Pet insurance platforms specialize in coverage options tailored to veterinary care, illness, and injury expenses for pets, while renters insurance platforms focus on protecting personal belongings and liability within rental properties. Platforms for pet insurance often provide customizable plans based on pet breed, age, and health conditions, whereas renters insurance platforms emphasize coverage limits for property damage, theft, and liability protection. Explore more to understand the distinct features and benefits of each insurance platform to make an informed decision.

Why it is important

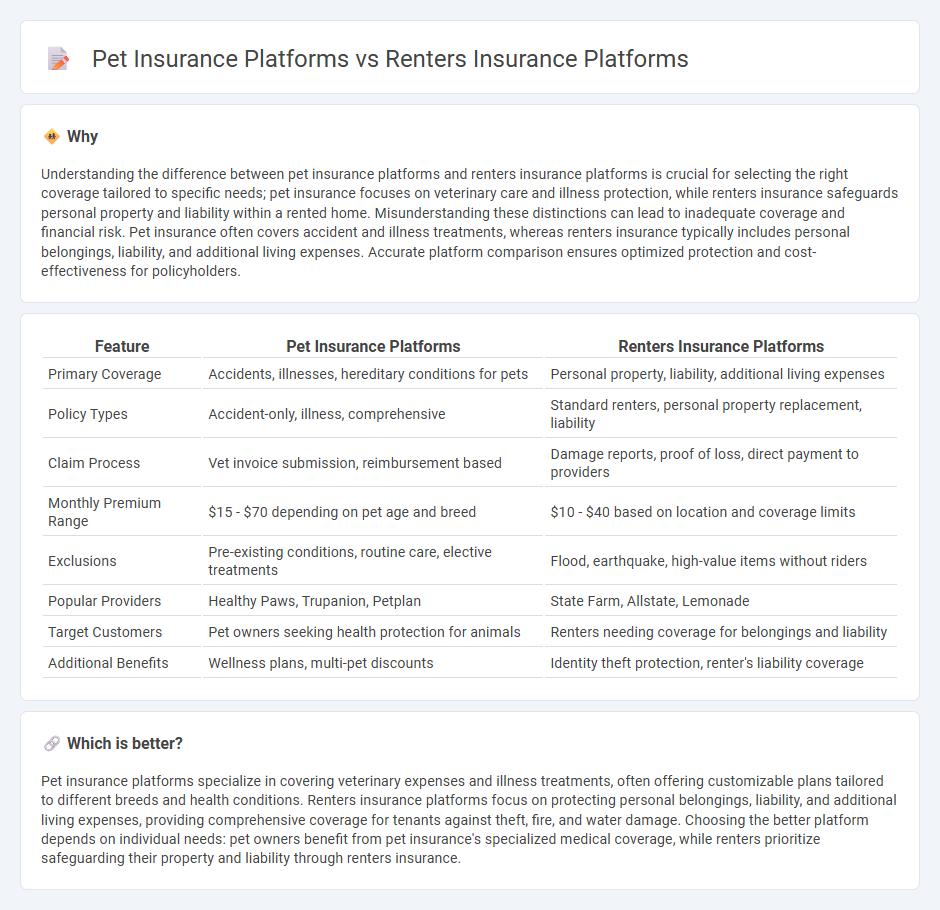

Understanding the difference between pet insurance platforms and renters insurance platforms is crucial for selecting the right coverage tailored to specific needs; pet insurance focuses on veterinary care and illness protection, while renters insurance safeguards personal property and liability within a rented home. Misunderstanding these distinctions can lead to inadequate coverage and financial risk. Pet insurance often covers accident and illness treatments, whereas renters insurance typically includes personal belongings, liability, and additional living expenses. Accurate platform comparison ensures optimized protection and cost-effectiveness for policyholders.

Comparison Table

| Feature | Pet Insurance Platforms | Renters Insurance Platforms |

|---|---|---|

| Primary Coverage | Accidents, illnesses, hereditary conditions for pets | Personal property, liability, additional living expenses |

| Policy Types | Accident-only, illness, comprehensive | Standard renters, personal property replacement, liability |

| Claim Process | Vet invoice submission, reimbursement based | Damage reports, proof of loss, direct payment to providers |

| Monthly Premium Range | $15 - $70 depending on pet age and breed | $10 - $40 based on location and coverage limits |

| Exclusions | Pre-existing conditions, routine care, elective treatments | Flood, earthquake, high-value items without riders |

| Popular Providers | Healthy Paws, Trupanion, Petplan | State Farm, Allstate, Lemonade |

| Target Customers | Pet owners seeking health protection for animals | Renters needing coverage for belongings and liability |

| Additional Benefits | Wellness plans, multi-pet discounts | Identity theft protection, renter's liability coverage |

Which is better?

Pet insurance platforms specialize in covering veterinary expenses and illness treatments, often offering customizable plans tailored to different breeds and health conditions. Renters insurance platforms focus on protecting personal belongings, liability, and additional living expenses, providing comprehensive coverage for tenants against theft, fire, and water damage. Choosing the better platform depends on individual needs: pet owners benefit from pet insurance's specialized medical coverage, while renters prioritize safeguarding their property and liability through renters insurance.

Connection

Pet insurance platforms and renters insurance platforms are connected through their shared focus on providing financial protection and risk management for everyday life assets, including pets and personal property. Both platforms utilize similar data analytics and underwriting technologies to assess risk, customize coverage options, and streamline claims processing. Integration of these services allows for bundled policies, offering convenience and comprehensive coverage tailored to renters who also seek pet protection.

Key Terms

**Renters Insurance Platforms:**

Renters insurance platforms provide tailored coverage options that protect personal property, liability, and additional living expenses for tenants, offering customizable policies and seamless online quote comparisons. These platforms leverage advanced algorithms and real-time data analytics to deliver competitive pricing and quick claim processing, enhancing the overall user experience. Explore the top renters insurance platforms to find the best policy suited to your needs.

Personal Property Coverage

Renters insurance platforms primarily emphasize Personal Property Coverage by protecting renters' belongings against risks such as theft, fire, and water damage, offering coverage limits that vary based on policy selection and endorsement options. Pet insurance platforms, while mainly focused on veterinary costs and wellness care, may occasionally include limited personal property coverage related to pet damage liability but lack the comprehensive protections found in renters insurance. Explore detailed comparisons to understand how Personal Property Coverage differs between renters and pet insurance platforms.

Liability Protection

Renters insurance platforms primarily emphasize liability protection against property damage or bodily injury occurring within a rented residence, covering incidents like accidental fire or guest injuries. Pet insurance platforms focus liability protection on veterinary bills and third-party damages caused by pets, such as bites or property destruction. Explore comprehensive options to understand how each insurance type secures your assets effectively.

Source and External Links

LeaseTrack - A platform that simplifies renters insurance by offering quick coverage options for renters and effortless insurance management and compliance tracking for property operators.

Sure - Connect Digital-first renters insurance - Enables property management and real estate companies to embed fully digital renters insurance solutions via APIs and white labels for seamless insurance purchase experiences.

Foxen | Renters Insurance Compliance + Rent Reporting Platform - Provides AI-enabled renters insurance compliance monitoring, automatic waiver enrollment, and integrates with property management software to reduce risk and improve onsite efficiency for multifamily properties.

dowidth.com

dowidth.com