Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets for accurate risk assessment, enhancing decision-making with predictive analytics. Robotic process automation underwriting streamlines routine tasks by automating rule-based workflows, increasing efficiency and reducing processing time. Explore the comparative advantages of AI underwriting and robotic process automation to optimize insurance operations.

Why it is important

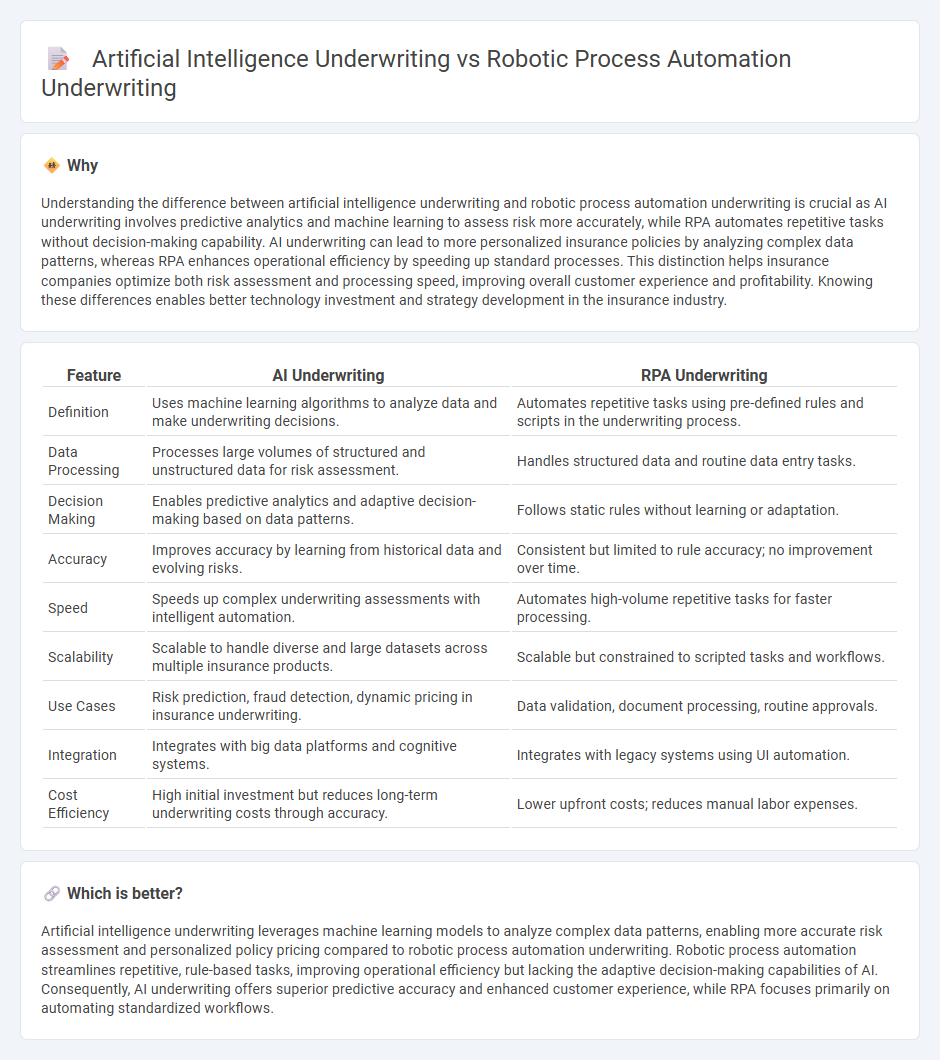

Understanding the difference between artificial intelligence underwriting and robotic process automation underwriting is crucial as AI underwriting involves predictive analytics and machine learning to assess risk more accurately, while RPA automates repetitive tasks without decision-making capability. AI underwriting can lead to more personalized insurance policies by analyzing complex data patterns, whereas RPA enhances operational efficiency by speeding up standard processes. This distinction helps insurance companies optimize both risk assessment and processing speed, improving overall customer experience and profitability. Knowing these differences enables better technology investment and strategy development in the insurance industry.

