Pre-existing condition coverage determines the extent to which an insurance policy covers health issues identified before the policy start date, while medical underwriting involves the insurer assessing an applicant's health history to set premiums or eligibility. Policies that exclude or limit pre-existing conditions often require detailed medical underwriting to evaluate risk accurately. Explore more to understand how these factors impact your insurance options and costs.

Why it is important

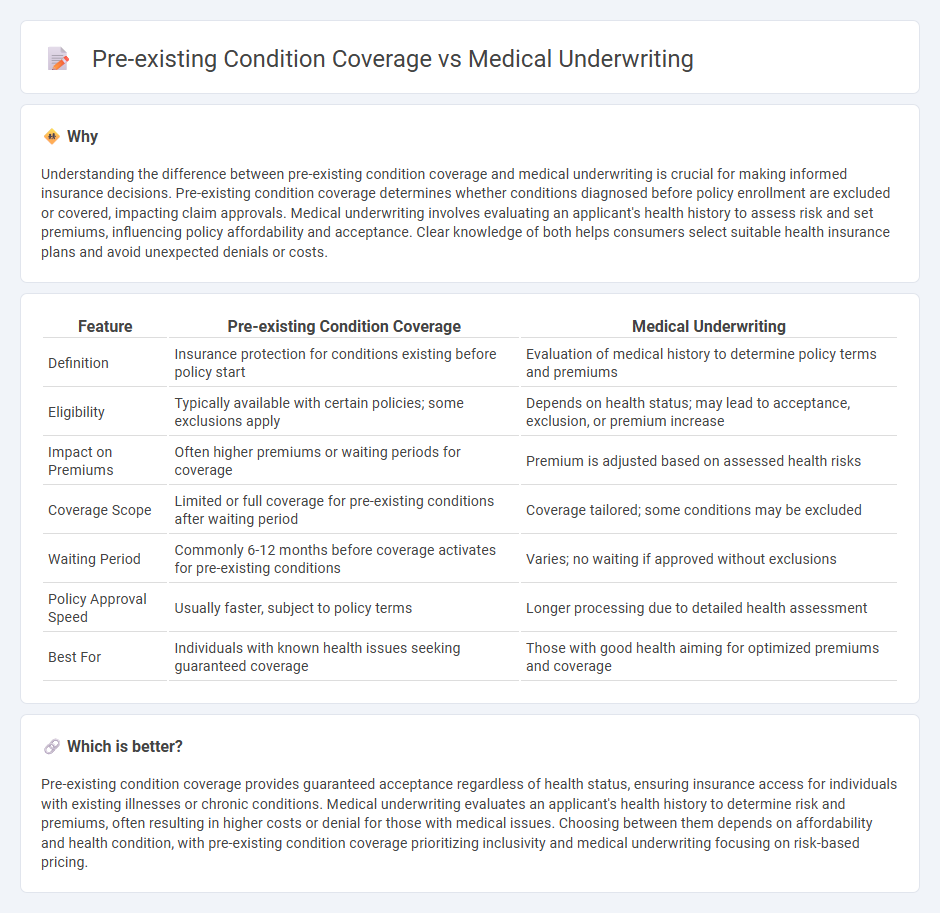

Understanding the difference between pre-existing condition coverage and medical underwriting is crucial for making informed insurance decisions. Pre-existing condition coverage determines whether conditions diagnosed before policy enrollment are excluded or covered, impacting claim approvals. Medical underwriting involves evaluating an applicant's health history to assess risk and set premiums, influencing policy affordability and acceptance. Clear knowledge of both helps consumers select suitable health insurance plans and avoid unexpected denials or costs.

Comparison Table

| Feature | Pre-existing Condition Coverage | Medical Underwriting |

|---|---|---|

| Definition | Insurance protection for conditions existing before policy start | Evaluation of medical history to determine policy terms and premiums |

| Eligibility | Typically available with certain policies; some exclusions apply | Depends on health status; may lead to acceptance, exclusion, or premium increase |

| Impact on Premiums | Often higher premiums or waiting periods for coverage | Premium is adjusted based on assessed health risks |

| Coverage Scope | Limited or full coverage for pre-existing conditions after waiting period | Coverage tailored; some conditions may be excluded |

| Waiting Period | Commonly 6-12 months before coverage activates for pre-existing conditions | Varies; no waiting if approved without exclusions |

| Policy Approval Speed | Usually faster, subject to policy terms | Longer processing due to detailed health assessment |

| Best For | Individuals with known health issues seeking guaranteed coverage | Those with good health aiming for optimized premiums and coverage |

Which is better?

Pre-existing condition coverage provides guaranteed acceptance regardless of health status, ensuring insurance access for individuals with existing illnesses or chronic conditions. Medical underwriting evaluates an applicant's health history to determine risk and premiums, often resulting in higher costs or denial for those with medical issues. Choosing between them depends on affordability and health condition, with pre-existing condition coverage prioritizing inclusivity and medical underwriting focusing on risk-based pricing.

Connection

Pre-existing condition coverage directly impacts the scope of medical underwriting by influencing the risk assessment process used by insurers. Medical underwriting evaluates an applicant's health history, including pre-existing conditions, to determine policy eligibility and premium rates. Insurers adjust coverage terms and pricing based on the severity and management of these conditions to minimize financial losses.

Key Terms

Risk Assessment

Medical underwriting involves a detailed evaluation of an applicant's health history, including pre-existing conditions, to determine their insurance risk and premium rates. Pre-existing condition coverage specifically addresses how insurance policies treat illnesses or health issues that existed prior to the start of coverage, often impacting eligibility and costs. Explore our comprehensive guide to understand the nuances between medical underwriting and pre-existing condition coverage in risk assessment.

Exclusion Period

Medical underwriting involves assessing an applicant's health status to determine insurance eligibility and premiums, often leading to exclusions for pre-existing conditions. Pre-existing condition coverage typically includes an exclusion period--ranging from 6 to 24 months--during which claims related to those conditions are not reimbursed. Explore more to understand how exclusion periods impact your insurance protection and options.

Premium Adjustment

Medical underwriting assesses an individual's health status to determine insurance premium adjustments, often resulting in higher costs for those with pre-existing conditions. Pre-existing condition coverage limits or eliminates premium increases related to past health issues, offering more stable rates. Explore how these factors influence your insurance premiums to make an informed choice.

Source and External Links

Medical Underwriting - Medical underwriting is the process used by insurance companies to evaluate health information to determine coverage approval and premium rates for applicants.

Medical Underwriting: How It Shapes Private Coverage Costs - This guide explains how medical underwriting assesses risk and determines health insurance coverage offers and costs based on an individual's health history.

What is Medical Underwriting? - Medical underwriting involves evaluating an applicant's health risks to decide whether to approve insurance applications and set premium rates.

dowidth.com

dowidth.com