Climate risk insurance offers targeted financial protection against specific climate-related events such as floods, hurricanes, and droughts by providing timely payouts to affected businesses and individuals. Catastrophe bonds are risk-linked securities that transfer the financial risk of extreme events from insurers to capital market investors, enabling rapid mobilization of large funds in the event of disasters. Explore the detailed differences and benefits of climate risk insurance versus catastrophe bonds to make informed decisions about risk management.

Why it is important

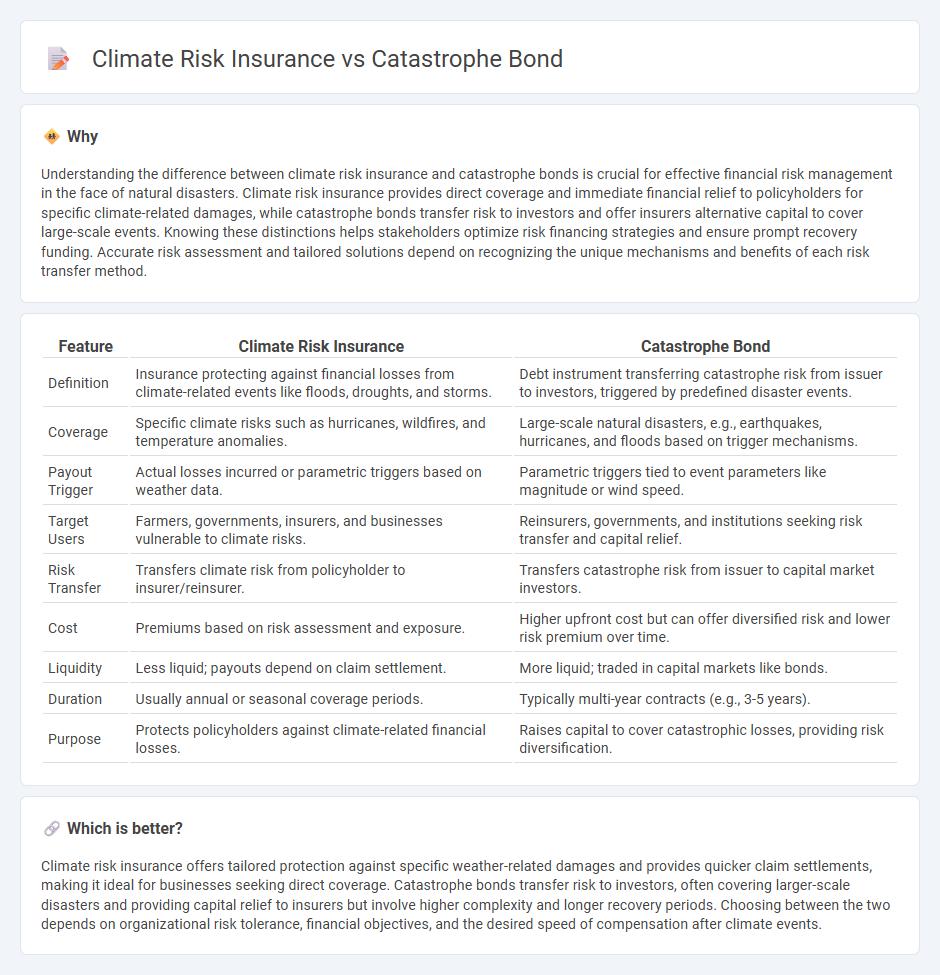

Understanding the difference between climate risk insurance and catastrophe bonds is crucial for effective financial risk management in the face of natural disasters. Climate risk insurance provides direct coverage and immediate financial relief to policyholders for specific climate-related damages, while catastrophe bonds transfer risk to investors and offer insurers alternative capital to cover large-scale events. Knowing these distinctions helps stakeholders optimize risk financing strategies and ensure prompt recovery funding. Accurate risk assessment and tailored solutions depend on recognizing the unique mechanisms and benefits of each risk transfer method.

