Catastrophe bonds transfer catastrophe risk from insurers to capital market investors by triggering payouts based on predefined loss events, providing a financial buffer after disasters. Industry loss warranties (ILWs) pay out when industry-wide losses exceed a specified threshold, offering reinsurers a mechanism to hedge against large-scale claims. Explore more to understand how these tools enhance risk management in insurance.

Why it is important

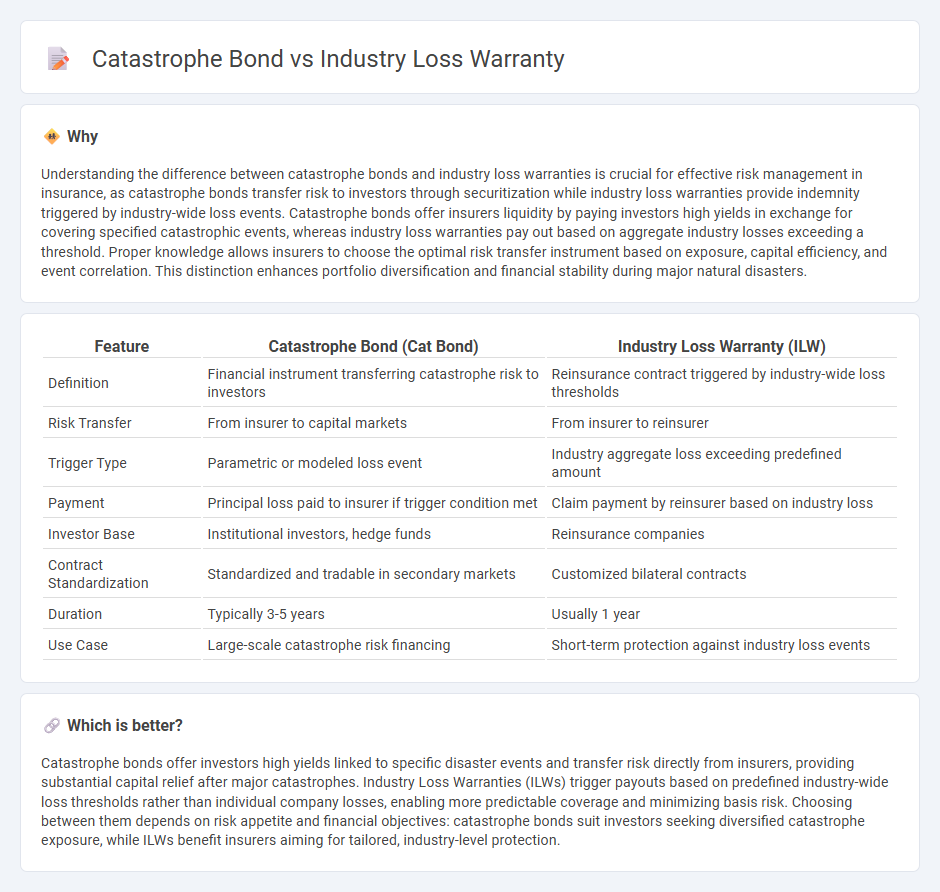

Understanding the difference between catastrophe bonds and industry loss warranties is crucial for effective risk management in insurance, as catastrophe bonds transfer risk to investors through securitization while industry loss warranties provide indemnity triggered by industry-wide loss events. Catastrophe bonds offer insurers liquidity by paying investors high yields in exchange for covering specified catastrophic events, whereas industry loss warranties pay out based on aggregate industry losses exceeding a threshold. Proper knowledge allows insurers to choose the optimal risk transfer instrument based on exposure, capital efficiency, and event correlation. This distinction enhances portfolio diversification and financial stability during major natural disasters.

