Pet insurance covers veterinary expenses for illnesses, accidents, and routine care, offering financial protection for your furry family members. Home insurance safeguards your property and belongings against damage or theft, including coverage for natural disasters and liability claims. Explore the differences between pet insurance and home insurance to choose the best protection for your needs.

Why it is important

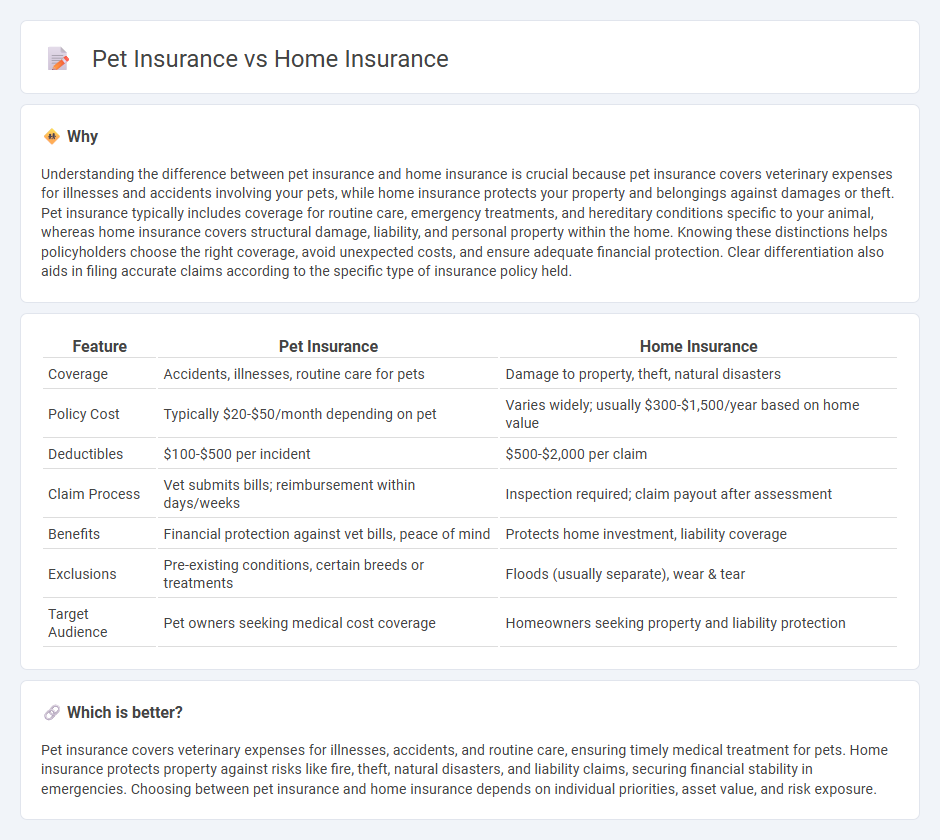

Understanding the difference between pet insurance and home insurance is crucial because pet insurance covers veterinary expenses for illnesses and accidents involving your pets, while home insurance protects your property and belongings against damages or theft. Pet insurance typically includes coverage for routine care, emergency treatments, and hereditary conditions specific to your animal, whereas home insurance covers structural damage, liability, and personal property within the home. Knowing these distinctions helps policyholders choose the right coverage, avoid unexpected costs, and ensure adequate financial protection. Clear differentiation also aids in filing accurate claims according to the specific type of insurance policy held.

Comparison Table

| Feature | Pet Insurance | Home Insurance |

|---|---|---|

| Coverage | Accidents, illnesses, routine care for pets | Damage to property, theft, natural disasters |

| Policy Cost | Typically $20-$50/month depending on pet | Varies widely; usually $300-$1,500/year based on home value |

| Deductibles | $100-$500 per incident | $500-$2,000 per claim |

| Claim Process | Vet submits bills; reimbursement within days/weeks | Inspection required; claim payout after assessment |

| Benefits | Financial protection against vet bills, peace of mind | Protects home investment, liability coverage |

| Exclusions | Pre-existing conditions, certain breeds or treatments | Floods (usually separate), wear & tear |

| Target Audience | Pet owners seeking medical cost coverage | Homeowners seeking property and liability protection |

Which is better?

Pet insurance covers veterinary expenses for illnesses, accidents, and routine care, ensuring timely medical treatment for pets. Home insurance protects property against risks like fire, theft, natural disasters, and liability claims, securing financial stability in emergencies. Choosing between pet insurance and home insurance depends on individual priorities, asset value, and risk exposure.

Connection

Pet insurance and home insurance are connected through the shared goal of protecting valuable assets and mitigating unexpected financial risks for homeowners. Both policies often complement each other by covering different aspects of household-related expenses, such as pet-related property damage included in some home insurance plans and veterinary bills covered by pet insurance. Insurers may offer bundled discounts for customers purchasing both policies, enhancing overall coverage efficiency and cost savings.

Key Terms

**Home Insurance:**

Home insurance provides financial protection against damage to your property caused by events such as fire, theft, or natural disasters, covering both the structure and personal belongings. Policies often include liability coverage for injuries occurring on your property, safeguarding your assets and peace of mind. Explore our detailed guide to understand how home insurance policies can be tailored to fit your unique needs.

Dwelling Coverage

Dwelling coverage in home insurance protects the physical structure of your house against damages caused by events like fire, storms, or vandalism, ensuring financial support for repairs or rebuilding. In contrast, pet insurance focuses on covering veterinary expenses and medical treatments for your pets, without offering any protection for your home's structure. Explore detailed comparisons to understand how dwelling coverage varies significantly between these two insurance types.

Personal Property

Home insurance primarily covers personal property such as furniture, electronics, and clothing against risks like theft, fire, or natural disasters, ensuring financial protection for homeowners. Pet insurance, on the other hand, does not cover personal property but specifically focuses on veterinary expenses and health care costs for pets. Explore detailed comparisons and coverage specifics to understand which insurance best suits your personal property and pet care needs.

Source and External Links

Homeowners Insurance - Get a Home Insurance Quote - Liberty Mutual offers customized homeowners insurance, including personal property coverage and liability coverage, based on factors like location and home materials.

Learn how home insurance works - This webpage explains typical homeowner policy coverages, including dwelling, other structures, personal property, and additional living expenses.

Homeowners Insurance - Get a Free Home Insurance Quote - GEICO offers home insurance quotes and explains essential concepts like the 80% rule for insuring a home's replacement cost.

dowidth.com

dowidth.com