Insurance sandbox provides a controlled regulatory environment where insurers and startups can test innovative products and services without fully meeting all regulatory requirements. Beta testing involves releasing a near-final insurance product to a select group of customers for real-world evaluation and feedback before official launch. Explore the key differences between insurance sandbox and beta testing to understand their strategic roles in insurance innovation.

Why it is important

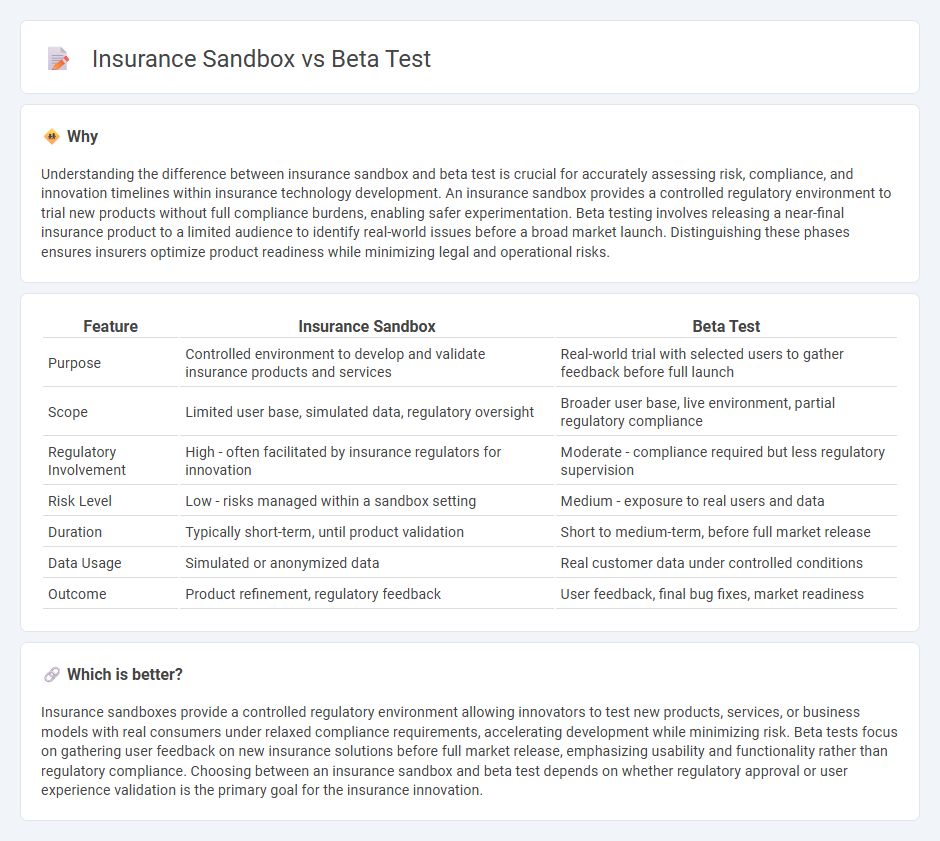

Understanding the difference between insurance sandbox and beta test is crucial for accurately assessing risk, compliance, and innovation timelines within insurance technology development. An insurance sandbox provides a controlled regulatory environment to trial new products without full compliance burdens, enabling safer experimentation. Beta testing involves releasing a near-final insurance product to a limited audience to identify real-world issues before a broad market launch. Distinguishing these phases ensures insurers optimize product readiness while minimizing legal and operational risks.

Comparison Table

| Feature | Insurance Sandbox | Beta Test |

|---|---|---|

| Purpose | Controlled environment to develop and validate insurance products and services | Real-world trial with selected users to gather feedback before full launch |

| Scope | Limited user base, simulated data, regulatory oversight | Broader user base, live environment, partial regulatory compliance |

| Regulatory Involvement | High - often facilitated by insurance regulators for innovation | Moderate - compliance required but less regulatory supervision |

| Risk Level | Low - risks managed within a sandbox setting | Medium - exposure to real users and data |

| Duration | Typically short-term, until product validation | Short to medium-term, before full market release |

| Data Usage | Simulated or anonymized data | Real customer data under controlled conditions |

| Outcome | Product refinement, regulatory feedback | User feedback, final bug fixes, market readiness |

Which is better?

Insurance sandboxes provide a controlled regulatory environment allowing innovators to test new products, services, or business models with real consumers under relaxed compliance requirements, accelerating development while minimizing risk. Beta tests focus on gathering user feedback on new insurance solutions before full market release, emphasizing usability and functionality rather than regulatory compliance. Choosing between an insurance sandbox and beta test depends on whether regulatory approval or user experience validation is the primary goal for the insurance innovation.

Connection

Insurance sandboxes enable insurers to experiment with innovative products and technologies in a controlled regulatory environment, reducing risks before full market release. Beta testing within these sandboxes allows real users to evaluate new insurance solutions, providing critical feedback for refinement. This connection accelerates product development while ensuring compliance and customer-centric innovations.

Key Terms

Regulatory Environment

Beta tests enable companies to trial products with controlled user groups, gathering real-world data under existing regulatory frameworks, often requiring compliance with strict privacy and consumer protection laws. Insurance sandboxes provide a regulatory-safe environment sanctioned by authorities, allowing innovators to experiment with new insurance models, products, and technologies without immediate full compliance, fostering regulatory collaboration and risk mitigation. Explore how these approaches impact innovation and regulatory strategy in the insurance sector to understand their strategic benefits.

Risk Assessment

Beta test environments simulate real-world scenarios to evaluate the performance and reliability of new risk assessment tools, allowing insurers to identify potential flaws before full deployment. Insurance sandboxes provide a controlled regulatory framework where innovative risk models and underwriting processes can be tested under actual market conditions with limited exposure. Explore the nuances of risk assessment strategies in both settings to enhance your insurance innovation roadmap.

Innovation Testing

Beta tests enable real-world user feedback on innovative insurance products before full market launch, accelerating product refinement and adoption. Insurance sandboxes provide a controlled regulatory environment for insurers to experiment with new technologies, business models, and compliance approaches without immediate risk. Explore how leveraging beta tests and insurance sandboxes drives transformational innovation in the insurance industry.

Source and External Links

Beta Testing - Complete Guide to Validate Products | GAT - Beta testing is a critical phase where external real users test a product in a real-world environment before its official release to gather performance and usability feedback.

What is a Beta Test? | Definition | Product Management ... - Beta testing is the final testing stage before a product's wide release, involving real users in production settings to detect bugs and ensure security and reliability, often done as open or closed tests.

What is a beta test? | Definition from TechTarget - A beta test is the second phase of software testing performed by a sample of the intended audience in real conditions before a public launch, following internal alpha testing.

dowidth.com

dowidth.com