Comparison Table

| Feature | Catastrophe Bond (Cat Bond) | Industry Loss Warranty (ILW) |

|---|---|---|

| Definition | Financial instrument transferring catastrophe risk to investors | Reinsurance contract triggered by industry-wide loss thresholds |

| Risk Transfer | From insurer to capital markets | From insurer to reinsurer |

| Trigger Type | Parametric or modeled loss event | Industry aggregate loss exceeding predefined amount |

| Payment | Principal loss paid to insurer if trigger condition met | Claim payment by reinsurer based on industry loss |

| Investor Base | Institutional investors, hedge funds | Reinsurance companies |

| Contract Standardization | Standardized and tradable in secondary markets | Customized bilateral contracts |

| Duration | Typically 3-5 years | Usually 1 year |

| Use Case | Large-scale catastrophe risk financing | Short-term protection against industry loss events |

Which is better?

Catastrophe bonds offer investors high yields linked to specific disaster events and transfer risk directly from insurers, providing substantial capital relief after major catastrophes. Industry Loss Warranties (ILWs) trigger payouts based on predefined industry-wide loss thresholds rather than individual company losses, enabling more predictable coverage and minimizing basis risk. Choosing between them depends on risk appetite and financial objectives: catastrophe bonds suit investors seeking diversified catastrophe exposure, while ILWs benefit insurers aiming for tailored, industry-level protection.

Connection

Catastrophe bonds and industry loss warranties are both financial instruments designed to transfer and mitigate risk related to large-scale insurance losses from natural disasters. Catastrophe bonds provide insurers with capital relief by allowing them to access funds when predefined loss thresholds are met, while industry loss warranties trigger payouts based on industry-wide loss indices rather than individual company losses. Their connection lies in managing catastrophe risk through alternative risk transfer mechanisms that offer liquidity and risk-sharing solutions beyond traditional reinsurance.

Key Terms

Trigger mechanism

Industry loss warranties (ILWs) activate based on industry-wide loss thresholds reported by authoritative sources, ensuring payout only when aggregate losses exceed set limits, thus providing clear trigger events linked to real-world catastrophes. Catastrophe bonds employ parametric or indemnity-based triggers, often tied to specific data points like hurricane wind speeds or earthquake magnitudes, enabling investors to assess risk independently of actual losses. Explore further to understand how these trigger mechanisms influence risk transfer and investment decisions.

Risk transfer

Industry loss warranties (ILWs) provide risk transfer by triggering payments when industry-wide losses exceed a specified threshold, offering direct protection against catastrophic events for insurers and reinsurers. Catastrophe bonds transfer risk to capital markets by allowing investors to absorb losses in exchange for attractive returns, effectively spreading catastrophe risk beyond traditional insurance sources. Explore how these instruments enhance risk management in the evolving insurance landscape.

Payout structure

Industry loss warranties (ILWs) provide payouts triggered by an industry-wide loss exceeding a predefined threshold, with compensation based on the notional amount agreed upon in the contract. Catastrophe bonds (cat bonds) deliver payouts depending on the occurrence and severity of specific catastrophic events, often linked to parametric triggers or modeled loss estimates, and can include principal reduction or full loss of investors' capital. Explore detailed comparative analyses to understand the nuanced payout mechanisms of ILWs versus cat bonds.

Source and External Links

Industry loss warranty - Wikipedia - Industry Loss Warranties (ILWs) are reinsurance contracts where protection is purchased based on total industry losses from a catastrophic event exceeding a specified trigger, with payout limits and triggers defined by industry-wide loss amounts rather than the buyer's own losses.

What are industry loss warranties (or ILW's)? - ILWs are reinsurance or derivative contracts triggered when total industry insured losses exceed a pre-defined threshold, with various types like Live Cat (traded during an event) and Dead Cat (traded after an event) providing flexible risk transfer in catastrophe-exposed markets.

Industry Loss Warranties (ILW) - Turker Broker - ILWs are insurance-linked securities that provide coverage based on an industry loss index for catastrophes like hurricanes and earthquakes, paying out when losses exceed a pre-agreed threshold indexed to industry-wide losses rather than individual insured losses.

dowidth.com

dowidth.com