Pet health insurance covers veterinary expenses including accidents, illnesses, and preventive care, providing financial protection for unexpected medical costs. Renter's insurance safeguards personal belongings against theft, fire, or damage, and offers liability coverage in case of accidents within the rental property. Explore more to understand which insurance best suits your specific needs and lifestyle.

Why it is important

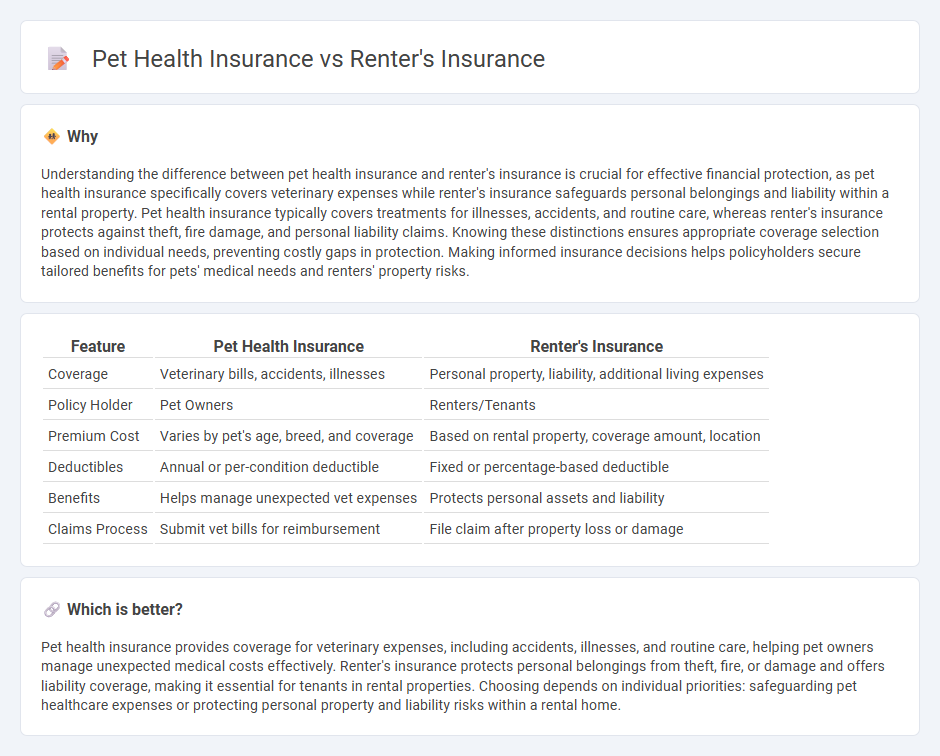

Understanding the difference between pet health insurance and renter's insurance is crucial for effective financial protection, as pet health insurance specifically covers veterinary expenses while renter's insurance safeguards personal belongings and liability within a rental property. Pet health insurance typically covers treatments for illnesses, accidents, and routine care, whereas renter's insurance protects against theft, fire damage, and personal liability claims. Knowing these distinctions ensures appropriate coverage selection based on individual needs, preventing costly gaps in protection. Making informed insurance decisions helps policyholders secure tailored benefits for pets' medical needs and renters' property risks.

Comparison Table

| Feature | Pet Health Insurance | Renter's Insurance |

|---|---|---|

| Coverage | Veterinary bills, accidents, illnesses | Personal property, liability, additional living expenses |

| Policy Holder | Pet Owners | Renters/Tenants |

| Premium Cost | Varies by pet's age, breed, and coverage | Based on rental property, coverage amount, location |

| Deductibles | Annual or per-condition deductible | Fixed or percentage-based deductible |

| Benefits | Helps manage unexpected vet expenses | Protects personal assets and liability |

| Claims Process | Submit vet bills for reimbursement | File claim after property loss or damage |

Which is better?

Pet health insurance provides coverage for veterinary expenses, including accidents, illnesses, and routine care, helping pet owners manage unexpected medical costs effectively. Renter's insurance protects personal belongings from theft, fire, or damage and offers liability coverage, making it essential for tenants in rental properties. Choosing depends on individual priorities: safeguarding pet healthcare expenses or protecting personal property and liability risks within a rental home.

Connection

Pet health insurance and renter's insurance are interconnected through the shared goal of providing financial protection for renters and their pets. Both insurance types cover unexpected expenses--pet health insurance covers veterinary care, while renter's insurance protects personal belongings and liability within a rental property. Combining these policies ensures comprehensive coverage, safeguarding renters' assets alongside their companion animals' well-being.

Key Terms

**Renter's Insurance:**

Renter's insurance provides financial protection for tenants by covering personal property loss, liability claims, and additional living expenses in case of damage or theft within the rental property. This insurance is essential for renters seeking to safeguard belongings like electronics, furniture, and clothing from unforeseen events such as fire, burglary, or water damage. Discover how renter's insurance can offer peace of mind and protect your assets in rented homes.

Personal Property Coverage

Renter's insurance provides personal property coverage that protects belongings such as furniture, electronics, and clothing against risks like theft, fire, or vandalism. Pet health insurance, by contrast, specifically covers veterinary expenses for illnesses, injuries, and routine care but does not extend to personal property protection. Discover detailed comparisons and find the best coverage options tailored to your needs.

Liability Protection

Renter's insurance typically includes liability protection covering damages or injuries caused by the insured party, whereas pet health insurance focuses on veterinary medical expenses and does not provide liability coverage for pet-related incidents. Liability protection in renter's insurance may cover accidental property damage or bodily injury to third parties, offering financial security against lawsuits or claims. Explore the specifics of each policy to understand how liability protection aligns with your needs.

Source and External Links

Get A Renters Insurance Quote - GEICO - Renters insurance protects your personal belongings from events like theft, fire, water damage, and also provides liability coverage for visitor injuries, with personalized options including special coverage for valuables like jewelry.

Renters Insurance - Get a Free Quote | Travelers Insurance - Renters insurance covers loss or damage to personal items from fire, lightning, windstorms, vandalism, as well as liability protection and additional living expenses if you must temporarily relocate.

Renters Insurance | III - Standard renters insurance protects belongings against various damages, includes liability coverage for legal defense up to recommended amounts, and offers no-fault medical coverage for visitors injured on your property.

dowidth.com

dowidth.com