Drone insurance covers damage, theft, and liability related to unmanned aerial vehicles, essential for commercial operators and hobbyists to protect costly equipment and comply with regulations. Life insurance provides financial security to beneficiaries by paying out a death benefit, helping to cover expenses like funeral costs, debts, and income replacement. Explore detailed comparisons to determine which policy best fits your risk management needs.

Why it is important

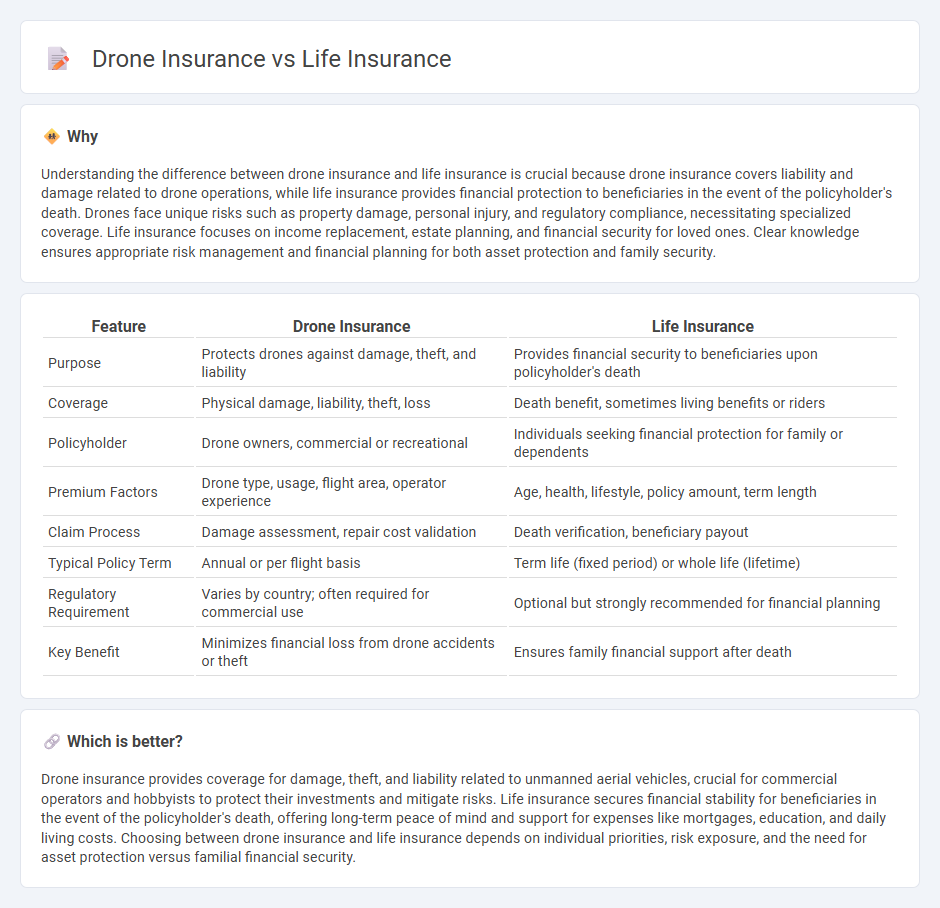

Understanding the difference between drone insurance and life insurance is crucial because drone insurance covers liability and damage related to drone operations, while life insurance provides financial protection to beneficiaries in the event of the policyholder's death. Drones face unique risks such as property damage, personal injury, and regulatory compliance, necessitating specialized coverage. Life insurance focuses on income replacement, estate planning, and financial security for loved ones. Clear knowledge ensures appropriate risk management and financial planning for both asset protection and family security.

Comparison Table

| Feature | Drone Insurance | Life Insurance |

|---|---|---|

| Purpose | Protects drones against damage, theft, and liability | Provides financial security to beneficiaries upon policyholder's death |

| Coverage | Physical damage, liability, theft, loss | Death benefit, sometimes living benefits or riders |

| Policyholder | Drone owners, commercial or recreational | Individuals seeking financial protection for family or dependents |

| Premium Factors | Drone type, usage, flight area, operator experience | Age, health, lifestyle, policy amount, term length |

| Claim Process | Damage assessment, repair cost validation | Death verification, beneficiary payout |

| Typical Policy Term | Annual or per flight basis | Term life (fixed period) or whole life (lifetime) |

| Regulatory Requirement | Varies by country; often required for commercial use | Optional but strongly recommended for financial planning |

| Key Benefit | Minimizes financial loss from drone accidents or theft | Ensures family financial support after death |

Which is better?

Drone insurance provides coverage for damage, theft, and liability related to unmanned aerial vehicles, crucial for commercial operators and hobbyists to protect their investments and mitigate risks. Life insurance secures financial stability for beneficiaries in the event of the policyholder's death, offering long-term peace of mind and support for expenses like mortgages, education, and daily living costs. Choosing between drone insurance and life insurance depends on individual priorities, risk exposure, and the need for asset protection versus familial financial security.

Connection

Drone insurance and life insurance are connected through risk management principles that protect individuals and assets from unforeseen events. Both types of insurance evaluate potential hazards, quantify exposure to loss, and provide financial compensation to mitigate the impact of accidents or damages. Regulatory compliance and technological advancements influence policy terms and premiums in both industries, ensuring comprehensive coverage for users and beneficiaries.

Key Terms

Life Insurance:

Life insurance provides financial protection by paying beneficiaries a death benefit, ensuring income replacement, debt coverage, and estate planning for policyholders' families. It often includes term, whole, and universal life policies tailored to diverse needs and budgets, with considerations like age, health, and coverage amount influencing premiums. Explore comprehensive details on life insurance options and benefits to secure your family's financial future.

Beneficiary

Life insurance designates a beneficiary who receives financial support upon the insured individual's death, providing security and peace of mind for loved ones. Drone insurance protects the operator or owner against liabilities and damages, but does not involve beneficiary designations as the coverage is asset-focused. Explore the differences in policy structures and beneficiary implications to choose the right insurance.

Premium

Life insurance premiums are typically calculated based on age, health, lifestyle, and coverage amount, reflecting the insured's risk of mortality. Drone insurance premiums depend on factors such as drone type, usage, coverage limits, and flight area, addressing the risk of property damage and liability. Explore detailed comparisons to determine which insurance premium best fits your needs.

Source and External Links

Life Insurance Policy - Get a Free Quote | Aflac - Aflac offers term, whole, and final expense life insurance policies that provide financial security to your loved ones through a death benefit paid after your passing, with options that include guaranteed-issue without medical questions and coverage that stays active as long as premiums are paid.

Life Insurance | Get Your Quote Today - Allstate - Life insurance from Allstate includes term and permanent life options like whole, universal, and variable life insurance, which provide lifelong coverage with benefits that can include cash value accumulation, flexible premiums, and financial protection for various needs such as funeral costs, debt, and education.

Life Insurance - Get a Free Quote Now - GEICO - GEICO explains different life insurance types, including term life that covers a specific period, whole life that lasts a lifetime with a guaranteed death benefit, and universal life which offers lifetime coverage plus a cash value fund with flexible premiums, helping you estimate coverage needs and affordability.

dowidth.com

dowidth.com