Flood risk modeling quantifies potential flood hazards using hydrological data, topography, and climate patterns to assess the probability and severity of flood events. Underwriting modeling evaluates individual policy risks by analyzing loss history, property characteristics, and exposure to tailor insurance premiums accurately. Explore the key differences and applications in insurance by diving deeper into flood risk and underwriting models.

Why it is important

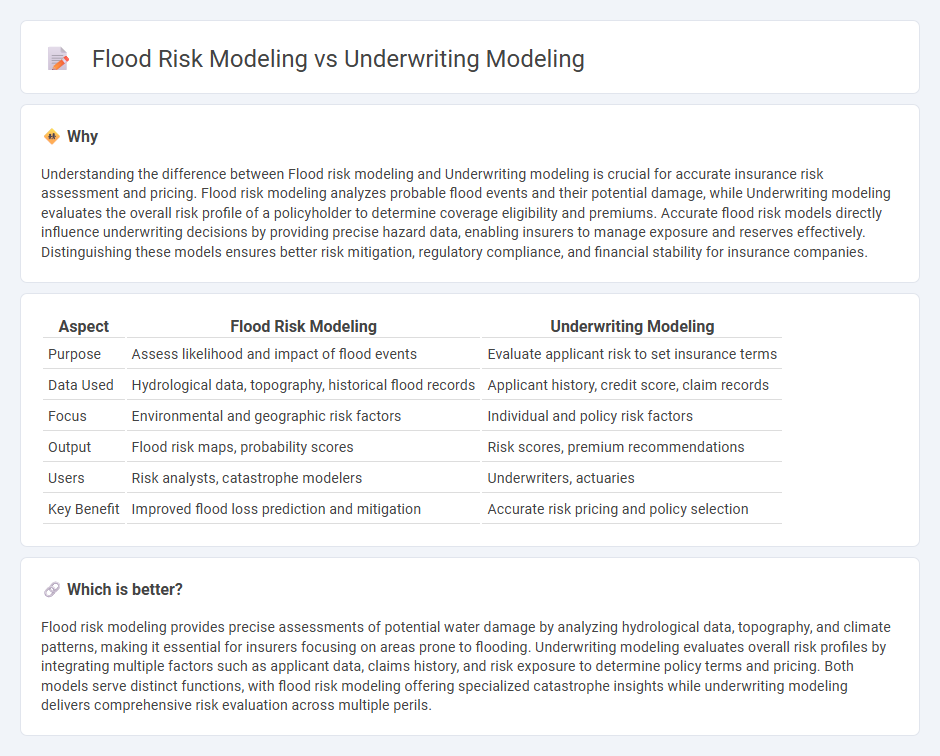

Understanding the difference between Flood risk modeling and Underwriting modeling is crucial for accurate insurance risk assessment and pricing. Flood risk modeling analyzes probable flood events and their potential damage, while Underwriting modeling evaluates the overall risk profile of a policyholder to determine coverage eligibility and premiums. Accurate flood risk models directly influence underwriting decisions by providing precise hazard data, enabling insurers to manage exposure and reserves effectively. Distinguishing these models ensures better risk mitigation, regulatory compliance, and financial stability for insurance companies.

Comparison Table

| Aspect | Flood Risk Modeling | Underwriting Modeling |

|---|---|---|

| Purpose | Assess likelihood and impact of flood events | Evaluate applicant risk to set insurance terms |

| Data Used | Hydrological data, topography, historical flood records | Applicant history, credit score, claim records |

| Focus | Environmental and geographic risk factors | Individual and policy risk factors |

| Output | Flood risk maps, probability scores | Risk scores, premium recommendations |

| Users | Risk analysts, catastrophe modelers | Underwriters, actuaries |

| Key Benefit | Improved flood loss prediction and mitigation | Accurate risk pricing and policy selection |

Which is better?

Flood risk modeling provides precise assessments of potential water damage by analyzing hydrological data, topography, and climate patterns, making it essential for insurers focusing on areas prone to flooding. Underwriting modeling evaluates overall risk profiles by integrating multiple factors such as applicant data, claims history, and risk exposure to determine policy terms and pricing. Both models serve distinct functions, with flood risk modeling offering specialized catastrophe insights while underwriting modeling delivers comprehensive risk evaluation across multiple perils.

Connection

Flood risk modeling provides critical data on potential flood events, which directly informs underwriting modeling by quantifying the likelihood and severity of flood-related claims. Underwriting models integrate these flood risk assessments to evaluate insurance policy risks, set premiums, and determine coverage limits accurately. This connection enhances insurers' ability to price policies effectively and manage overall portfolio risk related to flood hazards.

Key Terms

**Underwriting Modeling:**

Underwriting modeling utilizes historical data, risk factors, and predictive analytics to assess insurance applications and determine premium pricing accurately. This modeling focuses on evaluating financial risks associated with policyholders based on credit scores, claims history, and exposure to potential hazards. Explore detailed methodologies and tools to enhance underwriting accuracy and profitability.

Risk Selection

Underwriting modeling evaluates individual risk profiles to determine insurance eligibility and pricing, integrating factors like historical claims, asset values, and policyholder characteristics. Flood risk modeling focuses on assessing geographical and environmental variables such as rainfall patterns, topography, and drainage systems to predict potential flood impact and losses. Explore the distinctions and applications in risk selection to enhance insurance accuracy and resilience strategies.

Premium Pricing

Underwriting modeling integrates comprehensive risk assessments to determine accurate premium pricing, incorporating factors like historical claims data and individual policyholder risk profiles. Flood risk modeling specifically analyzes geographic, hydrological, and climate data to predict flood probability and potential damage, directly influencing premium adjustments in flood-prone areas. Discover more about how these models refine premium pricing strategies and enhance risk management.

Source and External Links

Guide to Underwriting Models - This guide outlines common underwriting models for business and personal lending, including automated underwriting systems and risk-based pricing models.

A 7-Step Framework For Underwriting Commercial Real Estate - This article provides a structured approach to underwriting commercial real estate deals, focusing on risk assessment and deal valuation.

7 Insurance Underwriting Models - This resource explores various insurance underwriting models tailored to different insurance types and risk complexities.

dowidth.com

dowidth.com