Behavioral policy pricing leverages individual customer data such as driving habits, lifestyle choices, and risk profiles to tailor insurance premiums, promoting fairness and accuracy in risk assessment. Dynamic pricing continuously adjusts insurance rates in real-time based on external factors like market trends, competitor pricing, and emerging data, ensuring responsive and competitive offerings. Explore the nuances between behavioral and dynamic pricing models to optimize your insurance strategy.

Why it is important

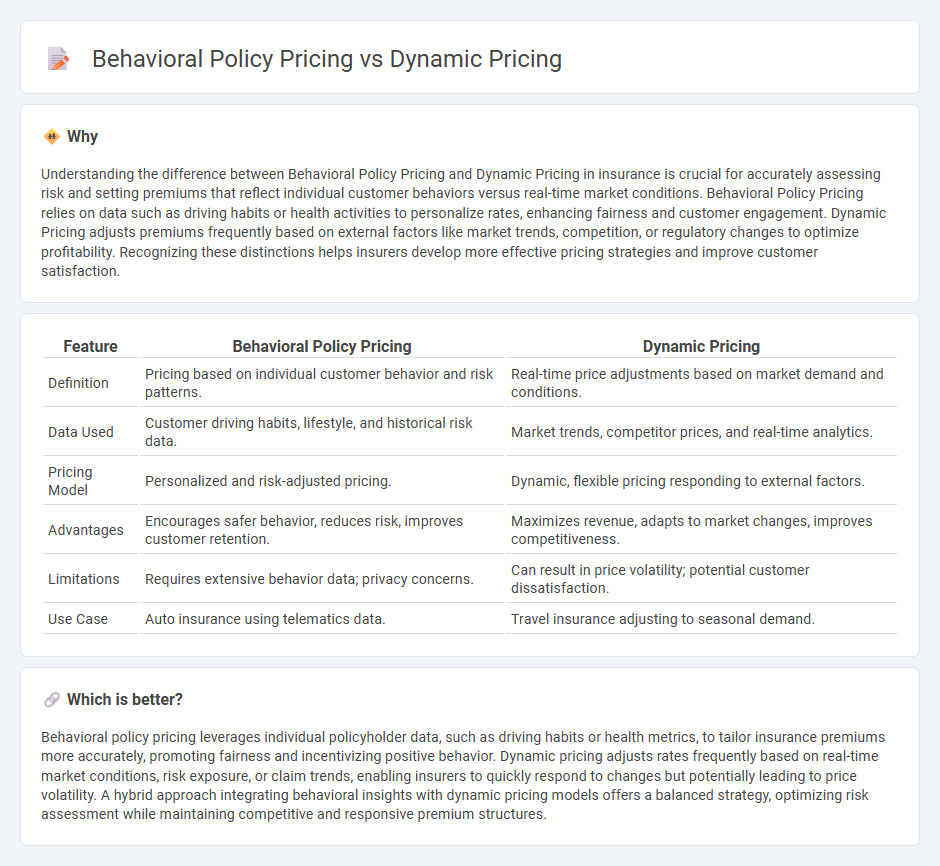

Understanding the difference between Behavioral Policy Pricing and Dynamic Pricing in insurance is crucial for accurately assessing risk and setting premiums that reflect individual customer behaviors versus real-time market conditions. Behavioral Policy Pricing relies on data such as driving habits or health activities to personalize rates, enhancing fairness and customer engagement. Dynamic Pricing adjusts premiums frequently based on external factors like market trends, competition, or regulatory changes to optimize profitability. Recognizing these distinctions helps insurers develop more effective pricing strategies and improve customer satisfaction.

Comparison Table

| Feature | Behavioral Policy Pricing | Dynamic Pricing |

|---|---|---|

| Definition | Pricing based on individual customer behavior and risk patterns. | Real-time price adjustments based on market demand and conditions. |

| Data Used | Customer driving habits, lifestyle, and historical risk data. | Market trends, competitor prices, and real-time analytics. |

| Pricing Model | Personalized and risk-adjusted pricing. | Dynamic, flexible pricing responding to external factors. |

| Advantages | Encourages safer behavior, reduces risk, improves customer retention. | Maximizes revenue, adapts to market changes, improves competitiveness. |

| Limitations | Requires extensive behavior data; privacy concerns. | Can result in price volatility; potential customer dissatisfaction. |

| Use Case | Auto insurance using telematics data. | Travel insurance adjusting to seasonal demand. |

Which is better?

Behavioral policy pricing leverages individual policyholder data, such as driving habits or health metrics, to tailor insurance premiums more accurately, promoting fairness and incentivizing positive behavior. Dynamic pricing adjusts rates frequently based on real-time market conditions, risk exposure, or claim trends, enabling insurers to quickly respond to changes but potentially leading to price volatility. A hybrid approach integrating behavioral insights with dynamic pricing models offers a balanced strategy, optimizing risk assessment while maintaining competitive and responsive premium structures.

Connection

Behavioral policy pricing and dynamic pricing are connected through their reliance on real-time data and customer behavior patterns to adjust insurance premiums accurately. Insurers use behavioral analytics to assess risk more precisely, enabling dynamic pricing models to tailor policies and prices dynamically based on individual actions and market changes. This integration enhances risk management and promotes personalized pricing strategies in the insurance industry.

Key Terms

Risk Assessment

Dynamic pricing leverages real-time data and market fluctuations to adjust prices, maximizing revenue by responding to demand variability. Behavioral policy pricing incorporates customer behavior patterns and risk assessment to tailor prices, minimizing potential losses from price sensitivity and purchase likelihood. Explore deeper insights into how risk assessment shapes these pricing strategies for optimal business outcomes.

Real-time Data

Dynamic pricing leverages real-time data such as market demand, competitor prices, and inventory levels to adjust prices instantly, maximizing revenue and responding quickly to market fluctuations. Behavioral policy pricing, on the other hand, utilizes consumer behavior patterns, purchase history, and user segmentation to personalize prices, enhancing customer satisfaction and loyalty. Explore how integrating real-time data with behavioral insights can optimize your pricing strategy for maximum impact.

Personalization

Dynamic pricing adjusts prices in real-time based on demand fluctuations, inventory levels, and competitor pricing, optimizing revenue through data-driven algorithms. Behavioral policy pricing tailors offers by analyzing individual customer behavior, preferences, and purchase history to enhance personalization and customer engagement. Explore how these pricing strategies can transform your revenue management and customer experience.

Source and External Links

Dynamic Pricing: What Is It & How It Effects E-Commerce - Dynamic pricing is a strategy where e-commerce businesses continuously adjust product prices in real time based on factors like demand, competition, and supply, often using algorithms to maximize revenue and stay competitive.

Dynamic vs. Static Pricing - Unlike static pricing, which keeps prices fixed, dynamic pricing allows prices to fluctuate in response to real-time market conditions such as changes in demand, inventory levels, competitor pricing, and customer behavior.

What is Dynamic Pricing? How It Works and Examples (2025) - Dynamic pricing enables businesses to charge different prices for the same product or service based on current demand, supply, and customer willingness to pay, with well-known examples including Uber's surge pricing and variable airline ticket costs.

dowidth.com

dowidth.com