Flood insurance integration focuses on protecting properties from water damage caused by natural flooding events, covering risks often excluded in standard homeowners insurance policies. Homeowners insurance integration provides broader protection against a variety of perils such as fire, theft, and liability but typically requires separate flood coverage for comprehensive risk management. Explore more about the benefits and distinctions between flood insurance and homeowners insurance integration to safeguard your property effectively.

Why it is important

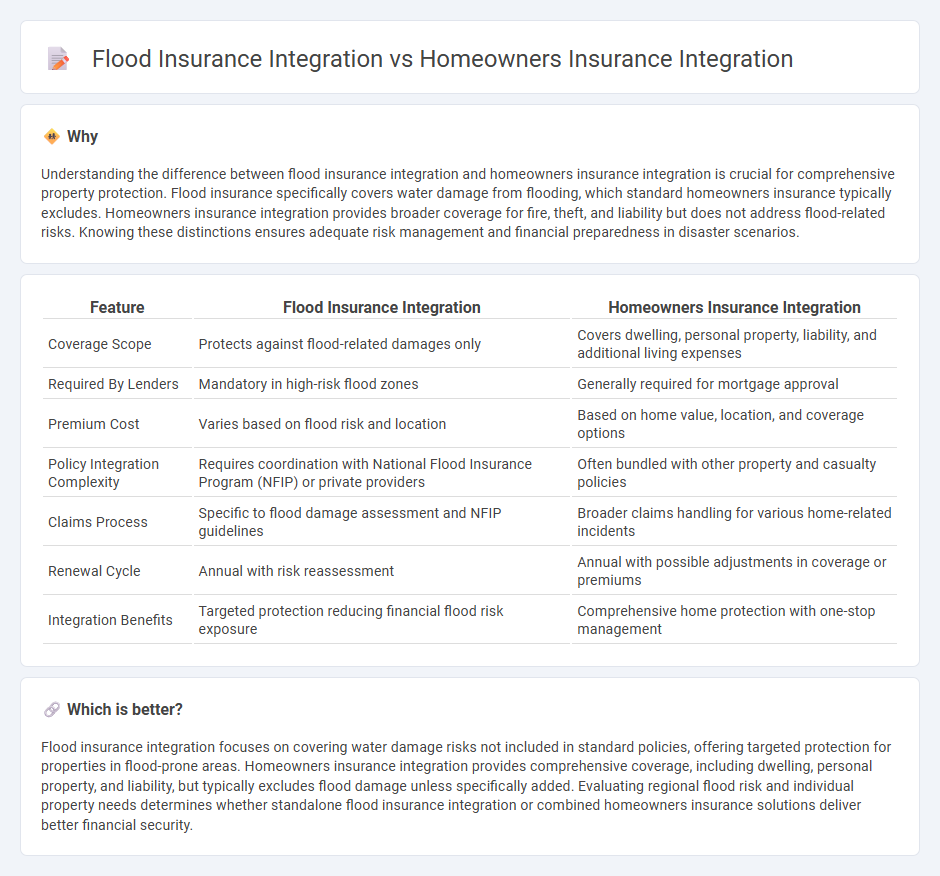

Understanding the difference between flood insurance integration and homeowners insurance integration is crucial for comprehensive property protection. Flood insurance specifically covers water damage from flooding, which standard homeowners insurance typically excludes. Homeowners insurance integration provides broader coverage for fire, theft, and liability but does not address flood-related risks. Knowing these distinctions ensures adequate risk management and financial preparedness in disaster scenarios.

Comparison Table

| Feature | Flood Insurance Integration | Homeowners Insurance Integration |

|---|---|---|

| Coverage Scope | Protects against flood-related damages only | Covers dwelling, personal property, liability, and additional living expenses |

| Required By Lenders | Mandatory in high-risk flood zones | Generally required for mortgage approval |

| Premium Cost | Varies based on flood risk and location | Based on home value, location, and coverage options |

| Policy Integration Complexity | Requires coordination with National Flood Insurance Program (NFIP) or private providers | Often bundled with other property and casualty policies |

| Claims Process | Specific to flood damage assessment and NFIP guidelines | Broader claims handling for various home-related incidents |

| Renewal Cycle | Annual with risk reassessment | Annual with possible adjustments in coverage or premiums |

| Integration Benefits | Targeted protection reducing financial flood risk exposure | Comprehensive home protection with one-stop management |

Which is better?

Flood insurance integration focuses on covering water damage risks not included in standard policies, offering targeted protection for properties in flood-prone areas. Homeowners insurance integration provides comprehensive coverage, including dwelling, personal property, and liability, but typically excludes flood damage unless specifically added. Evaluating regional flood risk and individual property needs determines whether standalone flood insurance integration or combined homeowners insurance solutions deliver better financial security.

Connection

Flood insurance integration enhances homeowners insurance by addressing coverage gaps related to water damage from flooding events. Combining flood insurance with homeowners insurance creates a comprehensive risk management solution that protects property investors from financial losses due to natural disasters. This integration leverages data analytics and policy bundling to streamline claims processing and improve overall customer experience.

Key Terms

Coverage Scope

Homeowners insurance integration typically covers property damage from fire, theft, and certain natural disasters excluding floods, while flood insurance integration specifically addresses flood-related damages often excluded from standard policies. The scope of homeowners insurance is broader for general perils but limited in terms of water damage, making flood insurance essential for properties in flood-prone areas. Explore detailed comparisons to maximize your insurance protection strategy.

Risk Assessment

Homeowners insurance integration primarily focuses on evaluating risks related to property damage from fire, theft, and liability, using data that includes building materials, location, and security features. Flood insurance integration concentrates specifically on assessing flood risks by analyzing geographic floodplain maps, historical flood data, and local drainage infrastructure. Explore our detailed analysis to understand how advanced risk assessment models optimize both insurance integrations for comprehensive protection.

Policy Exclusions

Homeowners insurance integration typically covers risks such as fire, theft, and liability but excludes flood damage, which is specifically addressed by flood insurance integration through the National Flood Insurance Program (NFIP). Policy exclusions in homeowners insurance often omit water-related damages, making flood insurance essential for comprehensive protection in flood-prone areas. Explore the key differences in policy exclusions between homeowners and flood insurance integrations to ensure optimal coverage.

Source and External Links

Home Insurance & Mortgage Integration | Progressive Partner - Progressive offers a Digital Mortgage Integration Program that streamlines homeowners insurance by linking loan application data with property records to quickly calculate and present insurance premiums for homebuyers, simplifying policy purchase and potentially comparing other carrier options.

Partnering with a Digital-First Insurer to Streamline and Enhance the Homebuying Experience - Hippo provides digital integration solutions for homebuilders, embedding personalized, competitively priced homeowners insurance into sales platforms or websites, which improves customer experience and helps ensure timely closings.

Homeowners' Solutions - Duck Creek - Duck Creek delivers homeowners insurance SaaS and integrations to automate underwriting, policy issuance, and management with ecosystem data for accurate pricing and smart sensor alerts, enabling rapid product deployment and improved protection efficiency.

dowidth.com

dowidth.com