On-demand insurance offers flexible coverage activated only when needed, providing cost-efficiency and tailored protection for specific events or periods. Usage-based insurance calculates premiums based on actual behavior or usage data, such as driving patterns, promoting fair pricing and personalized risk assessment. Explore the details of on-demand versus usage-based insurance to find the option that best fits your lifestyle and financial goals.

Why it is important

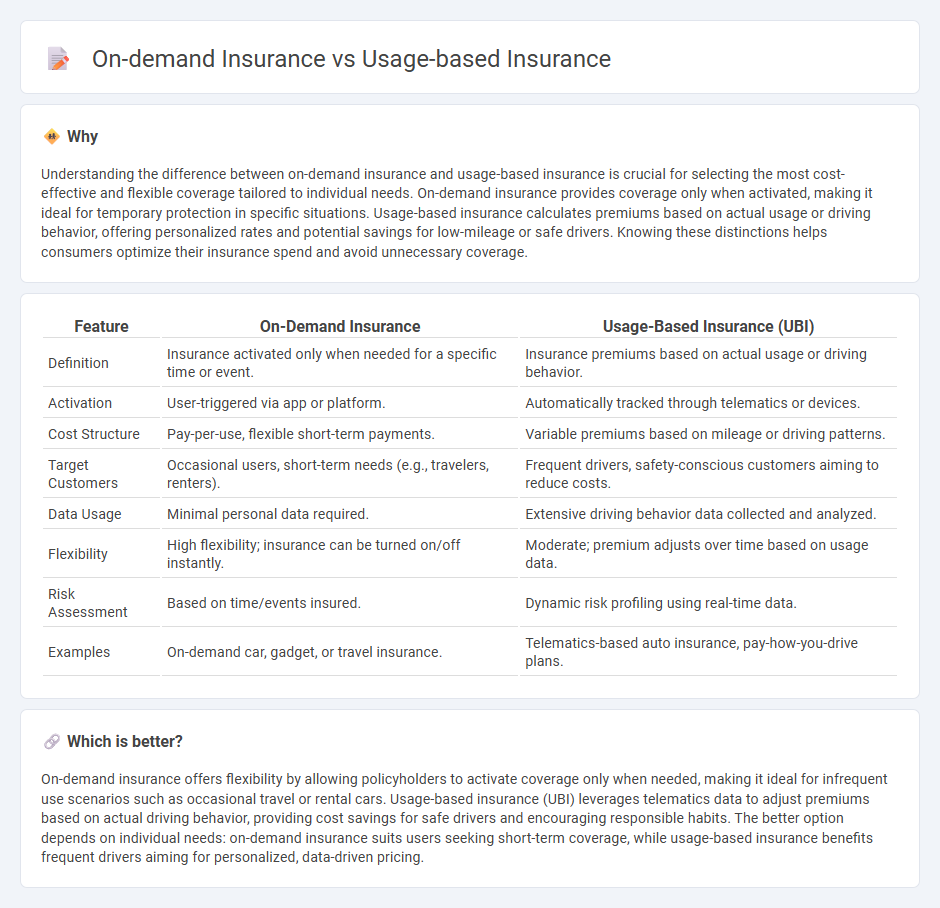

Understanding the difference between on-demand insurance and usage-based insurance is crucial for selecting the most cost-effective and flexible coverage tailored to individual needs. On-demand insurance provides coverage only when activated, making it ideal for temporary protection in specific situations. Usage-based insurance calculates premiums based on actual usage or driving behavior, offering personalized rates and potential savings for low-mileage or safe drivers. Knowing these distinctions helps consumers optimize their insurance spend and avoid unnecessary coverage.

Comparison Table

| Feature | On-Demand Insurance | Usage-Based Insurance (UBI) |

|---|---|---|

| Definition | Insurance activated only when needed for a specific time or event. | Insurance premiums based on actual usage or driving behavior. |

| Activation | User-triggered via app or platform. | Automatically tracked through telematics or devices. |

| Cost Structure | Pay-per-use, flexible short-term payments. | Variable premiums based on mileage or driving patterns. |

| Target Customers | Occasional users, short-term needs (e.g., travelers, renters). | Frequent drivers, safety-conscious customers aiming to reduce costs. |

| Data Usage | Minimal personal data required. | Extensive driving behavior data collected and analyzed. |

| Flexibility | High flexibility; insurance can be turned on/off instantly. | Moderate; premium adjusts over time based on usage data. |

| Risk Assessment | Based on time/events insured. | Dynamic risk profiling using real-time data. |

| Examples | On-demand car, gadget, or travel insurance. | Telematics-based auto insurance, pay-how-you-drive plans. |

Which is better?

On-demand insurance offers flexibility by allowing policyholders to activate coverage only when needed, making it ideal for infrequent use scenarios such as occasional travel or rental cars. Usage-based insurance (UBI) leverages telematics data to adjust premiums based on actual driving behavior, providing cost savings for safe drivers and encouraging responsible habits. The better option depends on individual needs: on-demand insurance suits users seeking short-term coverage, while usage-based insurance benefits frequent drivers aiming for personalized, data-driven pricing.

Connection

On-demand insurance and usage-based insurance both leverage real-time data and digital platforms to offer flexible coverage tailored to individual needs. On-demand insurance provides short-term policies activated only when needed, while usage-based insurance calculates premiums based on actual behavior, such as driving patterns monitored through telematics. This integration enhances customer control, reduces costs, and promotes personalized risk assessment in the insurance industry.

Key Terms

Telematics

Telematics in usage-based insurance (UBI) collects detailed driving behavior data such as speed, mileage, and braking patterns to tailor premiums, promoting safer driving habits and cost efficiency. On-demand insurance leverages telematics to activate coverage only during specific periods or trips, providing flexible, pay-as-you-go protection ideal for infrequent drivers or renters. Explore more about how telematics technology is transforming personalized insurance solutions.

Flexibility

Usage-based insurance (UBI) offers premium calculations based on actual driving behavior, providing flexibility for regular drivers to save costs by aligning payments with mileage and risk factors. On-demand insurance allows users to activate coverage only when needed, ideal for occasional or short-term use, granting maximum control over policy duration and cost. Explore more about how these flexible insurance models adapt to diverse driving habits and lifestyles.

Premium Calculation

Usage-based insurance calculates premiums by analyzing real-time driving data such as mileage, speed, and driving behavior using telematics devices. On-demand insurance offers flexible, short-term coverage priced according to the immediate risk and duration of use, typically activated via mobile apps. Explore detailed comparisons and insights on how premium calculation varies between these innovative insurance models.

Source and External Links

Usage-Based Car Insurance - Usage-based insurance (UBI) calculates auto insurance premiums by analyzing how often and how safely you drive, using telematics devices or apps to monitor driving behaviors like hard braking, acceleration, and time of day, allowing insurers to personalize rates that may result in discounts or increases based on driving habits.

Usage-based insurance - UBI uses technology such as mobile apps or devices to track driving behavior (location, mileage, speed, rapid acceleration/braking) to tailor insurance premiums more fairly, but may raise privacy concerns as insurers collect detailed driving data.

Usage Based Insurance: Everything You Need To Know - Two main types of UBI include mileage-based (pay per mile) and driving-based programs that monitor driving behavior to offer customized insurance plans, often resulting in discounts of 10%-25% for safe drivers while potentially saving money by driving fewer miles.

dowidth.com

dowidth.com