Usage-based insurance (UBI) relies on telematics to monitor driving behavior, offering personalized premiums based on mileage, speed, and braking patterns. Snapshot insurance, a specific type of UBI, uses a device plugged into a vehicle's OBD-II port to collect detailed driving data over a trial period, enabling insurers to tailor rates more accurately. Discover how these innovative insurance models can optimize your coverage and savings.

Why it is important

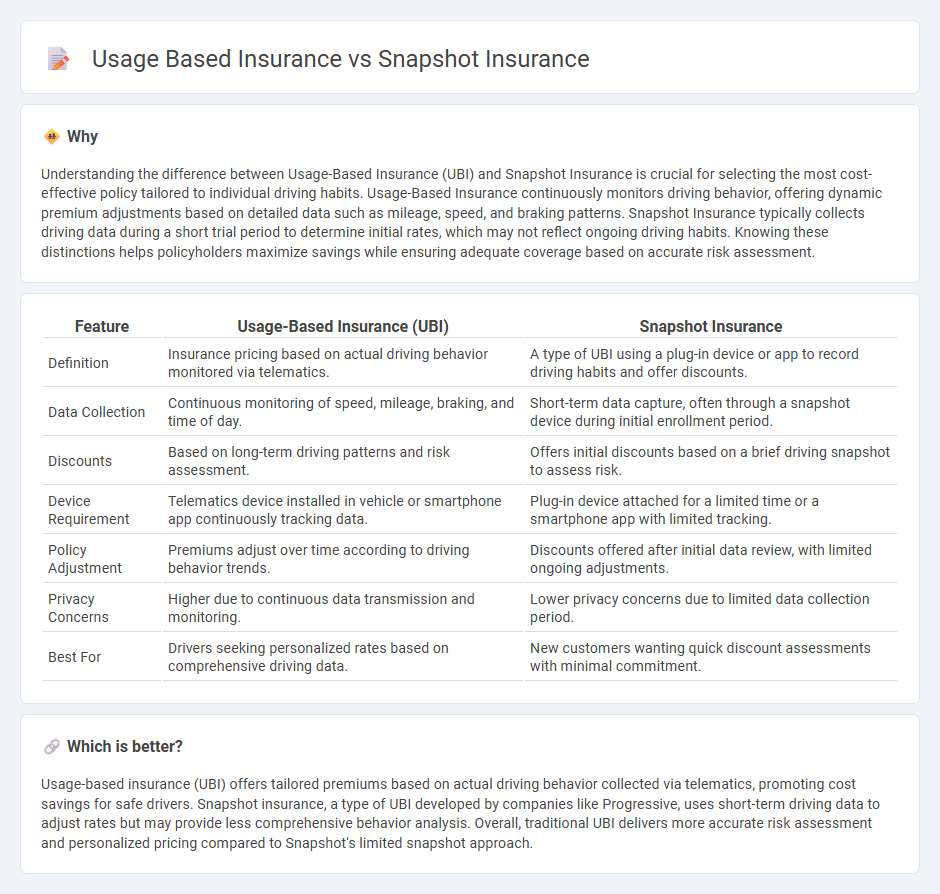

Understanding the difference between Usage-Based Insurance (UBI) and Snapshot Insurance is crucial for selecting the most cost-effective policy tailored to individual driving habits. Usage-Based Insurance continuously monitors driving behavior, offering dynamic premium adjustments based on detailed data such as mileage, speed, and braking patterns. Snapshot Insurance typically collects driving data during a short trial period to determine initial rates, which may not reflect ongoing driving habits. Knowing these distinctions helps policyholders maximize savings while ensuring adequate coverage based on accurate risk assessment.

Comparison Table

| Feature | Usage-Based Insurance (UBI) | Snapshot Insurance |

|---|---|---|

| Definition | Insurance pricing based on actual driving behavior monitored via telematics. | A type of UBI using a plug-in device or app to record driving habits and offer discounts. |

| Data Collection | Continuous monitoring of speed, mileage, braking, and time of day. | Short-term data capture, often through a snapshot device during initial enrollment period. |

| Discounts | Based on long-term driving patterns and risk assessment. | Offers initial discounts based on a brief driving snapshot to assess risk. |

| Device Requirement | Telematics device installed in vehicle or smartphone app continuously tracking data. | Plug-in device attached for a limited time or a smartphone app with limited tracking. |

| Policy Adjustment | Premiums adjust over time according to driving behavior trends. | Discounts offered after initial data review, with limited ongoing adjustments. |

| Privacy Concerns | Higher due to continuous data transmission and monitoring. | Lower privacy concerns due to limited data collection period. |

| Best For | Drivers seeking personalized rates based on comprehensive driving data. | New customers wanting quick discount assessments with minimal commitment. |

Which is better?

Usage-based insurance (UBI) offers tailored premiums based on actual driving behavior collected via telematics, promoting cost savings for safe drivers. Snapshot insurance, a type of UBI developed by companies like Progressive, uses short-term driving data to adjust rates but may provide less comprehensive behavior analysis. Overall, traditional UBI delivers more accurate risk assessment and personalized pricing compared to Snapshot's limited snapshot approach.

Connection

Usage-based insurance (UBI) and Snapshot insurance are connected through their reliance on telematics technology to monitor driving behavior and mileage in real-time. Snapshot insurance, a specific implementation of UBI developed by Progressive, collects data via a plug-in device or mobile app to tailor premiums based on factors such as speed, braking, and distance driven. Both approaches enhance risk assessment accuracy by leveraging driver-specific data, leading to more personalized and potentially lower insurance costs.

Key Terms

Telematics

Snapshot insurance uses a one-time driving behavior assessment through telematics devices to determine premiums, while usage-based insurance continuously monitors driving patterns such as speed, braking, and mileage to adjust rates dynamically. Telematics technology in usage-based insurance provides granular data, enabling personalized risk profiles and potentially lower costs for safe drivers. Discover how telematics is revolutionizing auto insurance pricing and risk management.

Pay-how-you-drive

Snapshot insurance and usage-based insurance both utilize telematics to monitor driving behavior, but Snapshot emphasizes Pay-How-You-Drive models where premiums are adjusted based on real-time driving habits like speed, braking, and mileage. Usage-based insurance often incorporates a broader range of data, including time of day and vehicle location, to tailor rates more precisely. Discover how Pay-How-You-Drive technology innovates auto insurance pricing to reward safe driving habits.

Data collection

Snapshot insurance leverages telematics devices or mobile apps to collect detailed driving data such as speed, acceleration, and braking patterns in real-time, enabling precise risk assessment. Usage based insurance (UBI) also uses telematics but emphasizes mileage and driving behavior over time to calculate premiums dynamically based on actual road usage. Explore the intricacies of data collection methods to understand which insurance model better fits your driving profile.

Source and External Links

Progressive Snapshot Review 2025 - This review explains how Progressive's Snapshot program works, offering discounts for safe driving but potentially increasing premiums for risky behavior in some states.

Progressive Snapshot Review: How Does it Work? - This page provides an overview of Progressive's Snapshot program, including its functionality, potential discounts, and the risk of premium increases for bad driving habits.

Snapshot Frequently Asked Questions - This FAQ section details how Snapshot works, including the options to use a mobile app or plug-in device, and how it affects insurance rates based on driving habits.

dowidth.com

dowidth.com