Earthquake microinsurance provides targeted financial protection against seismic events, offering policyholders rapid relief for property damage and personal loss in high-risk zones. Life microinsurance focuses on securing families' economic stability by providing death benefits tailored for low-income populations, ensuring continued support despite unforeseen life-ending events. Explore the distinct benefits and applications of both microinsurance types to better safeguard your future.

Why it is important

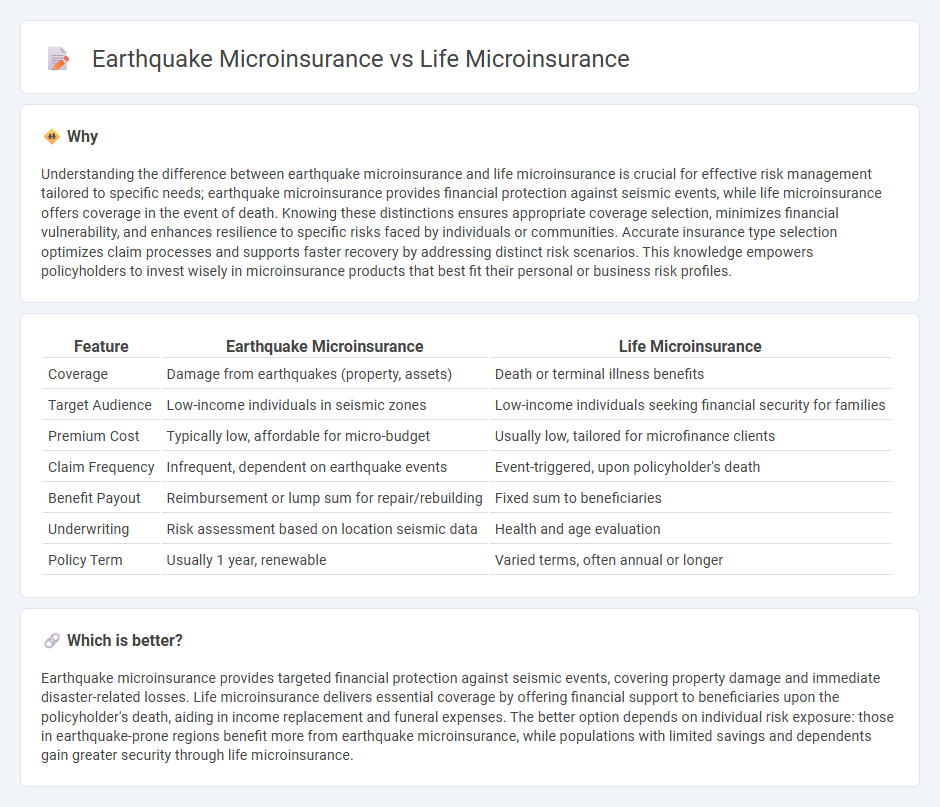

Understanding the difference between earthquake microinsurance and life microinsurance is crucial for effective risk management tailored to specific needs; earthquake microinsurance provides financial protection against seismic events, while life microinsurance offers coverage in the event of death. Knowing these distinctions ensures appropriate coverage selection, minimizes financial vulnerability, and enhances resilience to specific risks faced by individuals or communities. Accurate insurance type selection optimizes claim processes and supports faster recovery by addressing distinct risk scenarios. This knowledge empowers policyholders to invest wisely in microinsurance products that best fit their personal or business risk profiles.

Comparison Table

| Feature | Earthquake Microinsurance | Life Microinsurance |

|---|---|---|

| Coverage | Damage from earthquakes (property, assets) | Death or terminal illness benefits |

| Target Audience | Low-income individuals in seismic zones | Low-income individuals seeking financial security for families |

| Premium Cost | Typically low, affordable for micro-budget | Usually low, tailored for microfinance clients |

| Claim Frequency | Infrequent, dependent on earthquake events | Event-triggered, upon policyholder's death |

| Benefit Payout | Reimbursement or lump sum for repair/rebuilding | Fixed sum to beneficiaries |

| Underwriting | Risk assessment based on location seismic data | Health and age evaluation |

| Policy Term | Usually 1 year, renewable | Varied terms, often annual or longer |

Which is better?

Earthquake microinsurance provides targeted financial protection against seismic events, covering property damage and immediate disaster-related losses. Life microinsurance delivers essential coverage by offering financial support to beneficiaries upon the policyholder's death, aiding in income replacement and funeral expenses. The better option depends on individual risk exposure: those in earthquake-prone regions benefit more from earthquake microinsurance, while populations with limited savings and dependents gain greater security through life microinsurance.

Connection

Earthquake microinsurance and life microinsurance are connected through their role in providing financial protection to vulnerable populations against natural disasters and related mortality risks. Both insurance types offer affordable, small-scale coverage designed to mitigate the economic shocks and loss of income resulting from earthquakes and associated fatalities. Together, they enhance community resilience by ensuring policyholders can recover quickly from physical damage and personal loss.

Key Terms

**Life Microinsurance:**

Life microinsurance provides affordable financial protection against risks such as death, disability, and critical illness for low-income individuals, helping to secure families' economic stability. It typically offers coverage amounts tailored to income levels and includes benefits like funeral expenses and income replacement. Discover how life microinsurance can empower vulnerable communities and enhance financial resilience.

Beneficiary

Life microinsurance primarily protects family members or dependents by providing financial support in the event of the policyholder's death, ensuring income replacement and livelihood security. Earthquake microinsurance targets property owners and tenants, offering compensation to beneficiaries for damages or losses caused by seismic events, facilitating faster recovery and rebuilding. Explore detailed comparisons to understand which microinsurance type best suits your beneficiary's needs.

Premium

Life microinsurance premiums are typically lower due to lower risk variability and longer-term coverage compared to earthquake microinsurance, which demands higher premiums to offset sudden, severe damage risks. Earthquake microinsurance often requires additional risk assessment, catastrophe modeling, and contingency funds reflected in its pricing structure. Explore detailed premium comparisons and policy benefits to make an informed choice between these microinsurance types.

Source and External Links

Shriram Life Micro Insurance Plan | Life Insurance Policy at Affordable Premium - Offers affordable life insurance coverage starting from Rs750 per annum, with death benefits ranging from Rs1,000 to Rs2,00,000 and flexible policy tenures, designed for low-income individuals and groups.

Microinsurance - Wikipedia - Microinsurance provides low-premium, low-coverage life protection to people living on modest incomes, with products defined by regulatory caps and delivered through diverse channels including microfinance institutions and large insurers.

Life - Microinsurance Innovation Facility - Life microinsurance is the most widespread form of microinsurance, extending beyond credit-linked offerings to provide accessible death risk coverage to underserved populations.

dowidth.com

dowidth.com