Gig worker insurance offers flexible coverage tailored to independent contractors and freelancers, covering medical, disability, and liability risks without employer dependency. Group health insurance, typically provided through employers, pools risk among members to provide more affordable and comprehensive benefits, including preventive care and wellness programs. Explore the best insurance options to secure your health and financial stability based on your work status.

Why it is important

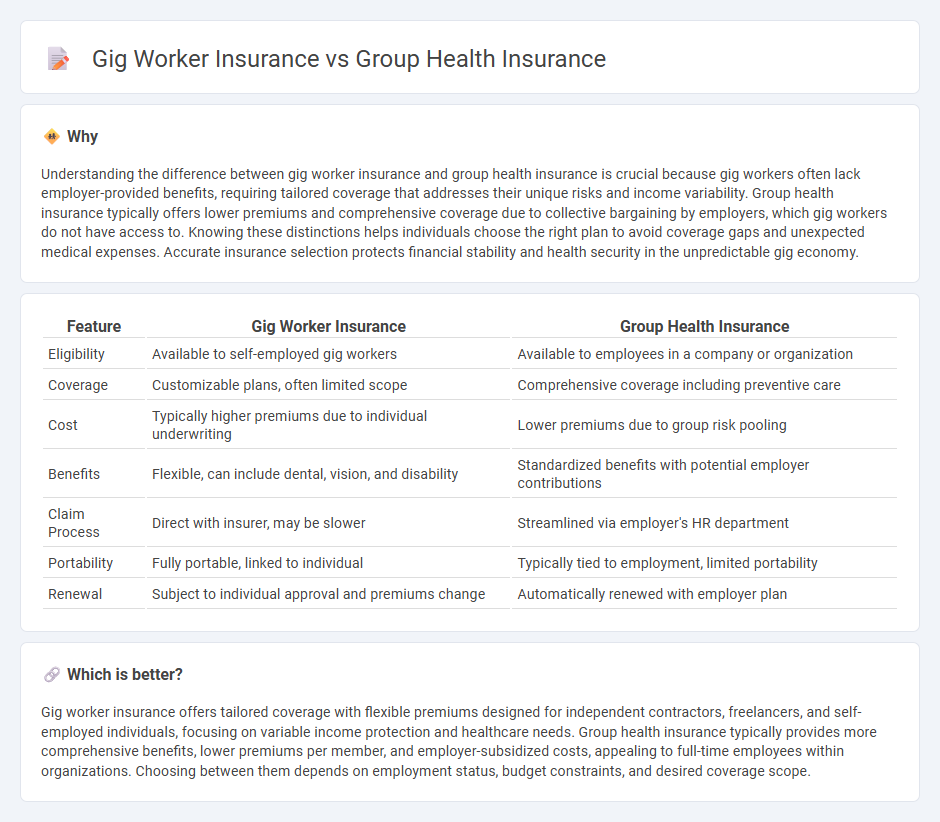

Understanding the difference between gig worker insurance and group health insurance is crucial because gig workers often lack employer-provided benefits, requiring tailored coverage that addresses their unique risks and income variability. Group health insurance typically offers lower premiums and comprehensive coverage due to collective bargaining by employers, which gig workers do not have access to. Knowing these distinctions helps individuals choose the right plan to avoid coverage gaps and unexpected medical expenses. Accurate insurance selection protects financial stability and health security in the unpredictable gig economy.

Comparison Table

| Feature | Gig Worker Insurance | Group Health Insurance |

|---|---|---|

| Eligibility | Available to self-employed gig workers | Available to employees in a company or organization |

| Coverage | Customizable plans, often limited scope | Comprehensive coverage including preventive care |

| Cost | Typically higher premiums due to individual underwriting | Lower premiums due to group risk pooling |

| Benefits | Flexible, can include dental, vision, and disability | Standardized benefits with potential employer contributions |

| Claim Process | Direct with insurer, may be slower | Streamlined via employer's HR department |

| Portability | Fully portable, linked to individual | Typically tied to employment, limited portability |

| Renewal | Subject to individual approval and premiums change | Automatically renewed with employer plan |

Which is better?

Gig worker insurance offers tailored coverage with flexible premiums designed for independent contractors, freelancers, and self-employed individuals, focusing on variable income protection and healthcare needs. Group health insurance typically provides more comprehensive benefits, lower premiums per member, and employer-subsidized costs, appealing to full-time employees within organizations. Choosing between them depends on employment status, budget constraints, and desired coverage scope.

Connection

Gig worker insurance and group health insurance are connected through shared risk pooling and cost management strategies that enhance coverage affordability and accessibility for independent contractors. Group health insurance plans offer collective bargaining power, enabling gig workers to access lower premiums and comprehensive benefits usually unavailable to individuals in the gig economy. Integrating gig worker insurance with group health options addresses coverage gaps by leveraging employer or association-sponsored plans tailored to the unique needs of freelance and contract workers.

Key Terms

Group Health Insurance:

Group health insurance offers comprehensive medical coverage to employees under a single policy, often negotiated by employers to include benefits like preventive care, prescription drugs, and mental health services. This type of insurance typically provides lower premiums and better coverage options due to risk pooling across a larger group, making it more cost-effective compared to individual plans. Explore the advantages and specifics of group health insurance plans to make an informed choice for your healthcare needs.

Employer-sponsored Plan

Employer-sponsored group health insurance plans typically offer comprehensive coverage with lower premiums due to risk pooling among employees. Gig worker insurance often involves higher costs and limited benefits since coverage is individual-based rather than group-based. Explore the differences in benefits and costs to determine the best insurance option for your employment situation.

Risk Pooling

Group health insurance leverages risk pooling by aggregating a large number of employees under a single policy, which distributes medical costs and reduces premiums for participants. Gig worker insurance lacks traditional risk pooling due to the independent nature of contracts, often resulting in higher premiums and less comprehensive coverage. Explore detailed comparisons to understand how risk pooling affects your health insurance options.

Source and External Links

Group Health Insurance through Trade Organizations | The Hartford - Group health insurance is often more affordable and can be accessed through professional, trade, or membership organizations where members share medical insurance costs similarly to a small business employer group plan.

Group Health Insurance Medical Plans | Cigna Healthcare - Cigna offers group health insurance plans providing employees with quality care and personalized benefits across various industries and organization sizes, emphasizing care coordination and cost control.

Health insurance for small business | Employer | UnitedHealthcare - UnitedHealthcare provides flexible group health insurance plans designed for small businesses, featuring extensive provider networks, additional coverage options like dental and vision, and plan options like Surest(r) and level-funded plans that offer cost control and potential savings.

dowidth.com

dowidth.com