Insurtech sandboxes provide a controlled environment for testing innovative insurance technologies and business models, enabling startups and insurers to experiment with minimal regulatory risk. Usage-based insurance (UBI) leverages telematics and real-time data to tailor premiums based on individual driver behavior, promoting fairness and cost efficiency. Explore how Insurtech sandboxes accelerate the development of cutting-edge UBI solutions and revolutionize the insurance landscape.

Why it is important

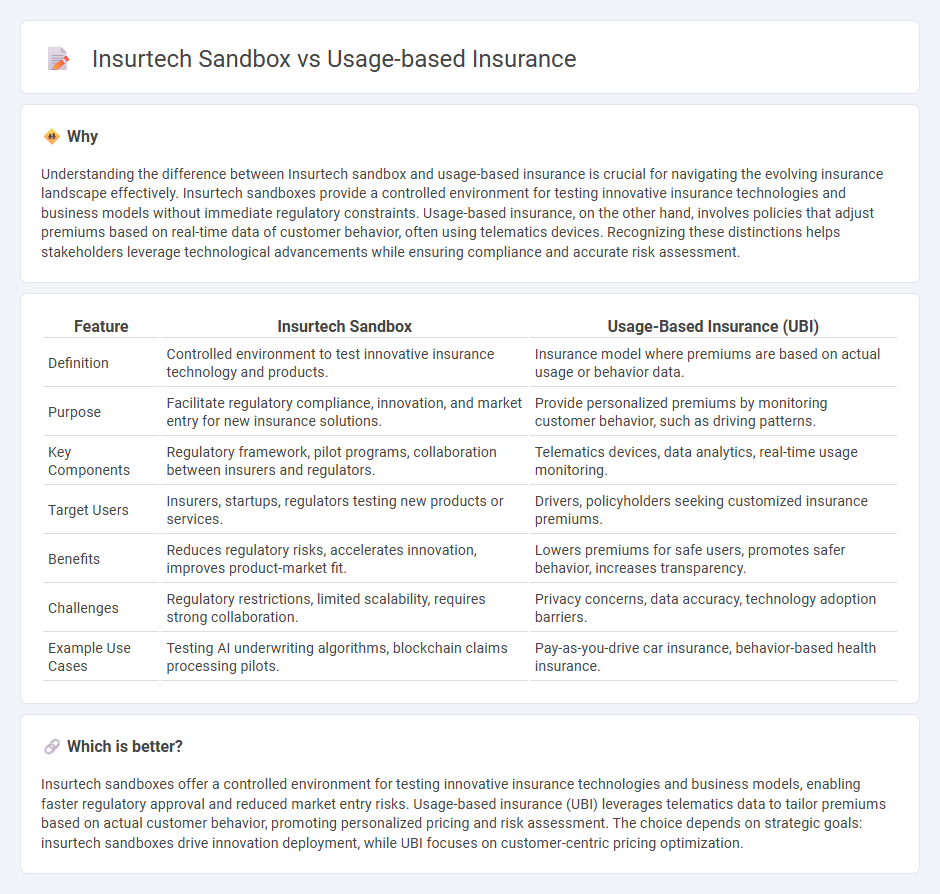

Understanding the difference between Insurtech sandbox and usage-based insurance is crucial for navigating the evolving insurance landscape effectively. Insurtech sandboxes provide a controlled environment for testing innovative insurance technologies and business models without immediate regulatory constraints. Usage-based insurance, on the other hand, involves policies that adjust premiums based on real-time data of customer behavior, often using telematics devices. Recognizing these distinctions helps stakeholders leverage technological advancements while ensuring compliance and accurate risk assessment.

Comparison Table

| Feature | Insurtech Sandbox | Usage-Based Insurance (UBI) |

|---|---|---|

| Definition | Controlled environment to test innovative insurance technology and products. | Insurance model where premiums are based on actual usage or behavior data. |

| Purpose | Facilitate regulatory compliance, innovation, and market entry for new insurance solutions. | Provide personalized premiums by monitoring customer behavior, such as driving patterns. |

| Key Components | Regulatory framework, pilot programs, collaboration between insurers and regulators. | Telematics devices, data analytics, real-time usage monitoring. |

| Target Users | Insurers, startups, regulators testing new products or services. | Drivers, policyholders seeking customized insurance premiums. |

| Benefits | Reduces regulatory risks, accelerates innovation, improves product-market fit. | Lowers premiums for safe users, promotes safer behavior, increases transparency. |

| Challenges | Regulatory restrictions, limited scalability, requires strong collaboration. | Privacy concerns, data accuracy, technology adoption barriers. |

| Example Use Cases | Testing AI underwriting algorithms, blockchain claims processing pilots. | Pay-as-you-drive car insurance, behavior-based health insurance. |

Which is better?

Insurtech sandboxes offer a controlled environment for testing innovative insurance technologies and business models, enabling faster regulatory approval and reduced market entry risks. Usage-based insurance (UBI) leverages telematics data to tailor premiums based on actual customer behavior, promoting personalized pricing and risk assessment. The choice depends on strategic goals: insurtech sandboxes drive innovation deployment, while UBI focuses on customer-centric pricing optimization.

Connection

Insurtech sandboxes provide a controlled environment for testing innovative insurance technologies, enabling the development and validation of Usage-Based Insurance (UBI) models that rely on real-time data collection from telematics devices. By leveraging sandbox frameworks, insurers can analyze driving behavior, optimize risk assessment, and customize premiums based on actual usage patterns without immediate regulatory constraints. This synergy accelerates UBI adoption, enhances customer personalization, and drives data-driven decision-making within the insurance sector.

Key Terms

Telematics

Usage-based insurance leverages telematics to collect real-time driving data, enabling insurers to tailor premiums based on actual behavior rather than traditional risk assessments. Insurtech sandboxes provide a regulatory environment for testing telematics innovations, fostering development of dynamic pricing models and advanced safety features. Explore how telematics-driven solutions are revolutionizing insurance by visiting our detailed analysis.

Regulatory Innovation

Usage-based insurance leveraging telematics data enables personalized premiums by analyzing individual driving behavior, promoting risk accuracy and customer engagement. Insurtech sandboxes provide controlled environments for testing innovative insurance products and regulatory frameworks, facilitating safer market entry and fostering compliance innovation. Discover how these regulatory innovations revolutionize insurance practices and accelerate digital transformation.

Data Analytics

Usage-based insurance leverages real-time telematics data to personalize premiums based on driving behavior, enhancing risk assessment through advanced data analytics. Insurtech sandboxes provide a controlled environment to test innovative data-driven models and machine learning algorithms, accelerating the adoption of predictive analytics in insurance. Discover how these technologies redefine underwriting accuracy and customer engagement through data innovation.

Source and External Links

Usage-Based Car Insurance - Progressive explains how usage-based insurance (UBI) calculates auto insurance rates by analyzing your driving habits--such as how often, when, and how safely you drive--using telematics devices or mobile apps, potentially leading to premium discounts or increases based on your driving data.

Usage-based insurance - The Washington State Office of the Insurance Commissioner describes UBI as a program where insurers use technology to monitor driving behavior (like miles driven, speed, time of day, and hard braking) to determine personalized premiums, moving away from traditional rating factors.

Want Your Auto Insurer to Track Your Driving? Understanding Usage-Based Insurance - The National Association of Insurance Commissioners highlights that UBI uses real-time driving data collected via devices or smartphones to directly influence your premium, offering variations like pay-as-you-drive or pay-how-you-drive, unlike traditional policies that rely on broader statistical factors.

dowidth.com

dowidth.com