic pricing based on personal health metrics. Discover how these innovations redefine risk assessment and premium personalization in insurance.

Source and External Links

Usage-Based Car Insurance | Progressive - Usage-based insurance (UBI) calculates auto insurance rates by analyzing how often and how safely you drive, using either a plug-in device or mobile app to measure driving behavior such as braking, acceleration, and mileage, potentially resulting in discounts or higher premiums based on the data collected.

Usage-based insurance | Office of the Insurance Commissioner - Usage-based insurance, also known as telematics, monitors driving habits like mileage, time of day, location, and driving style (e.g., rapid acceleration, hard braking) via a device or app, combining this data with traditional factors to set a personalized premium that may be lower for safer, less frequent drivers--though it also raises privacy concerns for some.

Usage Based Insurance: Everything You Need To Know - Usage-based insurance offers customized premiums through mileage-based (pay per mile) or behavior-based (tracking speed, braking, acceleration) programs, potentially providing discounts of 10%-25% for safe driving and low mileage, but not all drivers will qualify for these savings.

dowidth.com

dowidth.com