Pay-as-you-drive insurance charges premiums based strictly on the miles driven, offering cost savings for low-mileage drivers by directly linking insurance costs to actual distance. Usage-based insurance expands this model by incorporating driving behavior data such as speed, braking patterns, and time of day, enabling more personalized risk assessment and premiums. Explore the differences in how these innovative insurance models can tailor coverage to your driving habits.

Why it is important

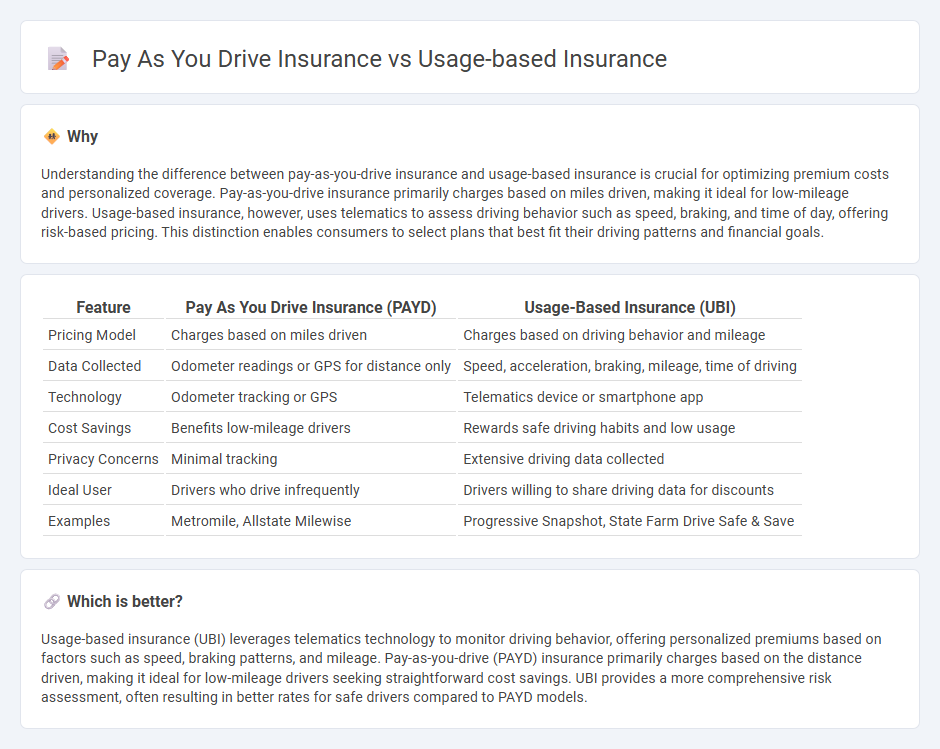

Understanding the difference between pay-as-you-drive insurance and usage-based insurance is crucial for optimizing premium costs and personalized coverage. Pay-as-you-drive insurance primarily charges based on miles driven, making it ideal for low-mileage drivers. Usage-based insurance, however, uses telematics to assess driving behavior such as speed, braking, and time of day, offering risk-based pricing. This distinction enables consumers to select plans that best fit their driving patterns and financial goals.

Comparison Table

| Feature | Pay As You Drive Insurance (PAYD) | Usage-Based Insurance (UBI) |

|---|---|---|

| Pricing Model | Charges based on miles driven | Charges based on driving behavior and mileage |

| Data Collected | Odometer readings or GPS for distance only | Speed, acceleration, braking, mileage, time of driving |

| Technology | Odometer tracking or GPS | Telematics device or smartphone app |

| Cost Savings | Benefits low-mileage drivers | Rewards safe driving habits and low usage |

| Privacy Concerns | Minimal tracking | Extensive driving data collected |

| Ideal User | Drivers who drive infrequently | Drivers willing to share driving data for discounts |

| Examples | Metromile, Allstate Milewise | Progressive Snapshot, State Farm Drive Safe & Save |

Which is better?

Usage-based insurance (UBI) leverages telematics technology to monitor driving behavior, offering personalized premiums based on factors such as speed, braking patterns, and mileage. Pay-as-you-drive (PAYD) insurance primarily charges based on the distance driven, making it ideal for low-mileage drivers seeking straightforward cost savings. UBI provides a more comprehensive risk assessment, often resulting in better rates for safe drivers compared to PAYD models.

Connection

Pay-as-you-drive (PAYD) insurance is a subset of usage-based insurance (UBI) that calculates premiums based on the number of miles driven, using telematics devices to track driving activity. Both PAYD and UBI leverage real-time data on driving behavior, such as speed, braking patterns, and distance, to tailor insurance costs more accurately to individual risk profiles. This connection allows insurers to offer personalized rates that encourage safer driving habits while reducing premiums for low-mileage drivers.

Key Terms

Telematics

Usage-based insurance (UBI) and pay-as-you-drive (PAYD) insurance both leverage telematics technology to collect real-time driving data, enabling personalized premium calculations based on mileage and driving behavior. UBI encompasses a broader scope, including metrics like speed, braking patterns, and time of day, while PAYD specifically charges premiums according to the distance driven. Explore how telematics enhances risk assessment and cost savings in modern automotive insurance models.

Premium Calculation

Usage-based insurance calculates premiums by monitoring real-time driving behavior, including factors such as speed, braking patterns, and mileage, offering highly personalized rates. Pay-as-you-drive insurance bases premiums primarily on the total number of miles driven, providing straightforward cost savings for low-mileage drivers. Explore how these distinct premium calculation methods can impact your overall insurance costs and coverage suitability.

Mileage Tracking

Usage-based insurance (UBI) relies on comprehensive driving behavior data such as speed, acceleration, and braking, while pay-as-you-drive (PAYD) insurance primarily focuses on mileage tracking to determine premiums. PAYD insurance offers a straightforward pricing model based on the exact miles driven, encouraging reduced driving and lower costs without analyzing additional driving habits. Explore the benefits and differences of these insurance models to determine which suits your driving needs best.

Source and External Links

Usage-Based Car Insurance - Usage-based insurance calculates auto insurance rates by monitoring how safely and how often you drive using telematics devices or mobile apps, offering potential discounts based on driving behavior like braking, acceleration, and mileage.

Usage-based insurance - This insurance model tracks driving habits such as miles driven, time of day, rapid acceleration or braking to customize premiums, with privacy concerns being a notable downside.

Usage Based Insurance: Everything You Need To Know - Usage-based insurance includes mileage-based plans that charge per mile driven and driving behavior-based plans that monitor speed and braking patterns, often resulting in discounts of 10%-25% for safer drivers.

dowidth.com

dowidth.com