Buy now insurance offers immediate coverage with straightforward premiums and flexible terms, catering to those seeking quick protection without long-term commitments. Universal life insurance combines lifelong coverage with a cash value component, allowing policyholders to adjust premiums and death benefits over time while accumulating savings tax-deferred. Explore the differences between these options to determine the best fit for your financial goals and protection needs.

Why it is important

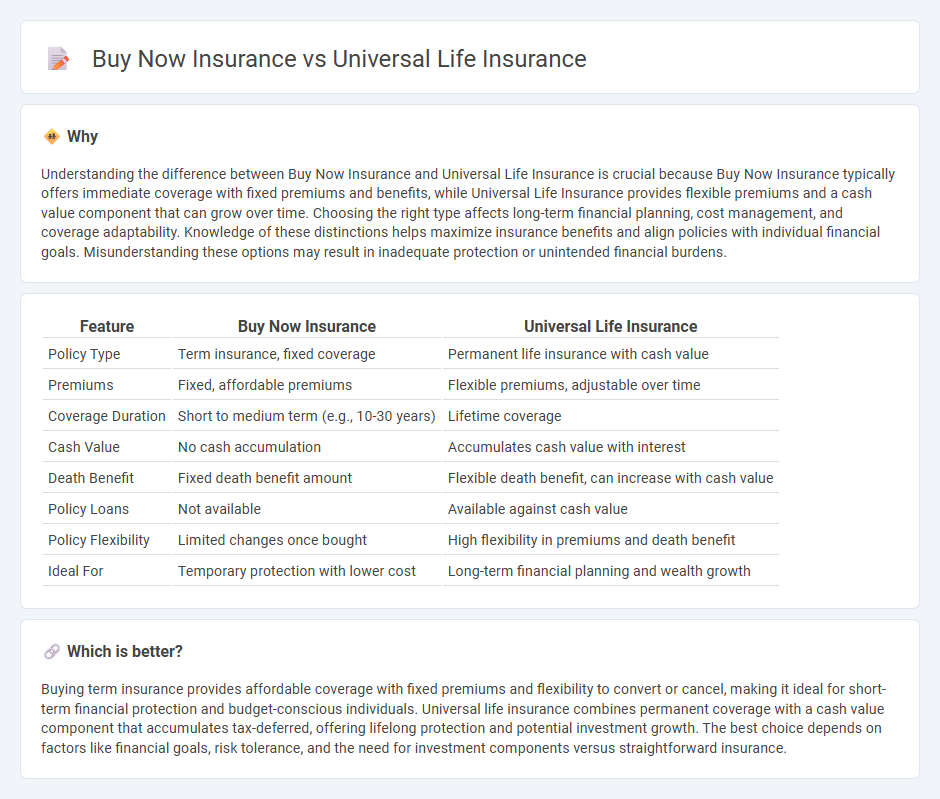

Understanding the difference between Buy Now Insurance and Universal Life Insurance is crucial because Buy Now Insurance typically offers immediate coverage with fixed premiums and benefits, while Universal Life Insurance provides flexible premiums and a cash value component that can grow over time. Choosing the right type affects long-term financial planning, cost management, and coverage adaptability. Knowledge of these distinctions helps maximize insurance benefits and align policies with individual financial goals. Misunderstanding these options may result in inadequate protection or unintended financial burdens.

Comparison Table

| Feature | Buy Now Insurance | Universal Life Insurance |

|---|---|---|

| Policy Type | Term insurance, fixed coverage | Permanent life insurance with cash value |

| Premiums | Fixed, affordable premiums | Flexible premiums, adjustable over time |

| Coverage Duration | Short to medium term (e.g., 10-30 years) | Lifetime coverage |

| Cash Value | No cash accumulation | Accumulates cash value with interest |

| Death Benefit | Fixed death benefit amount | Flexible death benefit, can increase with cash value |

| Policy Loans | Not available | Available against cash value |

| Policy Flexibility | Limited changes once bought | High flexibility in premiums and death benefit |

| Ideal For | Temporary protection with lower cost | Long-term financial planning and wealth growth |

Which is better?

Buying term insurance provides affordable coverage with fixed premiums and flexibility to convert or cancel, making it ideal for short-term financial protection and budget-conscious individuals. Universal life insurance combines permanent coverage with a cash value component that accumulates tax-deferred, offering lifelong protection and potential investment growth. The best choice depends on factors like financial goals, risk tolerance, and the need for investment components versus straightforward insurance.

Connection

Buy now insurance platforms streamline the purchase of Universal Life Insurance by offering instant quotes and simplified application processes through digital interfaces. Universal Life Insurance products benefit from these platforms by reaching a broader audience seeking flexible permanent coverage with cash value growth and adjustable premiums. This connection enhances customer experience and accelerates policy issuance in the evolving insurance market.

Key Terms

Cash Value

Universal life insurance builds cash value over time through flexible premium payments and interest crediting, allowing policyholders to access funds or adjust coverage. Buy now insurance typically offers limited or no cash value accumulation, focusing instead on immediate protection at affordable rates. Explore the key differences and benefits of each option to determine the best fit for your financial goals.

Premium Flexibility

Universal life insurance offers premium flexibility by allowing policyholders to adjust payment amounts and timing within certain limits, adapting to changing financial situations. Buy now insurance typically features fixed premiums that provide predictable costs but less adaptability over time. Explore more to understand which premium structure best aligns with your financial goals and lifestyle.

Death Benefit

Universal life insurance offers flexible death benefit options, allowing policyholders to choose between a level death benefit or an increasing death benefit tied to the policy's cash value. Buy now insurance typically provides a fixed death benefit with no cash value accumulation, catering to those seeking straightforward coverage. Explore detailed comparisons to determine which death benefit structure aligns best with your financial goals.

Source and External Links

Universal Life Insurance: What it is, How it works | Guardian - Universal life insurance is a flexible permanent life insurance policy that offers lifetime protection and builds cash value with tax advantages, allowing adjustments in premiums and death benefits.

What is Universal Life? - New York Life Insurance - Universal life insurance provides long-term coverage that is customizable to fit your budget and needs, offering flexibility in premium payments and death benefits.

Universal Life Insurance Policies & Quotes - Prudential Financial - Prudential offers universal life policies with no-lapse guarantees and flexibility in premium payments, providing long-term death benefit protection and cash value growth.

dowidth.com

dowidth.com