Insurance as a service leverages advanced technology and traditional models to offer customizable coverage with quick claims processing and robust risk management. Peer-to-peer insurance reshapes risk sharing by grouping individuals to collectively insure each other, often reducing costs and increasing transparency through decentralized platforms. Discover how these innovative approaches transform the insurance landscape and which model suits your needs best.

Why it is important

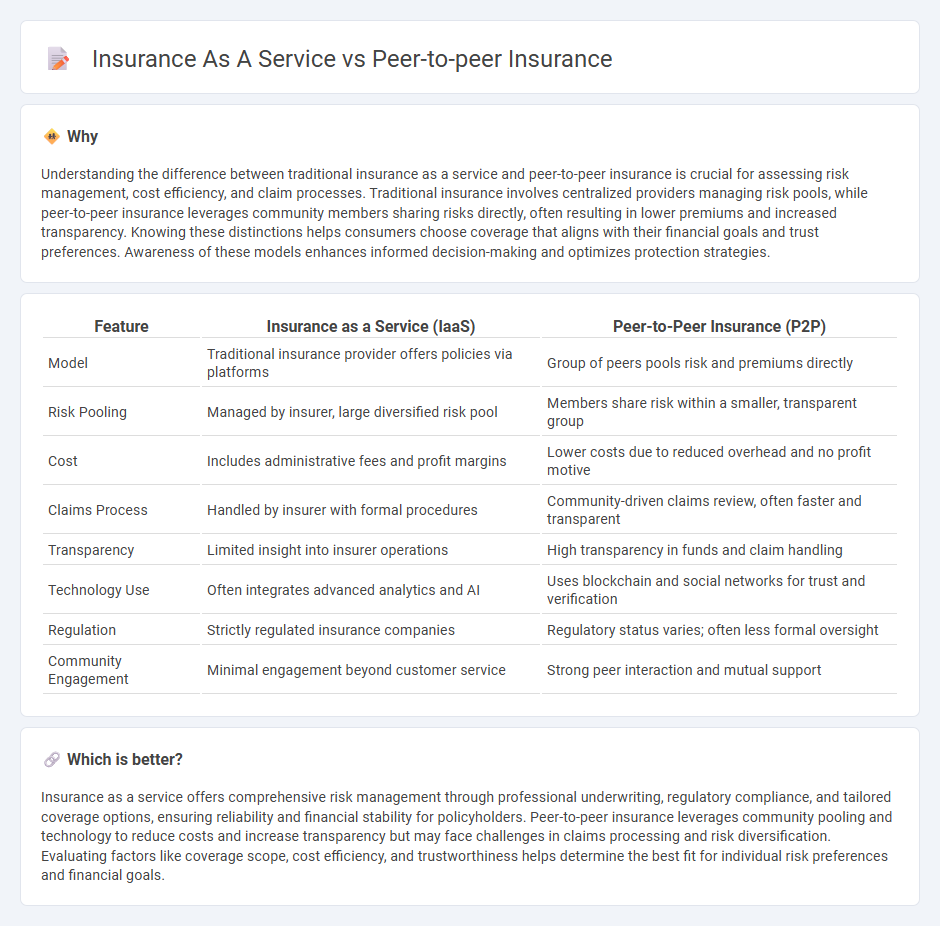

Understanding the difference between traditional insurance as a service and peer-to-peer insurance is crucial for assessing risk management, cost efficiency, and claim processes. Traditional insurance involves centralized providers managing risk pools, while peer-to-peer insurance leverages community members sharing risks directly, often resulting in lower premiums and increased transparency. Knowing these distinctions helps consumers choose coverage that aligns with their financial goals and trust preferences. Awareness of these models enhances informed decision-making and optimizes protection strategies.

Comparison Table

| Feature | Insurance as a Service (IaaS) | Peer-to-Peer Insurance (P2P) |

|---|---|---|

| Model | Traditional insurance provider offers policies via platforms | Group of peers pools risk and premiums directly |

| Risk Pooling | Managed by insurer, large diversified risk pool | Members share risk within a smaller, transparent group |

| Cost | Includes administrative fees and profit margins | Lower costs due to reduced overhead and no profit motive |

| Claims Process | Handled by insurer with formal procedures | Community-driven claims review, often faster and transparent |

| Transparency | Limited insight into insurer operations | High transparency in funds and claim handling |

| Technology Use | Often integrates advanced analytics and AI | Uses blockchain and social networks for trust and verification |

| Regulation | Strictly regulated insurance companies | Regulatory status varies; often less formal oversight |

| Community Engagement | Minimal engagement beyond customer service | Strong peer interaction and mutual support |

Which is better?

Insurance as a service offers comprehensive risk management through professional underwriting, regulatory compliance, and tailored coverage options, ensuring reliability and financial stability for policyholders. Peer-to-peer insurance leverages community pooling and technology to reduce costs and increase transparency but may face challenges in claims processing and risk diversification. Evaluating factors like coverage scope, cost efficiency, and trustworthiness helps determine the best fit for individual risk preferences and financial goals.

Connection

Insurance as a service leverages digital platforms to provide customizable coverage options, enhancing accessibility and efficiency. Peer-to-peer insurance operates within this model by enabling groups of individuals to pool premiums and share risk directly, reducing reliance on traditional insurers. Both concepts utilize technology and data analytics to foster transparency and lower costs for policyholders.

Key Terms

Risk Pooling

Peer-to-peer insurance leverages decentralized risk pooling by enabling individuals to form small groups that share liabilities and reduce costs collectively, enhancing transparency and trust. Insurance as a service centralizes risk management through digital platforms, offering scalable, customizable coverage solutions with data-driven actuarial models for improved risk assessment. Explore deeper insights into how these models optimize risk pooling efficiency and reshape the insurance landscape.

Decentralization

Peer-to-peer insurance leverages blockchain technology to enable decentralized risk-sharing among participants, removing traditional intermediaries and reducing costs. Insurance as a service typically relies on cloud platforms to offer modular, scalable coverage but often remains centralized under provider control. Explore further to understand how decentralization revolutionizes trust and transparency in modern insurance models.

Platform-based Model

Peer-to-peer insurance leverages decentralized, community-driven risk pooling where members share premiums and claims, promoting transparency and reduced costs. Insurance as a service operates on platform-based models offering scalable, on-demand coverage integrating AI and data analytics for personalized policies and seamless user experience. Explore how these platform-based models transform risk management and customer engagement in the insurance industry.

Source and External Links

Insurance Topics | Peer-to-Peer Insurance - Peer-to-peer insurance enables groups of individuals to pool their capital, self-organize, and self-administer their own insurance, combining trust, transparency, and cost reduction through shared responsibility and technology.

How Peer-to-Peer Insurance Works - The Actuary Magazine - P2P insurance merges modern technology and the sharing economy with traditional mutual insurance principles, allowing groups to collectively insure against specific risks without relying on a conventional insurance company.

Does car insurance cover peer-to-peer rentals? - In peer-to-peer car sharing, both car owners and renters must navigate unique insurance arrangements, with owners often relying on platform-provided coverage during rentals and renters potentially extending their personal auto insurance to the rented vehicle.

dowidth.com

dowidth.com