Cyber risk underwriting evaluates digital threats by analyzing data breaches, ransomware attacks, and system vulnerabilities to determine policy terms and premiums. Marine underwriting focuses on assessing risks related to shipping, cargo, and offshore operations, considering factors such as weather conditions, piracy, and vessel safety. Explore detailed comparisons to understand how specialized risk assessments shape these distinct underwriting practices.

Why it is important

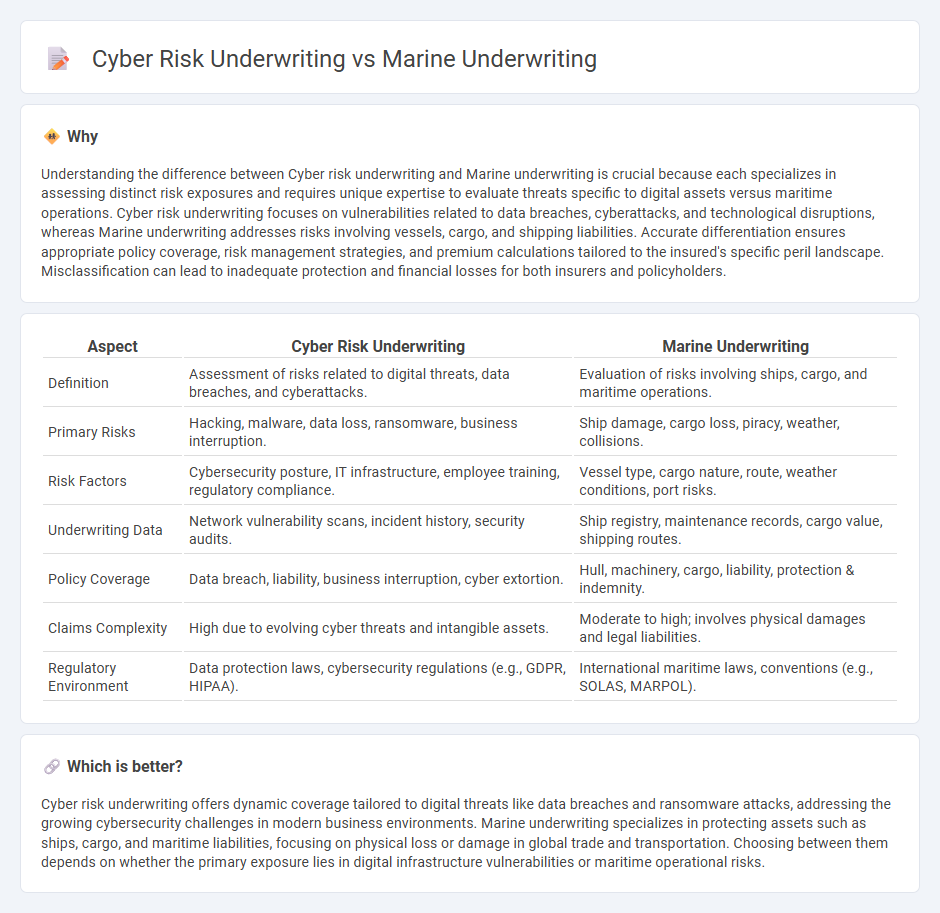

Understanding the difference between Cyber risk underwriting and Marine underwriting is crucial because each specializes in assessing distinct risk exposures and requires unique expertise to evaluate threats specific to digital assets versus maritime operations. Cyber risk underwriting focuses on vulnerabilities related to data breaches, cyberattacks, and technological disruptions, whereas Marine underwriting addresses risks involving vessels, cargo, and shipping liabilities. Accurate differentiation ensures appropriate policy coverage, risk management strategies, and premium calculations tailored to the insured's specific peril landscape. Misclassification can lead to inadequate protection and financial losses for both insurers and policyholders.

