Invisible insurance offers seamless protection by integrating coverage into everyday purchases, eliminating the need for separate policies, while usage-based insurance customizes premiums based on individual driving behavior tracked through telematics devices. These innovative insurance models leverage data analytics and digital technology to enhance risk assessment and provide cost-effective solutions tailored to consumer habits. Discover how these advancements are transforming traditional insurance landscapes and what benefits they bring to policyholders.

Why it is important

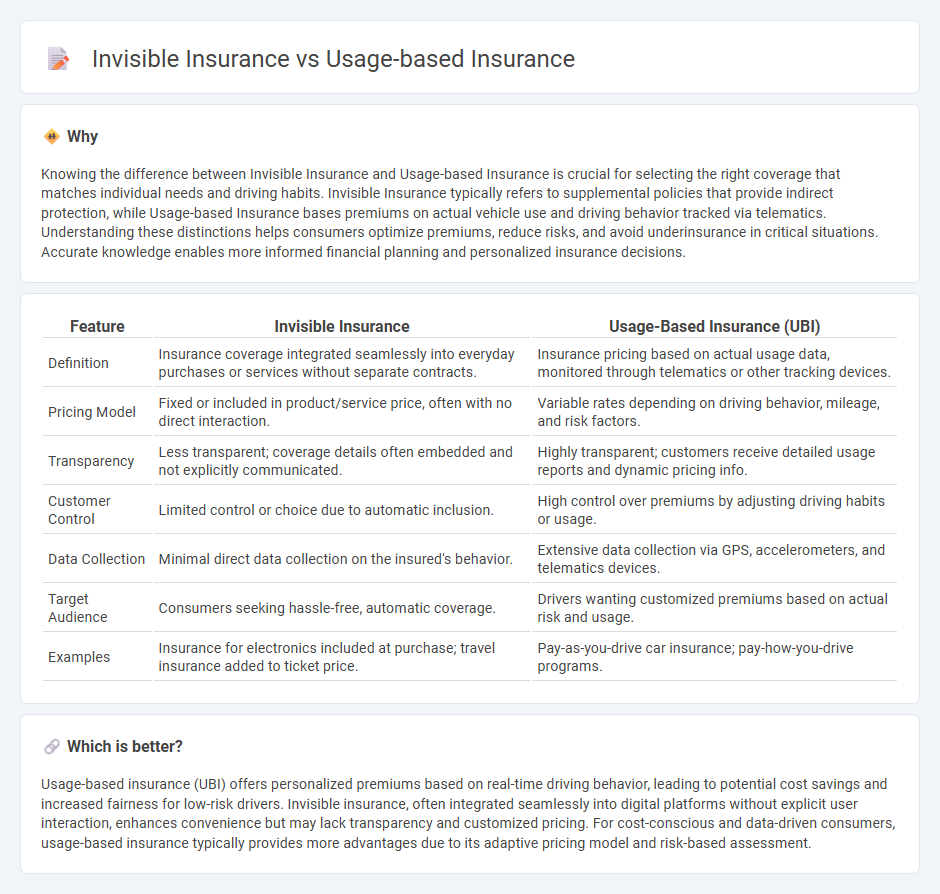

Knowing the difference between Invisible Insurance and Usage-based Insurance is crucial for selecting the right coverage that matches individual needs and driving habits. Invisible Insurance typically refers to supplemental policies that provide indirect protection, while Usage-based Insurance bases premiums on actual vehicle use and driving behavior tracked via telematics. Understanding these distinctions helps consumers optimize premiums, reduce risks, and avoid underinsurance in critical situations. Accurate knowledge enables more informed financial planning and personalized insurance decisions.

Comparison Table

| Feature | Invisible Insurance | Usage-Based Insurance (UBI) |

|---|---|---|

| Definition | Insurance coverage integrated seamlessly into everyday purchases or services without separate contracts. | Insurance pricing based on actual usage data, monitored through telematics or other tracking devices. |

| Pricing Model | Fixed or included in product/service price, often with no direct interaction. | Variable rates depending on driving behavior, mileage, and risk factors. |

| Transparency | Less transparent; coverage details often embedded and not explicitly communicated. | Highly transparent; customers receive detailed usage reports and dynamic pricing info. |

| Customer Control | Limited control or choice due to automatic inclusion. | High control over premiums by adjusting driving habits or usage. |

| Data Collection | Minimal direct data collection on the insured's behavior. | Extensive data collection via GPS, accelerometers, and telematics devices. |

| Target Audience | Consumers seeking hassle-free, automatic coverage. | Drivers wanting customized premiums based on actual risk and usage. |

| Examples | Insurance for electronics included at purchase; travel insurance added to ticket price. | Pay-as-you-drive car insurance; pay-how-you-drive programs. |

Which is better?

Usage-based insurance (UBI) offers personalized premiums based on real-time driving behavior, leading to potential cost savings and increased fairness for low-risk drivers. Invisible insurance, often integrated seamlessly into digital platforms without explicit user interaction, enhances convenience but may lack transparency and customized pricing. For cost-conscious and data-driven consumers, usage-based insurance typically provides more advantages due to its adaptive pricing model and risk-based assessment.

Connection

Invisible insurance integrates seamlessly into everyday life by providing automatic coverage without active user engagement, enhancing convenience and accessibility. Usage-based insurance (UBI) employs telematics technology to monitor actual driving behavior and usage patterns, enabling personalized premiums and risk assessment. Both models leverage advanced data analytics and connectivity to offer tailored, real-time insurance solutions that improve customer experience and pricing accuracy.

Key Terms

Telematics

Usage-based insurance (UBI) leverages telematics technology to monitor driving behavior, mileage, and vehicle usage, enabling insurers to offer personalized premiums based on actual risk. Invisible insurance integrates telematics data passively within digital ecosystems or connected devices, providing seamless coverage without active user intervention or policy management. Discover how telematics is transforming insurance models by exploring detailed insights into usage-based and invisible insurance solutions.

Embedded coverage

Usage-based insurance leverages telematics to track driving behavior, offering customized premiums based on actual usage, enhancing cost efficiency and risk assessment. Invisible insurance, exemplified by embedded coverage within products or services, provides seamless protection without requiring separate purchase or active engagement from the consumer, streamlining the user experience. Explore how embedded coverage in invisible insurance is transforming the insurance landscape with integrated, hassle-free protection.

Risk assessment

Usage-based insurance leverages telematics data such as driving behavior, mileage, and time of day to provide personalized risk assessment and dynamic premium adjustments, enhancing accuracy in pricing. Invisible insurance integrates risk assessment seamlessly into the customer's daily activities or transactions, often without explicit awareness, using real-time data analytics to trigger coverage automatically when needed. Explore further to understand how these innovative approaches redefine risk evaluation and customer experience in insurance.

Source and External Links

Usage-Based Car Insurance | Progressive - Usage-based insurance calculates your auto insurance premium by analyzing how safely and how often you drive using telematics via a plug-in device or mobile app, with two main program types: driving-based and mileage-based.

Usage-based insurance | Office of the Insurance Commissioner - Usage-based insurance uses technology to monitor driving behavior like miles driven, time of day, rapid acceleration, and braking to determine personalized insurance premiums, but it may raise privacy concerns.

Usage Based Insurance: Everything You Need To Know - Usage-based insurance offers discounts based on driving habits measured by tracking devices and includes mileage-based (pay per mile) and behavior-based programs that reward safe driving with up to 10%-25% off premiums.

dowidth.com

dowidth.com