Pet insurance platforms specialize in coverage options for veterinary care, accident protection, and wellness plans tailored to various animal breeds and ages. Auto insurance platforms focus on vehicle-related coverage including liability, collision, comprehensive, and roadside assistance for different car models and driver profiles. Explore how each platform meets specific needs by comparing features and benefits for tailored insurance solutions.

Why it is important

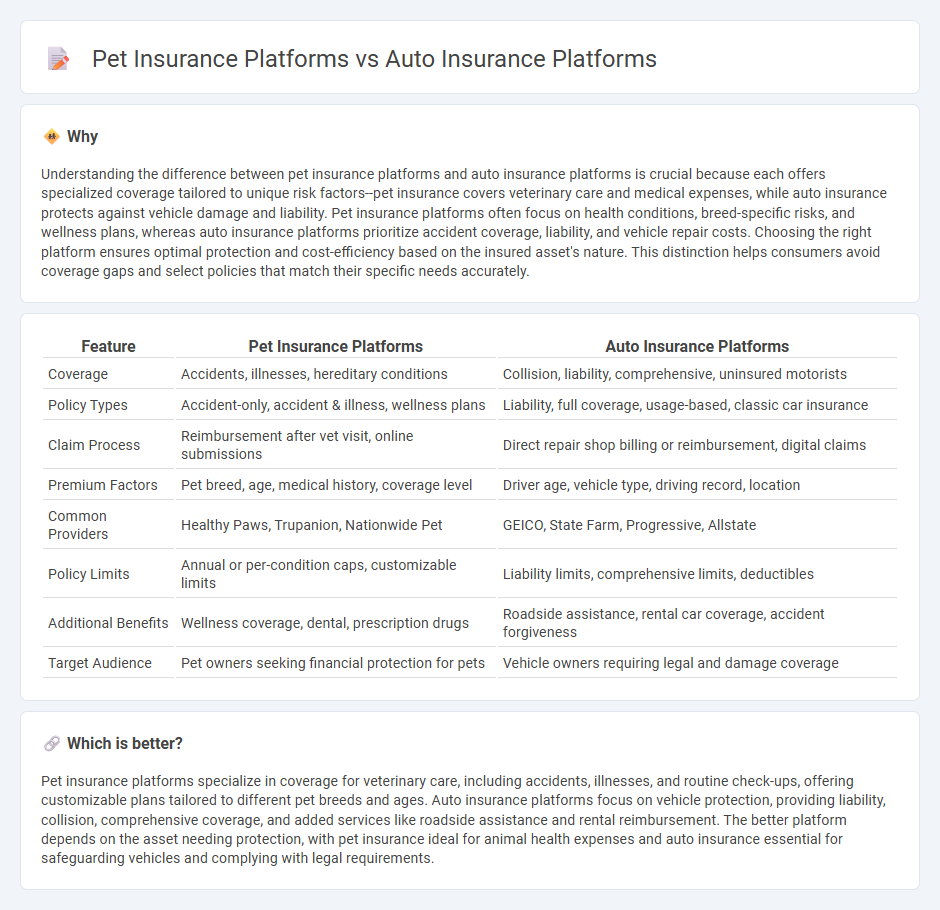

Understanding the difference between pet insurance platforms and auto insurance platforms is crucial because each offers specialized coverage tailored to unique risk factors--pet insurance covers veterinary care and medical expenses, while auto insurance protects against vehicle damage and liability. Pet insurance platforms often focus on health conditions, breed-specific risks, and wellness plans, whereas auto insurance platforms prioritize accident coverage, liability, and vehicle repair costs. Choosing the right platform ensures optimal protection and cost-efficiency based on the insured asset's nature. This distinction helps consumers avoid coverage gaps and select policies that match their specific needs accurately.

Comparison Table

| Feature | Pet Insurance Platforms | Auto Insurance Platforms |

|---|---|---|

| Coverage | Accidents, illnesses, hereditary conditions | Collision, liability, comprehensive, uninsured motorists |

| Policy Types | Accident-only, accident & illness, wellness plans | Liability, full coverage, usage-based, classic car insurance |

| Claim Process | Reimbursement after vet visit, online submissions | Direct repair shop billing or reimbursement, digital claims |

| Premium Factors | Pet breed, age, medical history, coverage level | Driver age, vehicle type, driving record, location |

| Common Providers | Healthy Paws, Trupanion, Nationwide Pet | GEICO, State Farm, Progressive, Allstate |

| Policy Limits | Annual or per-condition caps, customizable limits | Liability limits, comprehensive limits, deductibles |

| Additional Benefits | Wellness coverage, dental, prescription drugs | Roadside assistance, rental car coverage, accident forgiveness |

| Target Audience | Pet owners seeking financial protection for pets | Vehicle owners requiring legal and damage coverage |

Which is better?

Pet insurance platforms specialize in coverage for veterinary care, including accidents, illnesses, and routine check-ups, offering customizable plans tailored to different pet breeds and ages. Auto insurance platforms focus on vehicle protection, providing liability, collision, comprehensive coverage, and added services like roadside assistance and rental reimbursement. The better platform depends on the asset needing protection, with pet insurance ideal for animal health expenses and auto insurance essential for safeguarding vehicles and complying with legal requirements.

Connection

Pet insurance platforms and auto insurance platforms share a common framework in risk assessment, claims processing, and customer data management, leveraging similar algorithms and digital tools to optimize policy underwriting. Both utilize telematics and AI-driven analytics to personalize premiums and detect fraud, enhancing overall operational efficiency. Integration opportunities arise through cross-selling, bundled policy offerings, and unified customer portals that streamline user experience and retention.

Key Terms

**Auto Insurance Platforms:**

Auto insurance platforms leverage advanced telematics, AI-driven risk assessment, and personalized policy management to optimize coverage and pricing for drivers. These platforms integrate real-time data from connected vehicles, enabling tailored recommendations and instant claims processing. Explore how auto insurance technology transforms the driving experience and enhances customer satisfaction.

Telematics

Telematics technology in auto insurance platforms enables real-time tracking of driving behaviors, leading to personalized premiums and improved risk assessment, which significantly reduces claim costs. In contrast, pet insurance platforms lack telematics integration, relying primarily on health records and breed data for underwriting and pricing decisions. Explore how telematics is transforming insurance sectors to understand its broader impact.

Claims Automation

Auto insurance platforms leverage advanced claims automation technologies, integrating telematics data and AI-powered damage assessment tools to expedite claim processing and reduce fraud. Pet insurance platforms, while increasingly adopting automated claims submission and reimbursement systems, often rely on veterinary records and manual verification, reflecting industry-specific challenges. Explore how claims automation transforms both sectors by optimizing customer experience and operational efficiency.

Source and External Links

Insurify - A digital insurance platform that compares car insurance quotes from over 120 insurers like GEICO and Progressive, offering personalized quotes and potential savings up to $1,025 annually with options for self-service or expert help.

The General(r) Car Insurance - Provides flexible, affordable auto insurance tailored for drivers regardless of credit or driving history, featuring quick quotes, multiple coverage options, and a simple claims process.

Progressive Insurance - A leading auto insurer with customizable coverage options and 24/7 support, known for average savings of over $800 for drivers who switch and offering bundles including auto, motorcycle, RV, and life insurance.

dowidth.com

dowidth.com