Comparison Table

| Feature | Climate Risk Insurance | Catastrophe Bond |

|---|---|---|

| Definition | Insurance protecting against financial losses from climate-related events like floods, droughts, and storms. | Debt instrument transferring catastrophe risk from issuer to investors, triggered by predefined disaster events. |

| Coverage | Specific climate risks such as hurricanes, wildfires, and temperature anomalies. | Large-scale natural disasters, e.g., earthquakes, hurricanes, and floods based on trigger mechanisms. |

| Payout Trigger | Actual losses incurred or parametric triggers based on weather data. | Parametric triggers tied to event parameters like magnitude or wind speed. |

| Target Users | Farmers, governments, insurers, and businesses vulnerable to climate risks. | Reinsurers, governments, and institutions seeking risk transfer and capital relief. |

| Risk Transfer | Transfers climate risk from policyholder to insurer/reinsurer. | Transfers catastrophe risk from issuer to capital market investors. |

| Cost | Premiums based on risk assessment and exposure. | Higher upfront cost but can offer diversified risk and lower risk premium over time. |

| Liquidity | Less liquid; payouts depend on claim settlement. | More liquid; traded in capital markets like bonds. |

| Duration | Usually annual or seasonal coverage periods. | Typically multi-year contracts (e.g., 3-5 years). |

| Purpose | Protects policyholders against climate-related financial losses. | Raises capital to cover catastrophic losses, providing risk diversification. |

Which is better?

Climate risk insurance offers tailored protection against specific weather-related damages and provides quicker claim settlements, making it ideal for businesses seeking direct coverage. Catastrophe bonds transfer risk to investors, often covering larger-scale disasters and providing capital relief to insurers but involve higher complexity and longer recovery periods. Choosing between the two depends on organizational risk tolerance, financial objectives, and the desired speed of compensation after climate events.

Connection

Climate risk insurance provides financial protection against losses caused by climate-related events, while catastrophe bonds are risk-linked securities that transfer the financial risk of such disasters from insurers to investors. These financial instruments are interconnected because catastrophe bonds offer insurers a way to manage and diversify their exposure to large-scale climate risks by raising capital from the bond market. This connection enhances the resilience of the insurance industry against increasing climate volatility and supports quicker disaster recovery.

Key Terms

Catastrophe bond:

Catastrophe bonds are financial instruments designed to transfer catastrophe risk from insurers to investors, providing rapid capital infusion following a triggering event such as hurricanes or earthquakes. They enable insurers to manage significant payouts without compromising liquidity or solvency, with investors receiving high yields but accepting the risk of principal loss if predefined catastrophe parameters are met. Explore the mechanics, advantages, and applications of catastrophe bonds to better understand their role in climate risk management.

Risk securitization

Catastrophe bonds transform climate-related risks into tradable securities, enabling insurers to transfer potential losses from natural disasters to capital markets, thus enhancing risk diversification and liquidity. Climate risk insurance provides direct coverage against weather-related damages but remains constrained by underwriting limits and premium affordability. Explore the mechanisms and benefits of risk securitization to understand how innovative financial instruments mitigate climate vulnerabilities.

Trigger event

Catastrophe bonds activate payout based on predefined trigger events such as specific natural disasters exceeding measured parameters like wind speed or earthquake magnitude, ensuring rapid capital deployment. Climate risk insurance relies on indemnity or parametric triggers linked directly to loss assessments or environmental indices, providing tailored coverage against climate-related damages. Explore deeper insights on how trigger events impact financial resilience in climate risk management.

Source and External Links

Catastrophe bond - Wikipedia - Catastrophe bonds (cat bonds) are insurance-linked securities that transfer risks from a sponsor, usually an insurer, to investors, who lose principal if a specified catastrophe event happens, providing insurers with alternative catastrophe risk financing since the 1990s.

Cat Bond Primer - Wharton ESG Initiative - Catastrophe bonds are floating rate notes issued via a bankruptcy-remote special purpose vehicle that pays investors premiums unless a defined trigger event occurs, in which case some or all principal is transferred to the sponsor to cover disaster losses.

Catastrophe Bonds: Definition, Benefits, How To Structure | AgentSync - CAT bonds are high-yield, high-risk bonds created to fund insurers during natural disasters, structured via special purpose vehicles using triggers like indemnity and parametric triggers, and are the most popular instruments in the insurance-linked securities market.

dowidth.com

dowidth.com