Mental health insurance provides coverage for therapy sessions, psychiatric treatments, and medication prescribed for mental health conditions, whereas accident insurance offers financial protection against injuries or disabilities resulting from accidents. Mental health insurance often includes preventive care and supports ongoing mental wellness, while accident insurance focuses on immediate medical expenses and loss of income due to accidental events. Discover more about choosing the right insurance policy to safeguard your health and financial future.

Why it is important

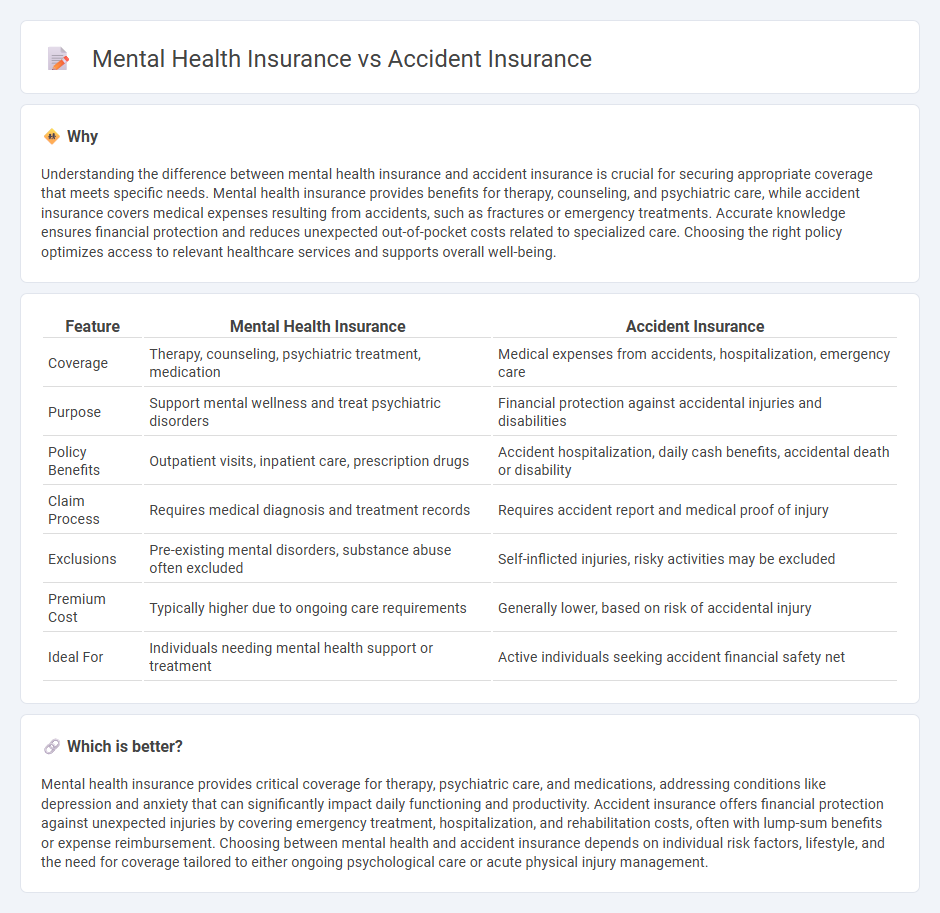

Understanding the difference between mental health insurance and accident insurance is crucial for securing appropriate coverage that meets specific needs. Mental health insurance provides benefits for therapy, counseling, and psychiatric care, while accident insurance covers medical expenses resulting from accidents, such as fractures or emergency treatments. Accurate knowledge ensures financial protection and reduces unexpected out-of-pocket costs related to specialized care. Choosing the right policy optimizes access to relevant healthcare services and supports overall well-being.

Comparison Table

| Feature | Mental Health Insurance | Accident Insurance |

|---|---|---|

| Coverage | Therapy, counseling, psychiatric treatment, medication | Medical expenses from accidents, hospitalization, emergency care |

| Purpose | Support mental wellness and treat psychiatric disorders | Financial protection against accidental injuries and disabilities |

| Policy Benefits | Outpatient visits, inpatient care, prescription drugs | Accident hospitalization, daily cash benefits, accidental death or disability |

| Claim Process | Requires medical diagnosis and treatment records | Requires accident report and medical proof of injury |

| Exclusions | Pre-existing mental disorders, substance abuse often excluded | Self-inflicted injuries, risky activities may be excluded |

| Premium Cost | Typically higher due to ongoing care requirements | Generally lower, based on risk of accidental injury |

| Ideal For | Individuals needing mental health support or treatment | Active individuals seeking accident financial safety net |

Which is better?

Mental health insurance provides critical coverage for therapy, psychiatric care, and medications, addressing conditions like depression and anxiety that can significantly impact daily functioning and productivity. Accident insurance offers financial protection against unexpected injuries by covering emergency treatment, hospitalization, and rehabilitation costs, often with lump-sum benefits or expense reimbursement. Choosing between mental health and accident insurance depends on individual risk factors, lifestyle, and the need for coverage tailored to either ongoing psychological care or acute physical injury management.

Connection

Mental health insurance and accident insurance are connected through their shared focus on comprehensive health coverage, addressing both psychological and physical impacts of unexpected events. Mental health coverage often complements accident insurance by providing support for trauma, stress disorders, and long-term psychological effects resulting from accidents. Integrating both ensures holistic care, reduces overall treatment costs, and improves patient recovery outcomes.

Key Terms

Coverage Scope

Accident insurance primarily covers costs related to accidental injuries, including emergency treatment, hospitalization, and rehabilitation, while mental health insurance focuses on expenses for psychiatric consultations, therapy sessions, and medication for mental health conditions. Coverage scope in accident insurance is limited to physical injuries resulting from unexpected events, whereas mental health insurance addresses ongoing psychological well-being and treatment plans. Explore detailed comparisons of coverage benefits and limitations to understand which insurance meets your specific needs.

Exclusions

Accident insurance typically excludes coverage for mental health conditions, focusing solely on physical injuries resulting from accidents. Mental health insurance specifically targets psychiatric disorders and excludes traumatic physical injuries covered under accident policies. Explore comprehensive policy options to understand how exclusions impact your coverage and protect your well-being.

Claims Process

Accident insurance claims typically require immediate medical reports, police reports if applicable, and proof of incident to expedite payout for injuries or damages. Mental health insurance claims often involve detailed medical records, psychologist or psychiatrist evaluations, and sometimes pre-authorization for treatments, making the process more documentation-heavy. Explore more about how claim procedures differ to optimize your insurance benefits.

Source and External Links

Understanding Accident Insurance - Accident insurance provides cash benefits to help cover additional expenses after an accident, complementing health insurance by covering costs like ambulance services and rehabilitation.

Accident Insurance - Accident insurance offers benefits for covered accidental injuries, such as broken bones or severe burns, and can help with expenses like rent or groceries during recovery.

What Is Accident Insurance? Coverage & Benefits Explained - Accident insurance provides funds to cover unexpected expenses after accidents, helping with costs that medical plans may not cover, such as lost wages or extra transportation costs.

dowidth.com

dowidth.com