Crop yield insurance provides financial protection based on actual crop production against losses due to natural disasters or pests, ensuring farmers receive compensation for reduced harvest volumes. Crop revenue insurance offers a broader safeguard by covering both yield losses and fluctuations in market prices, guaranteeing a minimum income regardless of market conditions. Explore the key differences and benefits of these insurance options to secure your agricultural investment effectively.

Why it is important

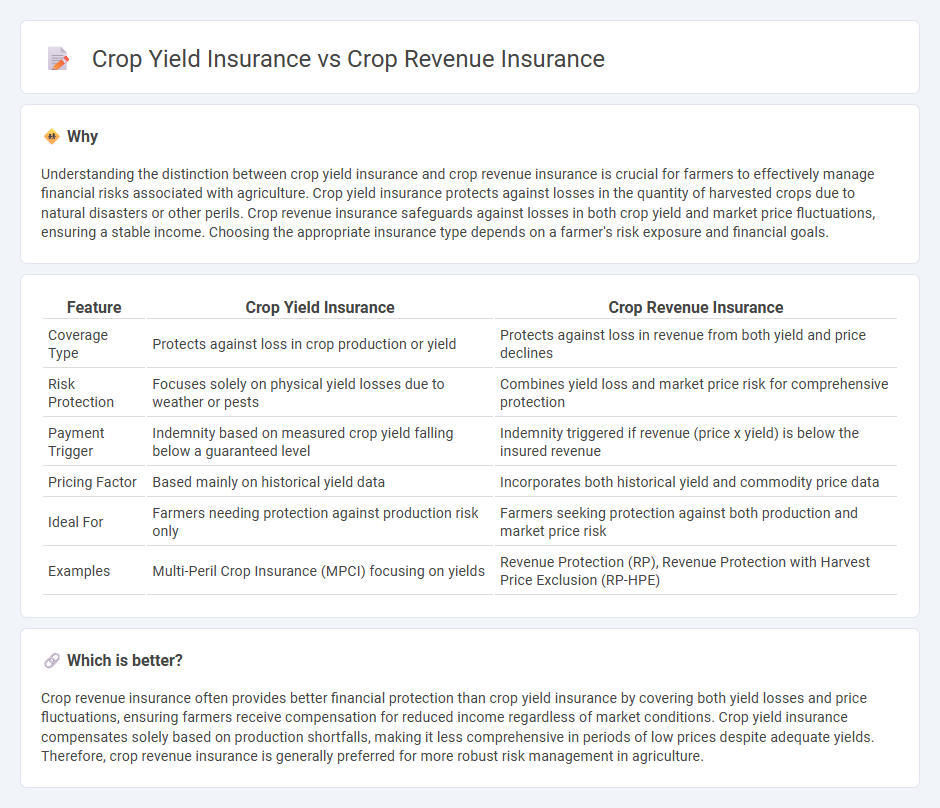

Understanding the distinction between crop yield insurance and crop revenue insurance is crucial for farmers to effectively manage financial risks associated with agriculture. Crop yield insurance protects against losses in the quantity of harvested crops due to natural disasters or other perils. Crop revenue insurance safeguards against losses in both crop yield and market price fluctuations, ensuring a stable income. Choosing the appropriate insurance type depends on a farmer's risk exposure and financial goals.

Comparison Table

| Feature | Crop Yield Insurance | Crop Revenue Insurance |

|---|---|---|

| Coverage Type | Protects against loss in crop production or yield | Protects against loss in revenue from both yield and price declines |

| Risk Protection | Focuses solely on physical yield losses due to weather or pests | Combines yield loss and market price risk for comprehensive protection |

| Payment Trigger | Indemnity based on measured crop yield falling below a guaranteed level | Indemnity triggered if revenue (price x yield) is below the insured revenue |

| Pricing Factor | Based mainly on historical yield data | Incorporates both historical yield and commodity price data |

| Ideal For | Farmers needing protection against production risk only | Farmers seeking protection against both production and market price risk |

| Examples | Multi-Peril Crop Insurance (MPCI) focusing on yields | Revenue Protection (RP), Revenue Protection with Harvest Price Exclusion (RP-HPE) |

Which is better?

Crop revenue insurance often provides better financial protection than crop yield insurance by covering both yield losses and price fluctuations, ensuring farmers receive compensation for reduced income regardless of market conditions. Crop yield insurance compensates solely based on production shortfalls, making it less comprehensive in periods of low prices despite adequate yields. Therefore, crop revenue insurance is generally preferred for more robust risk management in agriculture.

Connection

Crop yield insurance guarantees financial protection based on the quantity of agricultural output affected by adverse events like drought or pests. Crop revenue insurance combines this yield protection with price risk coverage, ensuring farmers receive compensation if either yield falls short or market prices decline. Both insurance types mitigate the financial risks linked to farming, but revenue insurance offers a broader safety net by addressing both production and market uncertainties.

Key Terms

Revenue Protection

Crop revenue insurance guarantees financial coverage based on the actual revenue from crop sales, protecting farmers against fluctuations in market prices and yield variations, whereas crop yield insurance specifically covers losses due to reduced crop production. Revenue Protection (RP) offers comprehensive risk management by combining both price and yield risk, making it a preferred option for farmers seeking stability in uncertain agricultural markets. Explore more to understand how Revenue Protection can safeguard your farming income effectively.

Yield Guarantee

Crop yield insurance guarantees farmers a specific level of production based on historical yields, providing protection against losses due to natural disasters, pests, or adverse weather conditions. Crop revenue insurance, on the other hand, offers coverage based on both yield and market price fluctuations, ensuring a minimum revenue even if crop prices drop significantly. Explore detailed comparisons to understand how yield guarantees in crop insurance can safeguard your agricultural income.

Price Risk

Crop revenue insurance covers losses from both lower yields and fluctuating market prices, providing farmers protection against price risk, whereas crop yield insurance protects solely against reduced crop production. By factoring in price volatility, crop revenue insurance offers a more comprehensive safety net for revenue stability. Explore how price risk impacts your insurance choice and maximize your farm's financial security.

Source and External Links

Understanding the Price Side of Revenue Crop Insurance - Explains how revenue insurance policies determine guaranteed prices and cover losses when total revenue falls below guaranteed levels based on yield and price forecasts set by USDA's Risk Management Agency (RMA), including options with or without harvest price adjustment.

Revenue Insurance Payment Scenarios for Corn and Soybeans in 2024 - Details how Revenue Protection (RP) and RP with Harvest Price Exclusion (RP-HPE) function to protect crop revenue using projected prices and coverage levels, illustrating how insurance payments are calculated across various prices and yields for major crops like corn and soybeans.

Whole-Farm Revenue Protection for Diversified Farms - Describes a crop-neutral revenue insurance called Whole-Farm Revenue Protection (WFRP) that covers all crops and livestock on a farm, offering coverage for revenue losses due to price and yield declines, with premium subsidies and discounts based on diversification and farm characteristics.

dowidth.com

dowidth.com