Pay per mile insurance charges customers based on the exact number of miles driven, offering personalized savings and cost-efficiency for low-mileage drivers. Low-mileage discount insurance provides a predetermined rate reduction for drivers who stay below a specific annual mileage threshold, rewarding consistent low usage. Discover how these insurance options can optimize your premiums and fit your driving habits.

Why it is important

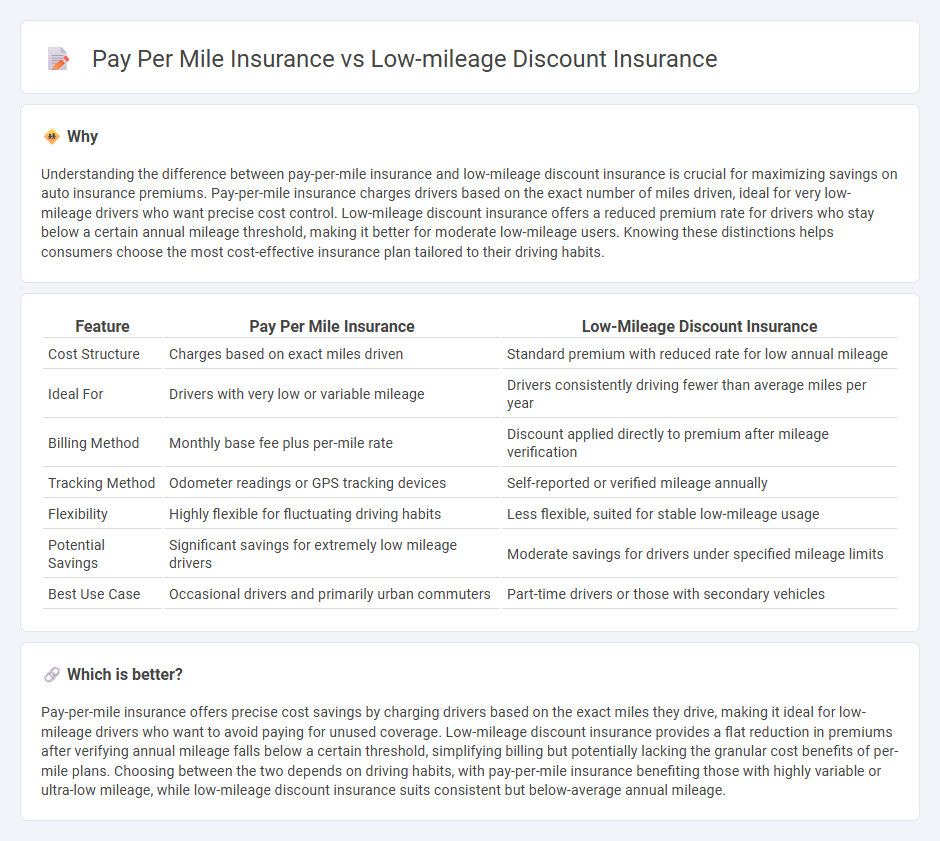

Understanding the difference between pay-per-mile insurance and low-mileage discount insurance is crucial for maximizing savings on auto insurance premiums. Pay-per-mile insurance charges drivers based on the exact number of miles driven, ideal for very low-mileage drivers who want precise cost control. Low-mileage discount insurance offers a reduced premium rate for drivers who stay below a certain annual mileage threshold, making it better for moderate low-mileage users. Knowing these distinctions helps consumers choose the most cost-effective insurance plan tailored to their driving habits.

Comparison Table

| Feature | Pay Per Mile Insurance | Low-Mileage Discount Insurance |

|---|---|---|

| Cost Structure | Charges based on exact miles driven | Standard premium with reduced rate for low annual mileage |

| Ideal For | Drivers with very low or variable mileage | Drivers consistently driving fewer than average miles per year |

| Billing Method | Monthly base fee plus per-mile rate | Discount applied directly to premium after mileage verification |

| Tracking Method | Odometer readings or GPS tracking devices | Self-reported or verified mileage annually |

| Flexibility | Highly flexible for fluctuating driving habits | Less flexible, suited for stable low-mileage usage |

| Potential Savings | Significant savings for extremely low mileage drivers | Moderate savings for drivers under specified mileage limits |

| Best Use Case | Occasional drivers and primarily urban commuters | Part-time drivers or those with secondary vehicles |

Which is better?

Pay-per-mile insurance offers precise cost savings by charging drivers based on the exact miles they drive, making it ideal for low-mileage drivers who want to avoid paying for unused coverage. Low-mileage discount insurance provides a flat reduction in premiums after verifying annual mileage falls below a certain threshold, simplifying billing but potentially lacking the granular cost benefits of per-mile plans. Choosing between the two depends on driving habits, with pay-per-mile insurance benefiting those with highly variable or ultra-low mileage, while low-mileage discount insurance suits consistent but below-average annual mileage.

Connection

Pay per mile insurance charges premiums based on the exact number of miles driven, providing a direct financial benefit to low-mileage drivers. Low-mileage discount insurance offers reduced rates or discounts for policyholders who drive fewer miles annually, recognizing their decreased risk exposure. Both insurance types aim to reward safer, less frequent drivers by aligning premiums with actual road usage.

Key Terms

Premium calculation

Low-mileage discount insurance offers reduced premiums based on annual mileage thresholds, typically rewarding drivers who stay under a set limit such as 7,500 to 10,000 miles per year. Pay-per-mile insurance calculates premiums directly from the exact number of miles driven, charging a base rate plus a fixed rate per mile, providing highly personalized cost savings for very low-mileage drivers. Explore detailed comparisons to understand which option can better optimize your insurance premium based on your driving habits.

Mileage tracking

Low-mileage discount insurance typically offers savings based on annual mileage estimates submitted at policy inception, reducing premiums for drivers who predictably drive fewer miles. Pay per mile insurance tracks mileage in real-time via a telematics device or mobile app, charging customers strictly according to actual miles driven, providing precise cost alignment. Explore the nuances of mileage tracking and how it can optimize your insurance savings.

Usage-based pricing

Low-mileage discount insurance offers reduced premiums to drivers who use their vehicles less than average, typically based on annual mileage thresholds, rewarding infrequent drivers. Pay per mile insurance uses telematics to track actual miles driven in real time, charging customers based on exact road usage rather than estimated mileage, providing a flexible and precise pricing model. Explore the differences between these usage-based pricing strategies to find the best fit for your driving habits.

Source and External Links

Best Low-Mileage Car Insurance Options (2025) - Money Geek - Low-mileage drivers (under 7,500 miles/year) can choose from traditional low-mileage discounts, pay-per-mile insurance, or usage-based insurance to save an average of $86 annually, with the best program depending on actual mileage and comfort with technology.

The Best Low-Mileage Car Insurance Companies (2025) - Jerry - Some insurers, like Allstate, Mile Auto, Nationwide, and Lemonade, offer special programs such as pay-per-mile policies and telematics-based discounts for verified low-mileage drivers, though significant discounts generally require proof of driving habits, not just self-reported mileage.

Car Insurance for Low-Mileage Drivers - The Zebra - Low-mileage drivers may save up to 30% with specific discounts, but often need to enroll in usage-based or pay-per-mile programs, as standard insurers typically offer only minor premium reductions without formal verification of mileage.

dowidth.com

dowidth.com