Pay-as-you-drive insurance calculates premiums based on the actual miles driven, promoting cost efficiency and encouraging reduced vehicle use. Event-based insurance offers coverage triggered by specific occurrences such as accidents or theft, providing tailored protection for particular risks. Explore how these innovative insurance models can optimize your coverage and savings.

Why it is important

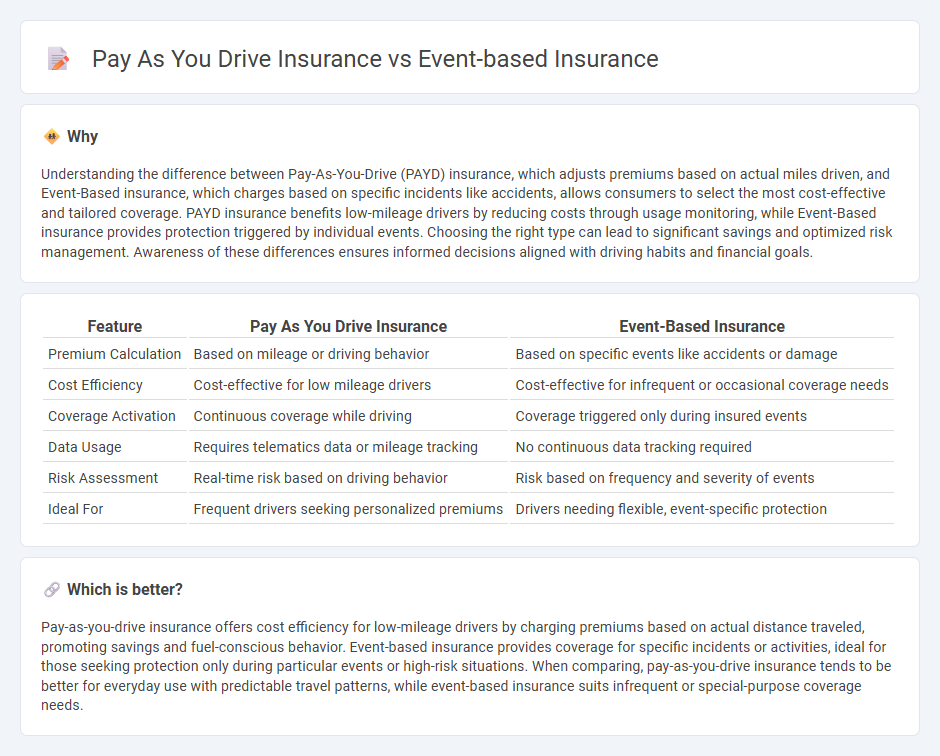

Understanding the difference between Pay-As-You-Drive (PAYD) insurance, which adjusts premiums based on actual miles driven, and Event-Based insurance, which charges based on specific incidents like accidents, allows consumers to select the most cost-effective and tailored coverage. PAYD insurance benefits low-mileage drivers by reducing costs through usage monitoring, while Event-Based insurance provides protection triggered by individual events. Choosing the right type can lead to significant savings and optimized risk management. Awareness of these differences ensures informed decisions aligned with driving habits and financial goals.

Comparison Table

| Feature | Pay As You Drive Insurance | Event-Based Insurance |

|---|---|---|

| Premium Calculation | Based on mileage or driving behavior | Based on specific events like accidents or damage |

| Cost Efficiency | Cost-effective for low mileage drivers | Cost-effective for infrequent or occasional coverage needs |

| Coverage Activation | Continuous coverage while driving | Coverage triggered only during insured events |

| Data Usage | Requires telematics data or mileage tracking | No continuous data tracking required |

| Risk Assessment | Real-time risk based on driving behavior | Risk based on frequency and severity of events |

| Ideal For | Frequent drivers seeking personalized premiums | Drivers needing flexible, event-specific protection |

Which is better?

Pay-as-you-drive insurance offers cost efficiency for low-mileage drivers by charging premiums based on actual distance traveled, promoting savings and fuel-conscious behavior. Event-based insurance provides coverage for specific incidents or activities, ideal for those seeking protection only during particular events or high-risk situations. When comparing, pay-as-you-drive insurance tends to be better for everyday use with predictable travel patterns, while event-based insurance suits infrequent or special-purpose coverage needs.

Connection

Pay-as-you-drive insurance and event-based insurance both leverage real-time data to tailor premiums according to actual usage patterns, promoting cost efficiency and personalized coverage. Pay-as-you-drive charges customers based on mileage, while event-based insurance adjusts premiums or triggers coverage only when specified incidents or driving events occur. This connection enables dynamic insurance models that reward safer behaviors and reduce unnecessary expenses by closely monitoring driving habits and specific risk events.

Key Terms

Triggering Event

Event-based insurance activates coverage only when a specific triggering event occurs, such as a flood or theft, ensuring protection is aligned with actual risk exposure. Pay-as-you-drive insurance calculates premiums based on miles driven or driving behavior, with no singular event triggering coverage initiation. Explore the detailed mechanics and benefits of each model to determine the best fit for your insurance needs.

Usage-Based Premium

Event-based insurance calculates premiums based on specific occurrences such as accidents or claims, offering tailored coverage that adapts to real-time risk events. Pay as you drive insurance determines premiums primarily by actual driving behavior and mileage, using telematics to monitor factors like speed, distance, and driving patterns. Explore these usage-based premium models to understand which best suits your driving habits and risk tolerance.

Telematics

Event-based insurance leverages telematics technology to monitor specific driving behaviors such as sudden braking or rapid acceleration, enabling personalized premiums based on real-time risk assessments. Pay-as-you-drive insurance utilizes telematics to track overall mileage and driving patterns, offering cost savings by charging customers according to the distance they actually drive. Explore the nuances of telematics applications in these insurance models to better understand their benefits and limitations.

Source and External Links

Wedding & Special Event Insurance - GEICO - Event-based insurance typically includes liability and cancellation coverage protecting against injury, property damage, and event cancellations with policies starting as low as $75 for liability and $130 for cancellation coverage up to $2 million.

Event Insurance | Thimble - Event insurance is a liability policy covering bodily injury, property damage, and liquor liability for event organizers, offered by the hour or day, but generally does not cover event cancellation.

Event Insurance - NAIC - Event insurance commonly provides coverage for event cancellation, liability, personal injury, property damage, and liquor liability, suited for single-occurrence short-duration events like weddings, reunions, or block parties.

dowidth.com

dowidth.com