Deepfake insurance specifically addresses risks associated with synthetic media misuse and deepfake technology, offering coverage for reputational harm and financial losses stemming from manipulated digital content. Technology Errors and Omissions (E&O) insurance protects technology service providers against claims of negligence, software failures, and professional errors impacting client operations. Explore the distinctions and benefits of these specialized insurance policies to safeguard your business in the evolving tech landscape.

Why it is important

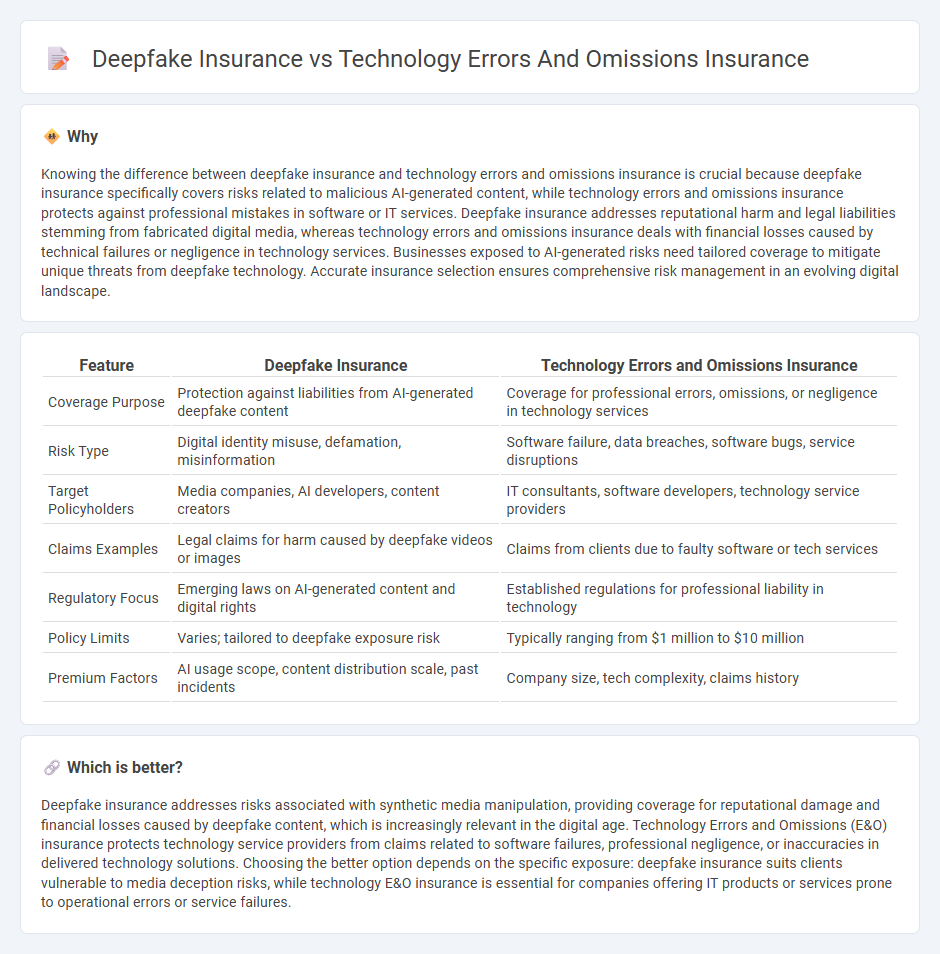

Knowing the difference between deepfake insurance and technology errors and omissions insurance is crucial because deepfake insurance specifically covers risks related to malicious AI-generated content, while technology errors and omissions insurance protects against professional mistakes in software or IT services. Deepfake insurance addresses reputational harm and legal liabilities stemming from fabricated digital media, whereas technology errors and omissions insurance deals with financial losses caused by technical failures or negligence in technology services. Businesses exposed to AI-generated risks need tailored coverage to mitigate unique threats from deepfake technology. Accurate insurance selection ensures comprehensive risk management in an evolving digital landscape.

Comparison Table

| Feature | Deepfake Insurance | Technology Errors and Omissions Insurance |

|---|---|---|

| Coverage Purpose | Protection against liabilities from AI-generated deepfake content | Coverage for professional errors, omissions, or negligence in technology services |

| Risk Type | Digital identity misuse, defamation, misinformation | Software failure, data breaches, software bugs, service disruptions |

| Target Policyholders | Media companies, AI developers, content creators | IT consultants, software developers, technology service providers |

| Claims Examples | Legal claims for harm caused by deepfake videos or images | Claims from clients due to faulty software or tech services |

| Regulatory Focus | Emerging laws on AI-generated content and digital rights | Established regulations for professional liability in technology |

| Policy Limits | Varies; tailored to deepfake exposure risk | Typically ranging from $1 million to $10 million |

| Premium Factors | AI usage scope, content distribution scale, past incidents | Company size, tech complexity, claims history |

Which is better?

Deepfake insurance addresses risks associated with synthetic media manipulation, providing coverage for reputational damage and financial losses caused by deepfake content, which is increasingly relevant in the digital age. Technology Errors and Omissions (E&O) insurance protects technology service providers from claims related to software failures, professional negligence, or inaccuracies in delivered technology solutions. Choosing the better option depends on the specific exposure: deepfake insurance suits clients vulnerable to media deception risks, while technology E&O insurance is essential for companies offering IT products or services prone to operational errors or service failures.

Connection

Deepfake insurance and technology errors and omissions (E&O) insurance both address emerging risks in the digital and technological landscape. Deepfake insurance specifically protects against damages caused by manipulated media content, while technology E&O insurance covers liabilities arising from software failures, technology errors, and professional mistakes. Both types of insurance play crucial roles in mitigating financial losses related to cyber threats, digital manipulation, and technology-driven errors in businesses and individuals.

Key Terms

**Technology Errors and Omissions Insurance:**

Technology Errors and Omissions Insurance provides critical protection for software developers, IT consultants, and tech firms against claims arising from software failures, coding errors, or negligence leading to financial loss. This insurance covers legal defense costs and settlements related to professional mistakes in technology services or products, safeguarding business continuity in a highly specialized market. Discover more about how Technology Errors and Omissions Insurance can mitigate risks associated with technological liabilities.

Professional Liability

Technology Errors and Omissions (E&O) Insurance protects professionals against claims related to software failures, coding errors, or technology service delivery negligence, covering financial losses caused by these mistakes. Deepfake Insurance specifically addresses liabilities arising from the creation or distribution of manipulated synthetic media, focusing on protecting professionals involved in content creation and AI technologies from defamation, copyright infringement, or misuse of deepfake technology. Explore more to understand which professional liability coverage suits your tech or media operations best.

Claims-made Policy

Technology errors and omissions insurance (E&O) provides coverage for claims arising from negligent acts, errors, or omissions in technology services on a claims-made basis, meaning it covers only claims reported during the policy period. Deepfake insurance, a specialized form of E&O, addresses risks related to synthetic media and malicious AI-generated content, often requiring tailored coverage terms within a claims-made policy to manage evolving digital threats. Explore detailed differences and policy nuances to better protect your technology enterprise against emerging liabilities.

Source and External Links

Technology Errors and Omissions Insurance - This insurance covers providers of technology products or services against negligence, mistakes, or oversights, including data breaches.

Technology Errors and Omissions Insurance - Helps protect businesses from damages caused by mistakes in products or services, such as failing to meet deadlines or selling incompatible products.

Tech E&O Insurance Coverage - Protects businesses from financial loss and liability claims arising from technology products or services, offering comprehensive coverage for various risks.

dowidth.com

dowidth.com