Embedded insurance integrates coverage directly into the purchase process of a product or service, offering seamless protection tailored to specific needs. Usage-based insurance calculates premiums based on real-time data, such as driving behavior or mileage, providing personalized and often cost-effective coverage. Explore how these innovative insurance models can optimize your protection strategy.

Why it is important

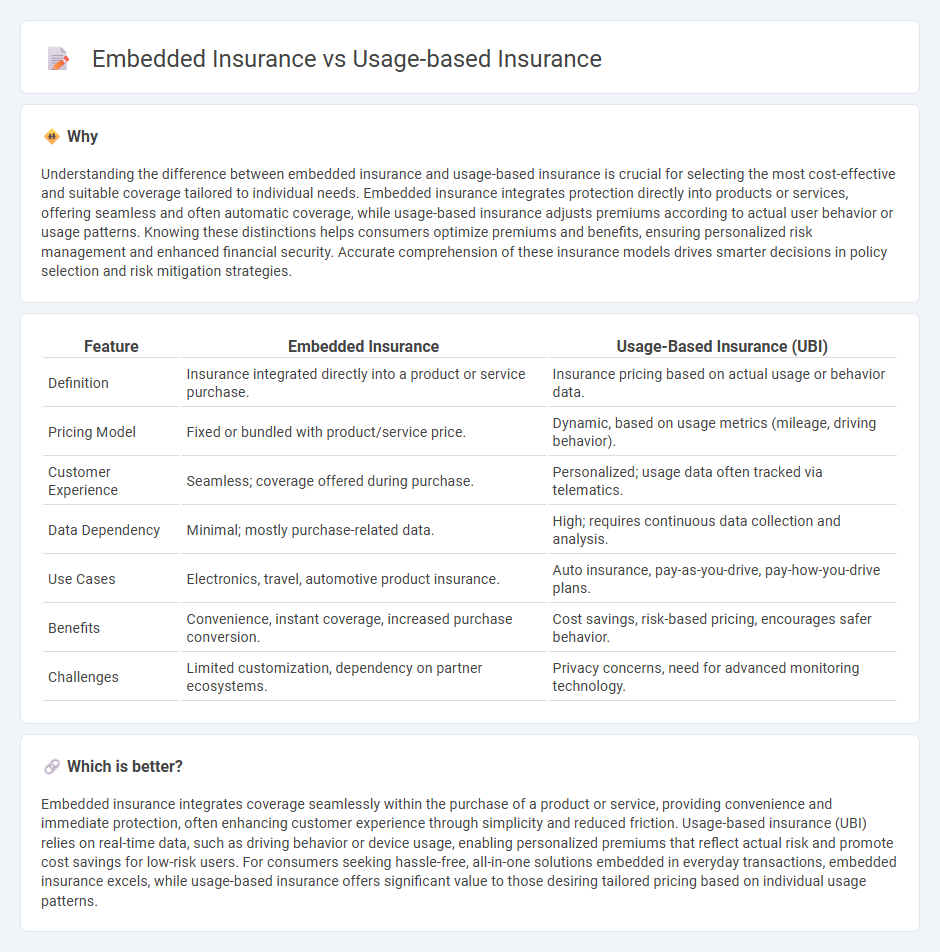

Understanding the difference between embedded insurance and usage-based insurance is crucial for selecting the most cost-effective and suitable coverage tailored to individual needs. Embedded insurance integrates protection directly into products or services, offering seamless and often automatic coverage, while usage-based insurance adjusts premiums according to actual user behavior or usage patterns. Knowing these distinctions helps consumers optimize premiums and benefits, ensuring personalized risk management and enhanced financial security. Accurate comprehension of these insurance models drives smarter decisions in policy selection and risk mitigation strategies.

Comparison Table

| Feature | Embedded Insurance | Usage-Based Insurance (UBI) |

|---|---|---|

| Definition | Insurance integrated directly into a product or service purchase. | Insurance pricing based on actual usage or behavior data. |

| Pricing Model | Fixed or bundled with product/service price. | Dynamic, based on usage metrics (mileage, driving behavior). |

| Customer Experience | Seamless; coverage offered during purchase. | Personalized; usage data often tracked via telematics. |

| Data Dependency | Minimal; mostly purchase-related data. | High; requires continuous data collection and analysis. |

| Use Cases | Electronics, travel, automotive product insurance. | Auto insurance, pay-as-you-drive, pay-how-you-drive plans. |

| Benefits | Convenience, instant coverage, increased purchase conversion. | Cost savings, risk-based pricing, encourages safer behavior. |

| Challenges | Limited customization, dependency on partner ecosystems. | Privacy concerns, need for advanced monitoring technology. |

Which is better?

Embedded insurance integrates coverage seamlessly within the purchase of a product or service, providing convenience and immediate protection, often enhancing customer experience through simplicity and reduced friction. Usage-based insurance (UBI) relies on real-time data, such as driving behavior or device usage, enabling personalized premiums that reflect actual risk and promote cost savings for low-risk users. For consumers seeking hassle-free, all-in-one solutions embedded in everyday transactions, embedded insurance excels, while usage-based insurance offers significant value to those desiring tailored pricing based on individual usage patterns.

Connection

Embedded insurance integrates coverage directly into the purchase of products or services, enhancing customer convenience and seamless protection. Usage-based insurance (UBI) leverages real-time data from telematics to tailor premiums according to individual behavior, promoting personalized risk assessment. Combining embedded insurance with UBI allows insurers to offer dynamic, context-sensitive policies embedded in transactions while accurately pricing risk based on actual usage patterns.

Key Terms

Telematics

Usage-based insurance leverages telematics devices to monitor real-time driving behaviors such as speed, braking patterns, and mileage, enabling insurers to tailor premiums based on individual risk profiles. Embedded insurance integrates coverage seamlessly into the purchase of products or services, often including telematics to provide dynamic pricing and enhanced customer engagement directly within the acquisition process. Explore how the fusion of telematics with these innovative insurance models is reshaping risk assessment and customer experience.

API Integration

Usage-based insurance leverages telematics data collected via APIs to offer personalized premiums based on driving behavior, enhancing risk assessment accuracy through real-time analytics. Embedded insurance seamlessly integrates coverage options directly within third-party platforms or applications using API integration, providing instant access and frictionless purchasing experiences for customers. Explore how API integration transforms insurance models by enabling tailored solutions and streamlining policy management.

Personalization

Usage-based insurance leverages telematics and real-time data to tailor premiums based on individual driving behavior, offering highly personalized rates that reward safe driving habits. Embedded insurance integrates coverage directly into the purchase process of a product or service, providing seamless, context-specific protection often customized to the buyer's immediate needs. Explore how these innovative insurance models enhance personalization to meet diverse consumer expectations.

Source and External Links

Usage-Based Car Insurance - Progressive - Usage-based insurance calculates auto insurance rates by analyzing how often and how safely you drive, using telematics data collected via a device or app to tailor premiums based on driving behavior or mileage.

Usage-based insurance - Washington State Office of the Insurance Commissioner - Usage-based insurance (UBI) tracks driving behaviors such as miles driven, time of day, and driving style with devices or apps to customize premiums, though it may raise privacy concerns and may not always guarantee discounts.

Usage-based insurance - Wikipedia - Usage-based insurance, including pay-as-you-drive and pay-how-you-drive models, bases premiums on data like distance, speed, location, and driving habits collected via telematics, encouraging safer driving by linking risk to insurance costs.

dowidth.com

dowidth.com