Comparison Table

| Aspect | Cyber Risk Underwriting | Marine Underwriting |

|---|---|---|

| Definition | Assessment of risks related to digital threats, data breaches, and cyberattacks. | Evaluation of risks involving ships, cargo, and maritime operations. |

| Primary Risks | Hacking, malware, data loss, ransomware, business interruption. | Ship damage, cargo loss, piracy, weather, collisions. |

| Risk Factors | Cybersecurity posture, IT infrastructure, employee training, regulatory compliance. | Vessel type, cargo nature, route, weather conditions, port risks. |

| Underwriting Data | Network vulnerability scans, incident history, security audits. | Ship registry, maintenance records, cargo value, shipping routes. |

| Policy Coverage | Data breach, liability, business interruption, cyber extortion. | Hull, machinery, cargo, liability, protection & indemnity. |

| Claims Complexity | High due to evolving cyber threats and intangible assets. | Moderate to high; involves physical damages and legal liabilities. |

| Regulatory Environment | Data protection laws, cybersecurity regulations (e.g., GDPR, HIPAA). | International maritime laws, conventions (e.g., SOLAS, MARPOL). |

Which is better?

Cyber risk underwriting offers dynamic coverage tailored to digital threats like data breaches and ransomware attacks, addressing the growing cybersecurity challenges in modern business environments. Marine underwriting specializes in protecting assets such as ships, cargo, and maritime liabilities, focusing on physical loss or damage in global trade and transportation. Choosing between them depends on whether the primary exposure lies in digital infrastructure vulnerabilities or maritime operational risks.

Connection

Cyber risk underwriting and marine underwriting intersect through the growing reliance on digital systems within maritime operations, increasing exposure to cyber threats such as hacking, ransomware, and data breaches. Underwriters assess not only traditional physical risks like cargo loss or vessel damage but also evaluate vulnerabilities in IT infrastructure, navigation systems, and communication networks critical to marine operations. This integrated approach enhances risk management strategies, ensuring comprehensive coverage that addresses both cyber incidents and maritime perils in an increasingly interconnected environment.

Key Terms

**Marine Underwriting:**

Marine underwriting involves assessing risks related to shipping, cargo, and maritime operations, focusing on perils like weather, piracy, and vessel damage. It requires expertise in maritime law, navigation, and international trade to evaluate liability and coverage accurately. Explore our detailed insights to understand the complexities and best practices of marine underwriting.

Hull and Cargo

Marine underwriting for Hull and Cargo focuses on physical protection and indemnity coverage for ships and goods against risks like collision, weather damage, and piracy. Cyber risk underwriting involves assessing vulnerabilities in digital systems controlling shipping operations, addressing threats such as ransomware, cyber fraud, and data breaches. Explore detailed distinctions and risk management strategies to optimize marine insurance portfolios.

Institute Clauses

Marine underwriting centers on assessing risks related to the transportation of goods over water, with Institute Clauses such as the Institute Cargo Clauses standardizing coverage for risks like loss, damage, or delay. Cyber risk underwriting evaluates potential losses from cyber incidents, but lacks universally accepted clauses like those found in marine insurance, relying instead on evolving policy wordings tailored to data breaches, business interruption, and cyber extortion. Explore the nuances of Institute Clauses in marine underwriting compared to the evolving frameworks in cyber risk coverage for a comprehensive understanding.

Source and External Links

Marine Insurance Underwriting: Meaning, Benefits and Challenges - Marine insurance underwriting involves evaluating, assessing, and providing coverage for risks related to sea voyages, cargo transport, and vessels to protect businesses from unpredictable dangers of maritime trade.

What is Marine Underwriting and Who are Marine Underwriters? - Marine underwriting refers to providing insurance coverage for boats, ships, and cargo, with underwriters focusing on assessing risks, causes of loss, and ensuring compliance with international maritime regulations.

Certified Marine Insurance Underwriter (CMIU) - AIBM US - The CMIU program trains professionals to excel in marine insurance underwriting by developing expertise in risk assessment, product knowledge, and international regulations to offer tailored insurance solutions in a complex global market.

dowidth.com

dowidth.com