Microinsurance offers affordable coverage tailored for low-income individuals, focusing on basic protection against specific risks such as illness, accidents, or natural disasters. Health insurance provides broader benefits, covering a wide range of medical expenses including hospital stays, surgeries, and preventive care. Discover how each type suits different needs and income levels to make informed coverage choices.

Why it is important

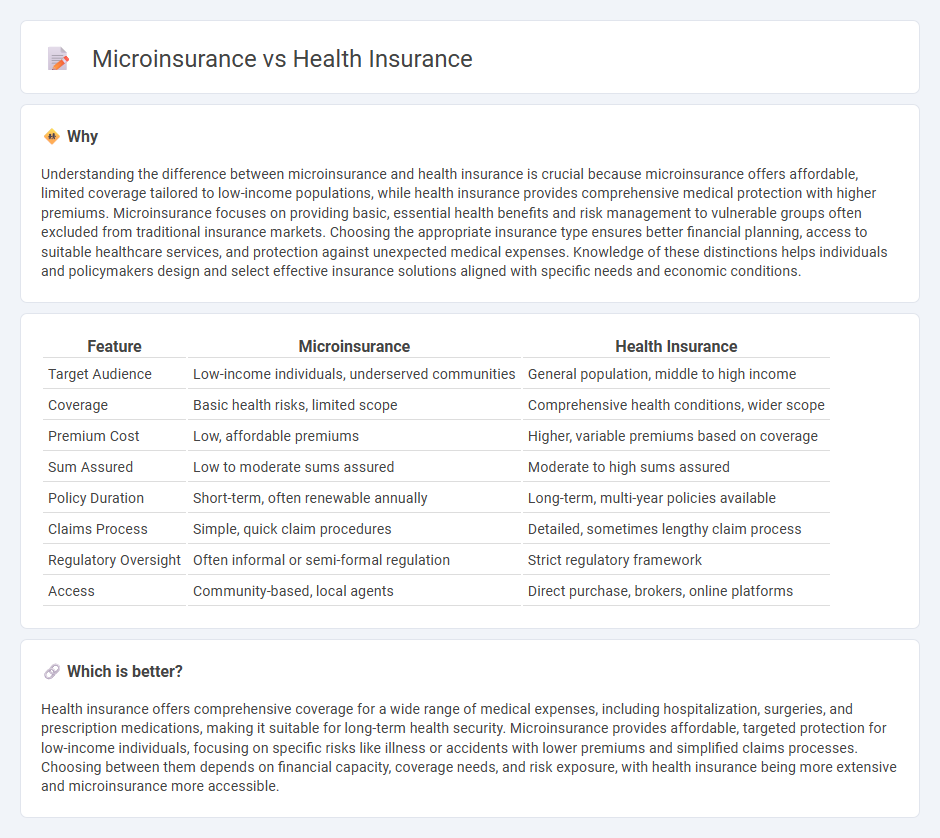

Understanding the difference between microinsurance and health insurance is crucial because microinsurance offers affordable, limited coverage tailored to low-income populations, while health insurance provides comprehensive medical protection with higher premiums. Microinsurance focuses on providing basic, essential health benefits and risk management to vulnerable groups often excluded from traditional insurance markets. Choosing the appropriate insurance type ensures better financial planning, access to suitable healthcare services, and protection against unexpected medical expenses. Knowledge of these distinctions helps individuals and policymakers design and select effective insurance solutions aligned with specific needs and economic conditions.

Comparison Table

| Feature | Microinsurance | Health Insurance |

|---|---|---|

| Target Audience | Low-income individuals, underserved communities | General population, middle to high income |

| Coverage | Basic health risks, limited scope | Comprehensive health conditions, wider scope |

| Premium Cost | Low, affordable premiums | Higher, variable premiums based on coverage |

| Sum Assured | Low to moderate sums assured | Moderate to high sums assured |

| Policy Duration | Short-term, often renewable annually | Long-term, multi-year policies available |

| Claims Process | Simple, quick claim procedures | Detailed, sometimes lengthy claim process |

| Regulatory Oversight | Often informal or semi-formal regulation | Strict regulatory framework |

| Access | Community-based, local agents | Direct purchase, brokers, online platforms |

Which is better?

Health insurance offers comprehensive coverage for a wide range of medical expenses, including hospitalization, surgeries, and prescription medications, making it suitable for long-term health security. Microinsurance provides affordable, targeted protection for low-income individuals, focusing on specific risks like illness or accidents with lower premiums and simplified claims processes. Choosing between them depends on financial capacity, coverage needs, and risk exposure, with health insurance being more extensive and microinsurance more accessible.

Connection

Microinsurance and health insurance are connected through their shared goal of providing affordable financial protection against medical expenses for low-income populations. Microinsurance offers tailored, low-cost health insurance plans that cover essential healthcare services, addressing gaps in traditional health insurance coverage. This connection enhances access to medical care and reduces the risk of financial hardship due to health emergencies in underserved communities.

Key Terms

Premium

Premiums for health insurance often require higher payments due to extensive coverage and a wider range of medical services, while microinsurance premiums are designed to be low-cost and affordable for low-income individuals. Health insurance premiums vary based on age, health condition, and coverage limits, whereas microinsurance premiums focus on minimizing financial risk for basic healthcare access. Explore detailed comparisons of premium structures to understand which option best suits your healthcare needs.

Coverage

Health insurance typically offers comprehensive coverage, including hospitalization, outpatient care, prescription drugs, and preventive services, often with higher premiums and broader networks. Microinsurance targets low-income individuals with affordable premiums and limited coverage, focusing on essential health services and catastrophic events. Explore detailed comparisons to find the best fit for your healthcare needs and budget.

Accessibility

Health insurance typically offers comprehensive coverage but often comes with higher premiums and more stringent eligibility criteria, making it less accessible to low-income populations. Microinsurance provides affordable, simplified health protection tailored for underserved communities, ensuring essential medical services are within reach for those with limited financial resources. Explore the benefits and differences of health insurance and microinsurance to find the best fit for your needs.

Source and External Links

Health insurance | USAGov - Provides comprehensive information on Medicaid, Medicare, the Affordable Care Act (ACA) health insurance marketplace, and COBRA options for health insurance coverage.

Individual and family health insurance plans - Offers tools to find and understand health insurance plans for individuals and families, including coverage details and tips for managing healthcare costs.

Individual Health - Family Medical Insurance - Helps users explore individual and family health insurance plans, featuring specialty care programs, member discounts, and global coverage options.

dowidth.com

dowidth.com