Digital claim automation leverages artificial intelligence and machine learning algorithms to process insurance claims swiftly and with minimal human intervention, reducing errors and operational costs. Third-party claim adjusters provide personalized assessment services, navigating complex claims by conducting on-site inspections and negotiating settlements tailored to individual policies. Discover how integrating digital solutions with expert adjusters can revolutionize your claims management.

Why it is important

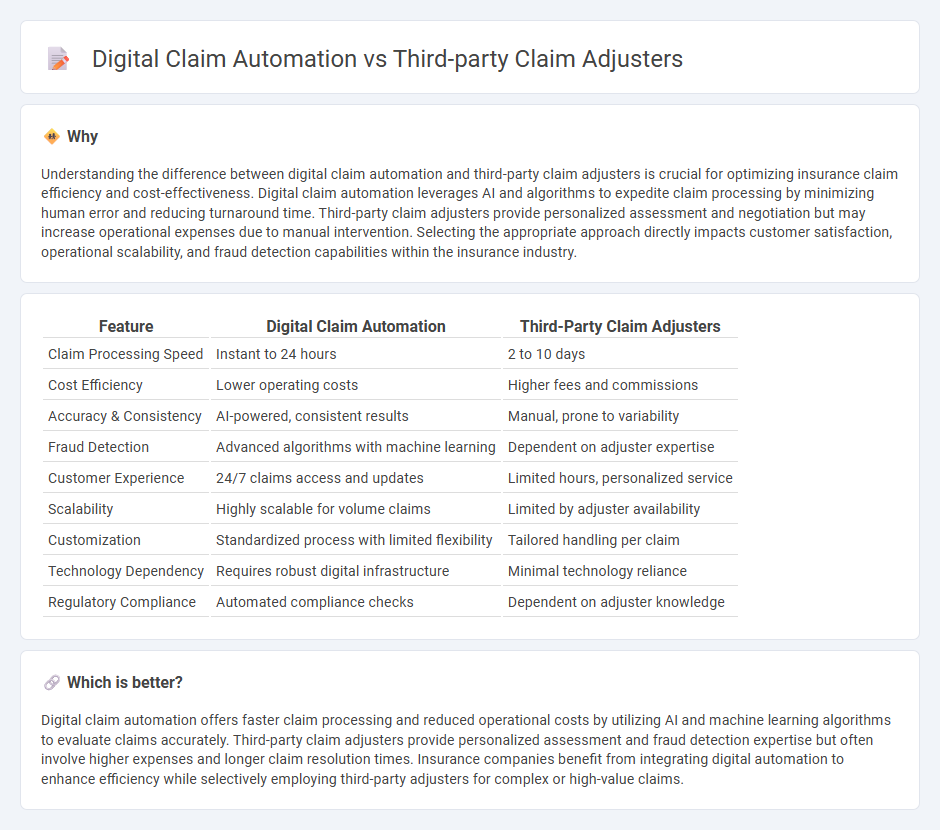

Understanding the difference between digital claim automation and third-party claim adjusters is crucial for optimizing insurance claim efficiency and cost-effectiveness. Digital claim automation leverages AI and algorithms to expedite claim processing by minimizing human error and reducing turnaround time. Third-party claim adjusters provide personalized assessment and negotiation but may increase operational expenses due to manual intervention. Selecting the appropriate approach directly impacts customer satisfaction, operational scalability, and fraud detection capabilities within the insurance industry.

Comparison Table

| Feature | Digital Claim Automation | Third-Party Claim Adjusters |

|---|---|---|

| Claim Processing Speed | Instant to 24 hours | 2 to 10 days |

| Cost Efficiency | Lower operating costs | Higher fees and commissions |

| Accuracy & Consistency | AI-powered, consistent results | Manual, prone to variability |

| Fraud Detection | Advanced algorithms with machine learning | Dependent on adjuster expertise |

| Customer Experience | 24/7 claims access and updates | Limited hours, personalized service |

| Scalability | Highly scalable for volume claims | Limited by adjuster availability |

| Customization | Standardized process with limited flexibility | Tailored handling per claim |

| Technology Dependency | Requires robust digital infrastructure | Minimal technology reliance |

| Regulatory Compliance | Automated compliance checks | Dependent on adjuster knowledge |

Which is better?

Digital claim automation offers faster claim processing and reduced operational costs by utilizing AI and machine learning algorithms to evaluate claims accurately. Third-party claim adjusters provide personalized assessment and fraud detection expertise but often involve higher expenses and longer claim resolution times. Insurance companies benefit from integrating digital automation to enhance efficiency while selectively employing third-party adjusters for complex or high-value claims.

Connection

Digital claim automation enhances the efficiency of third-party claim adjusters by streamlining data collection, processing, and assessment tasks. Automated systems provide real-time access to accurate policy information and claim histories, enabling adjusters to make faster, more informed decisions. Integration of digital tools reduces manual errors and accelerates settlement cycles, improving overall customer satisfaction in the insurance claims process.

Key Terms

Human assessment

Third-party claim adjusters provide personalized human assessment ensuring nuanced evaluation of complex claims, leveraging expertise that AI might miss. Digital claim automation accelerates processing through algorithms but may lack the empathy and judgment crucial for certain case nuances. Explore how balancing human insight with automation enhances claim accuracy and customer satisfaction.

AI-driven processing

Third-party claim adjusters manually handle insurance claims by investigating, verifying, and negotiating settlements, often resulting in longer processing times and higher operational costs. Digital claim automation leverages AI-driven processing to analyze claims rapidly, detect fraud, and expedite settlements with increased accuracy and reduced human error. Explore how AI-powered claim automation is revolutionizing the insurance industry for faster, more efficient claim management.

Claims efficiency

Third-party claim adjusters provide personalized, on-site evaluations to ensure accurate damage assessments, enhancing claims accuracy through expert judgment. Digital claim automation accelerates claims processing using AI-driven workflows, reducing manual errors and operational costs while improving customer satisfaction. Explore how integrating both methods can optimize claims efficiency and transform your claims management strategy.

Source and External Links

Third Party Claims Management Solutions - Enlyte - Enlyte's third-party claim solution provides adjusters with injury and liability information to streamline workflows and improve claim settlement accuracy and efficiency.

What is a TPA? Understanding the Role of Third-Party Administrators - Third-party administrators (TPAs) like CNC act as independent companies that manage claims for insurers, offering specialized expertise, regulatory compliance, and efficiency for adjusters handling third-party claims.

What Is a Third Party Insurance Claim? (& How to File One) - In third-party claims, the adjuster represents the at-fault party's insurer, not the claimant, and their role is to investigate the claim and seek to settle it for the lowest possible amount.

dowidth.com

dowidth.com