Comparison Table

| Feature | AI Underwriting | RPA Underwriting |

|---|---|---|

| Definition | Uses machine learning algorithms to analyze data and make underwriting decisions. | Automates repetitive tasks using pre-defined rules and scripts in the underwriting process. |

| Data Processing | Processes large volumes of structured and unstructured data for risk assessment. | Handles structured data and routine data entry tasks. |

| Decision Making | Enables predictive analytics and adaptive decision-making based on data patterns. | Follows static rules without learning or adaptation. |

| Accuracy | Improves accuracy by learning from historical data and evolving risks. | Consistent but limited to rule accuracy; no improvement over time. |

| Speed | Speeds up complex underwriting assessments with intelligent automation. | Automates high-volume repetitive tasks for faster processing. |

| Scalability | Scalable to handle diverse and large datasets across multiple insurance products. | Scalable but constrained to scripted tasks and workflows. |

| Use Cases | Risk prediction, fraud detection, dynamic pricing in insurance underwriting. | Data validation, document processing, routine approvals. |

| Integration | Integrates with big data platforms and cognitive systems. | Integrates with legacy systems using UI automation. |

| Cost Efficiency | High initial investment but reduces long-term underwriting costs through accuracy. | Lower upfront costs; reduces manual labor expenses. |

Which is better?

Artificial intelligence underwriting leverages machine learning models to analyze complex data patterns, enabling more accurate risk assessment and personalized policy pricing compared to robotic process automation underwriting. Robotic process automation streamlines repetitive, rule-based tasks, improving operational efficiency but lacking the adaptive decision-making capabilities of AI. Consequently, AI underwriting offers superior predictive accuracy and enhanced customer experience, while RPA focuses primarily on automating standardized workflows.

Connection

Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets for accurate risk assessment, while robotic process automation underwriting streamlines repetitive tasks such as data entry and policy verification. Both technologies integrate to enhance efficiency, reduce human error, and speed up the underwriting process in insurance. Combining AI's decision-making capabilities with RPA's automation leads to improved precision and faster policy issuance.

Key Terms

Automation

Robotic Process Automation (RPA) underwriting emphasizes rule-based automation, streamlining repetitive tasks such as data entry and document verification without learning capabilities. Artificial Intelligence (AI) underwriting leverages machine learning and natural language processing to analyze complex datasets, predict risks, and make dynamic decisions with greater accuracy. Explore in-depth insights to understand how these technologies transform underwriting efficiency.

Risk Assessment

Robotic Process Automation (RPA) underwriting streamlines repetitive risk assessment tasks by automating data extraction and validation, boosting efficiency and accuracy in policy evaluations. Artificial Intelligence (AI) underwriting leverages machine learning algorithms to analyze complex risk factors, identify patterns, and predict potential claims with higher precision, enhancing decision-making capabilities. Explore the latest advancements in underwriting technologies to understand how integrating RPA and AI can optimize risk assessment strategies.

Decision Algorithms

Robotic Process Automation (RPA) underwriting uses predefined, rule-based decision algorithms to automate repetitive tasks, ensuring consistency and high-speed processing without human intervention. In contrast, Artificial Intelligence (AI) underwriting employs advanced machine learning models and adaptive algorithms that analyze vast datasets to improve decision accuracy and predict risk dynamically. Explore how integrating these technologies can enhance underwriting efficiency and precision.

Source and External Links

Automation Software Platform for Insurance Underwriting - Robotic Process Automation (RPA) helps automate repetitive underwriting tasks, enabling faster policy processing and better risk evaluations using AI and machine learning, thus increasing throughput and efficiency in insurance underwriting.

Exploring Role of Automation in Various Underwriting Types - Underwriting automation via RPA and AI enhances data intake by automating document processing and consolidating information for risk assessment, reducing data collection time by up to 70% and freeing underwriters for analysis and decisions.

A Guide to Robotic Process Automation in Insurance - Ringy - RPA in underwriting automates data collection from multiple sources, pre-populates forms, and handles policy issuance and renewals, boosting efficiency and allowing underwriters to focus on complex evaluations while improving compliance reporting and reducing costs.

dowidth.com

dowidth.com