Embedded insurance integrates coverage seamlessly within the purchase of products or services, offering convenience and immediate protection without separate policy management. Captive insurance involves a company creating its own insurance subsidiary to cover risks internally, providing tailored risk management and potential cost savings. Explore the key differences between embedded and captive insurance to determine the best fit for your risk management strategy.

Why it is important

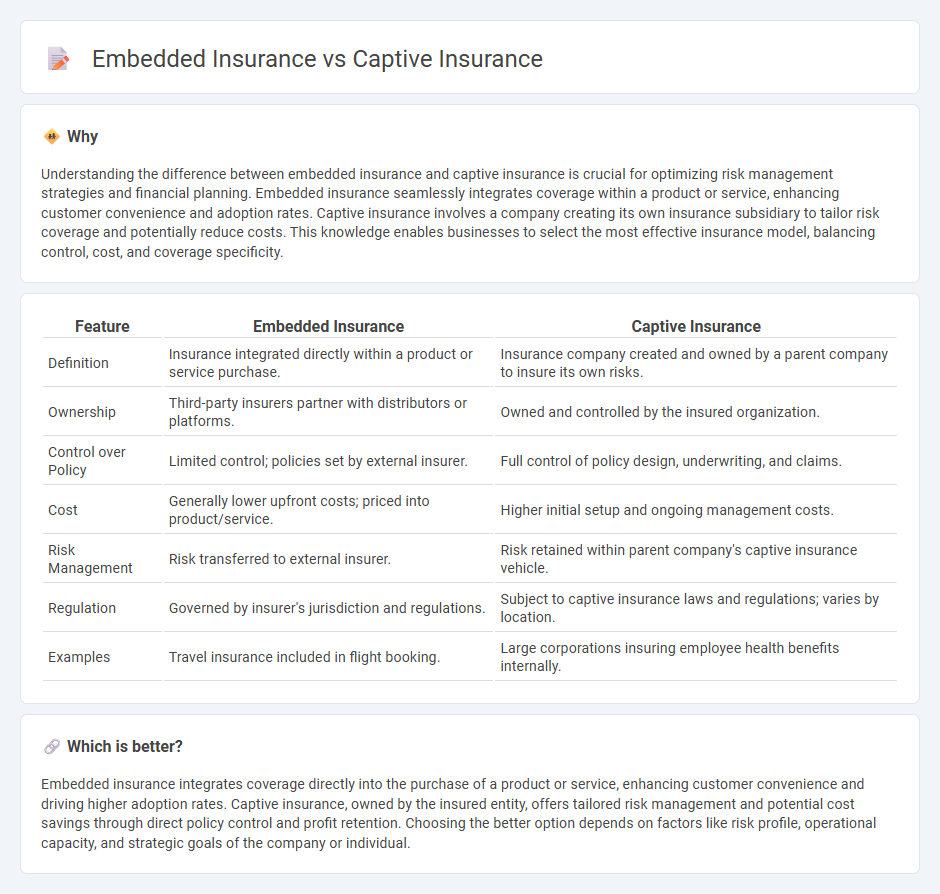

Understanding the difference between embedded insurance and captive insurance is crucial for optimizing risk management strategies and financial planning. Embedded insurance seamlessly integrates coverage within a product or service, enhancing customer convenience and adoption rates. Captive insurance involves a company creating its own insurance subsidiary to tailor risk coverage and potentially reduce costs. This knowledge enables businesses to select the most effective insurance model, balancing control, cost, and coverage specificity.

Comparison Table

| Feature | Embedded Insurance | Captive Insurance |

|---|---|---|

| Definition | Insurance integrated directly within a product or service purchase. | Insurance company created and owned by a parent company to insure its own risks. |

| Ownership | Third-party insurers partner with distributors or platforms. | Owned and controlled by the insured organization. |

| Control over Policy | Limited control; policies set by external insurer. | Full control of policy design, underwriting, and claims. |

| Cost | Generally lower upfront costs; priced into product/service. | Higher initial setup and ongoing management costs. |

| Risk Management | Risk transferred to external insurer. | Risk retained within parent company's captive insurance vehicle. |

| Regulation | Governed by insurer's jurisdiction and regulations. | Subject to captive insurance laws and regulations; varies by location. |

| Examples | Travel insurance included in flight booking. | Large corporations insuring employee health benefits internally. |

Which is better?

Embedded insurance integrates coverage directly into the purchase of a product or service, enhancing customer convenience and driving higher adoption rates. Captive insurance, owned by the insured entity, offers tailored risk management and potential cost savings through direct policy control and profit retention. Choosing the better option depends on factors like risk profile, operational capacity, and strategic goals of the company or individual.

Connection

Embedded insurance integrates coverage directly into products or services, enhancing customer experience by simplifying access and purchase. Captive insurance, where a company creates its own insurance subsidiary to manage risks, often uses embedded insurance models to tailor coverage specifically for its parent company's needs. This connection leverages embedded insurance's seamless integration with the captive insurer's customized risk management strategies, optimizing cost control and operational efficiency.

Key Terms

Risk Retention

Captive insurance involves a company creating its own licensed insurance subsidiary to retain and manage unique risks internally, enhancing control and potentially reducing costs associated with traditional insurance. Embedded insurance integrates coverage directly into a product or service offering, usually underwritten by a third-party insurer, allowing seamless risk transfer without the company retaining the risk itself. Explore the distinct advantages and strategic considerations of risk retention in captive versus embedded insurance models to optimize your risk management approach.

Distribution Channel

Captive insurance utilizes a controlled distribution channel, often managed internally by the parent company, ensuring direct oversight and tailored risk management solutions. Embedded insurance integrates directly into third-party platforms such as e-commerce or service providers, leveraging digital ecosystems to reach customers seamlessly at the point of sale. Explore how these distinct distribution channels impact risk transfer efficiency and customer experience in detail.

Customization

Captive insurance offers unparalleled customization by allowing businesses to create tailored risk management solutions that directly align with their specific operational needs and financial goals. Embedded insurance integrates coverage seamlessly within a product or service, providing convenience and a streamlined customer experience but typically with less flexibility in policy terms. Discover more about how each approach can optimize your risk strategy with personalized benefits.

Source and External Links

Captive insurance - Wikipedia - Captive insurance is a model where a company creates its own licensed insurance subsidiary to insure its own risks, offering tailored coverage, potential tax benefits, and greater control over risk management and cash flow.

What Is Captive Insurance? - Captive.com - A captive insurer is an insurance company wholly owned by its insureds, established to provide customized coverage when commercial insurance is too costly, unavailable, or poorly matched to the insured's needs, while allowing owners to directly control their insurance program and retain underwriting profits.

Insurance Topics | Captive Insurance Companies - NAIC - Captive insurance companies are wholly owned subsidiaries formed by non-insurance parent companies to self-insure their unique risks, operate under state regulation like commercial insurers, and are used by a wide range of organizations for both risk management and potential tax advantages.

dowidth.com

dowidth.com