Digital health insurance leverages technology to offer streamlined policy management, rapid claims processing, and telemedicine access, enhancing convenience and efficiency for policyholders. Supplemental health insurance provides additional financial protection by covering gaps in primary health plans, such as copayments, deductibles, and specific services like dental or vision care. Explore the key differences and benefits of digital and supplemental health insurance to make informed coverage decisions.

Why it is important

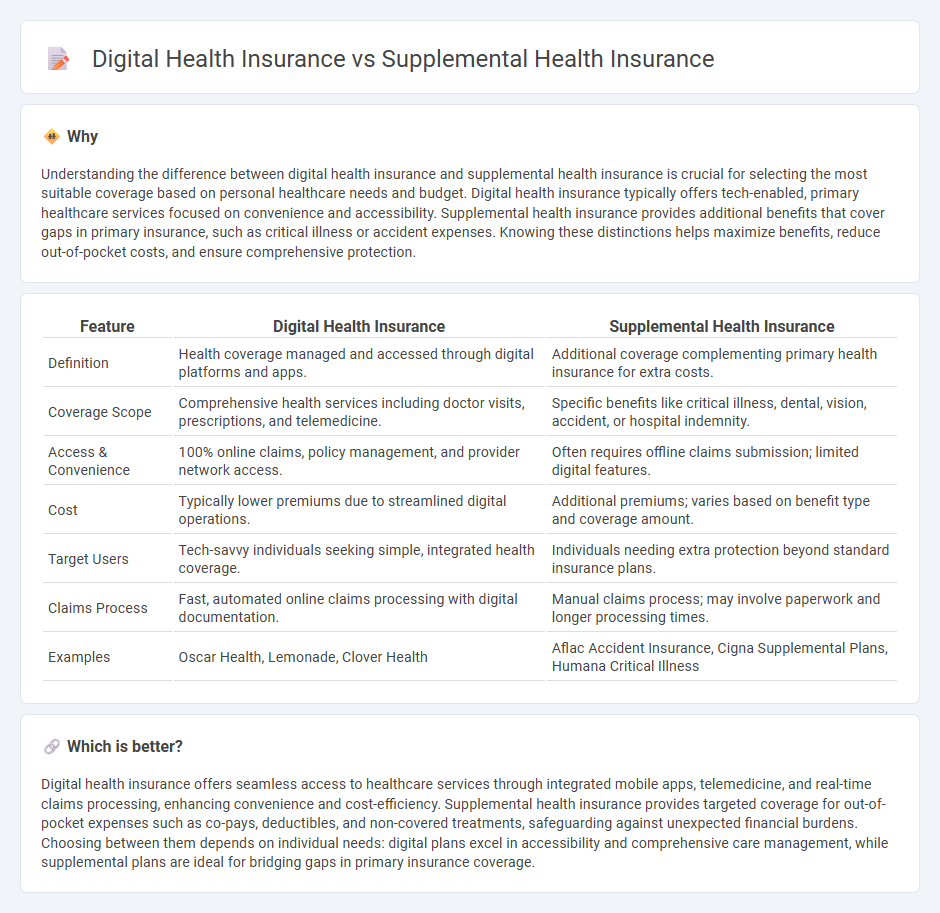

Understanding the difference between digital health insurance and supplemental health insurance is crucial for selecting the most suitable coverage based on personal healthcare needs and budget. Digital health insurance typically offers tech-enabled, primary healthcare services focused on convenience and accessibility. Supplemental health insurance provides additional benefits that cover gaps in primary insurance, such as critical illness or accident expenses. Knowing these distinctions helps maximize benefits, reduce out-of-pocket costs, and ensure comprehensive protection.

Comparison Table

| Feature | Digital Health Insurance | Supplemental Health Insurance |

|---|---|---|

| Definition | Health coverage managed and accessed through digital platforms and apps. | Additional coverage complementing primary health insurance for extra costs. |

| Coverage Scope | Comprehensive health services including doctor visits, prescriptions, and telemedicine. | Specific benefits like critical illness, dental, vision, accident, or hospital indemnity. |

| Access & Convenience | 100% online claims, policy management, and provider network access. | Often requires offline claims submission; limited digital features. |

| Cost | Typically lower premiums due to streamlined digital operations. | Additional premiums; varies based on benefit type and coverage amount. |

| Target Users | Tech-savvy individuals seeking simple, integrated health coverage. | Individuals needing extra protection beyond standard insurance plans. |

| Claims Process | Fast, automated online claims processing with digital documentation. | Manual claims process; may involve paperwork and longer processing times. |

| Examples | Oscar Health, Lemonade, Clover Health | Aflac Accident Insurance, Cigna Supplemental Plans, Humana Critical Illness |

Which is better?

Digital health insurance offers seamless access to healthcare services through integrated mobile apps, telemedicine, and real-time claims processing, enhancing convenience and cost-efficiency. Supplemental health insurance provides targeted coverage for out-of-pocket expenses such as co-pays, deductibles, and non-covered treatments, safeguarding against unexpected financial burdens. Choosing between them depends on individual needs: digital plans excel in accessibility and comprehensive care management, while supplemental plans are ideal for bridging gaps in primary insurance coverage.

Connection

Digital health insurance leverages technology to streamline policy management, claims processing, and customer engagement, enhancing accessibility and efficiency for users. Supplemental health insurance provides additional coverage beyond primary health plans, addressing gaps such as copayments, deductibles, and specialized treatments. Integration of digital health insurance platforms with supplemental insurance products enables seamless enrollment, real-time claims coordination, and personalized coverage options, improving healthcare affordability and patient outcomes.

Key Terms

**Supplemental Health Insurance:**

Supplemental health insurance provides additional coverage to fill gaps left by primary health plans, covering expenses like copayments, deductibles, and specific treatments such as dental, vision, or critical illness benefits. It enhances financial protection by decreasing out-of-pocket costs and offering access to a broader range of healthcare services, especially for conditions not fully covered by basic plans. Explore how supplemental health insurance can complement your existing coverage and improve healthcare affordability.

Gap Coverage

Supplemental health insurance provides gap coverage by filling the financial voids left by primary health plans, including deductibles, copayments, and coinsurance, ensuring comprehensive protection against unforeseen medical expenses. Digital health insurance leverages technology for streamlined enrollment, claims processing, and personalized gap coverage options tailored to individual needs through mobile apps and online platforms. Explore how these innovations transform gap coverage to make informed decisions about your health plan.

Out-of-Pocket Expenses

Supplemental health insurance traditionally covers costs like copayments, deductibles, and coinsurance that primary health plans often exclude, effectively reducing out-of-pocket expenses during medical emergencies. Digital health insurance leverages technology to provide personalized plans that optimize coverage and streamline claims, potentially lowering overall out-of-pocket spending through real-time cost tracking and tailored policy options. Explore further to understand how each option can best meet your financial and healthcare needs.

Source and External Links

Supplemental Health Insurance - Supplemental health insurance is a type of insurance that helps pay for treatments and services that standard health insurance plans may not cover.

Explore Supplemental Insurance Options - Supplemental insurance provides additional cash benefits to policyholders for specific medical conditions or circumstances, offering a contrast to secondary insurance.

Supplemental Health Insurance Products - State Farm offers supplemental health insurance products that cover additional expenses such as hospital admissions and intensive care beyond primary health insurance.

dowidth.com

dowidth.com