Micro-mobility insurance covers e-scooters, e-bikes, and other small electric vehicles used for short-distance travel, focusing on personal accident, theft, and liability protection. In contrast, commercial vehicle insurance provides broader coverage for trucks, vans, and cars used for business purposes, including property damage, cargo protection, and third-party liability. Explore the key differences and determine which insurance type suits your needs best.

Why it is important

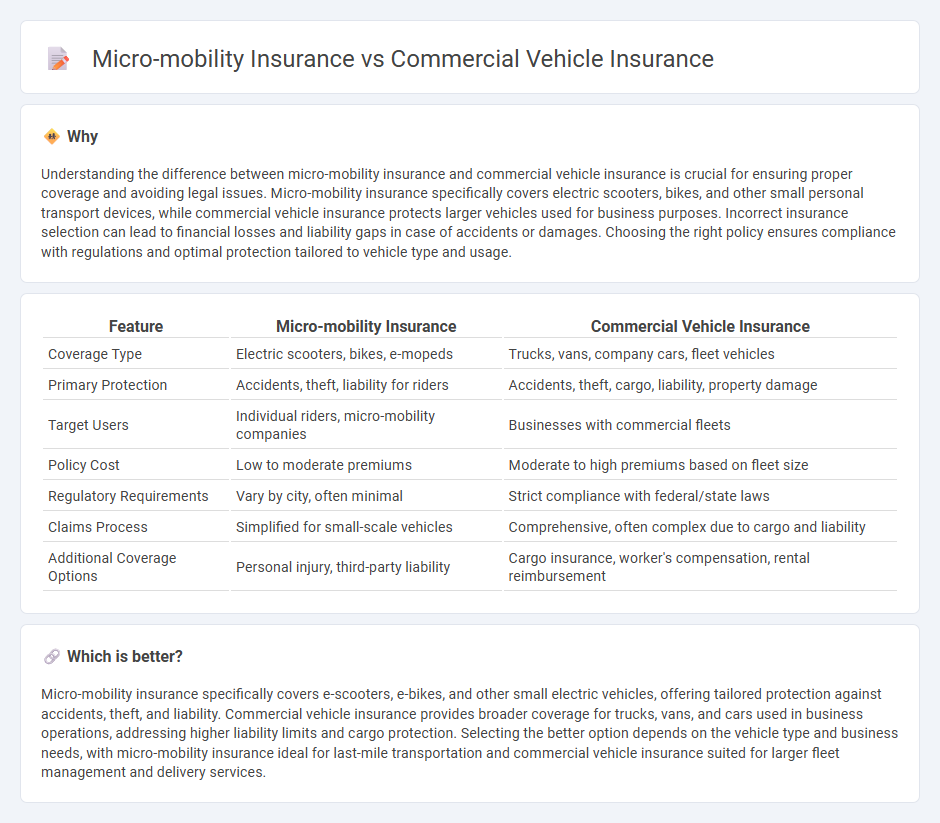

Understanding the difference between micro-mobility insurance and commercial vehicle insurance is crucial for ensuring proper coverage and avoiding legal issues. Micro-mobility insurance specifically covers electric scooters, bikes, and other small personal transport devices, while commercial vehicle insurance protects larger vehicles used for business purposes. Incorrect insurance selection can lead to financial losses and liability gaps in case of accidents or damages. Choosing the right policy ensures compliance with regulations and optimal protection tailored to vehicle type and usage.

Comparison Table

| Feature | Micro-mobility Insurance | Commercial Vehicle Insurance |

|---|---|---|

| Coverage Type | Electric scooters, bikes, e-mopeds | Trucks, vans, company cars, fleet vehicles |

| Primary Protection | Accidents, theft, liability for riders | Accidents, theft, cargo, liability, property damage |

| Target Users | Individual riders, micro-mobility companies | Businesses with commercial fleets |

| Policy Cost | Low to moderate premiums | Moderate to high premiums based on fleet size |

| Regulatory Requirements | Vary by city, often minimal | Strict compliance with federal/state laws |

| Claims Process | Simplified for small-scale vehicles | Comprehensive, often complex due to cargo and liability |

| Additional Coverage Options | Personal injury, third-party liability | Cargo insurance, worker's compensation, rental reimbursement |

Which is better?

Micro-mobility insurance specifically covers e-scooters, e-bikes, and other small electric vehicles, offering tailored protection against accidents, theft, and liability. Commercial vehicle insurance provides broader coverage for trucks, vans, and cars used in business operations, addressing higher liability limits and cargo protection. Selecting the better option depends on the vehicle type and business needs, with micro-mobility insurance ideal for last-mile transportation and commercial vehicle insurance suited for larger fleet management and delivery services.

Connection

Micro-mobility insurance and commercial vehicle insurance intersect through their shared goal of mitigating risks associated with transportation assets. Both insurance types address liability coverage, physical damage, and injury protection, yet micro-mobility focuses on electric scooters and bikes, while commercial vehicle insurance covers trucks, vans, and fleet vehicles used for business operations. As urban mobility shifts towards integrated transport networks, insurers develop hybrid policies to accommodate overlapping coverage needs between micro-mobility devices and commercial fleets.

Key Terms

Coverage Scope

Commercial vehicle insurance primarily covers larger vehicles such as trucks, vans, and buses used for business purposes, offering protection against liabilities, property damage, and cargo loss. Micro-mobility insurance targets smaller, non-traditional transport modes like e-scooters, e-bikes, and shared bicycles, providing coverage for personal injury, theft, and third-party damages. Explore the detailed differences in coverage scope to choose the right insurance for your transportation needs.

Vehicle Type

Commercial vehicle insurance primarily covers larger vehicles such as trucks, vans, and buses used for business purposes, providing protection against liabilities and damages during commercial operations. Micro-mobility insurance targets smaller, lightweight vehicles like e-scooters, e-bikes, and skateboards, addressing the unique risks associated with urban and last-mile transportation modes. Discover more about these specialized insurance policies and their tailored coverage options.

Liability Limits

Commercial vehicle insurance typically offers higher liability limits to cover extensive damages and bodily injury caused during business operations, often reaching millions of dollars. Micro-mobility insurance, designed for e-scooters, bikes, and similar small vehicles, usually features lower liability limits but includes specialized coverage for personal injury and property damage in urban environments. Explore more about how these liability limits impact your coverage needs and risk management strategies.

Source and External Links

Texas Commercial Auto Insurance - This insurance covers business-owned vehicles in Texas, helping with expenses like medical bills and legal fees if involved in an accident

Commercial Auto Insurance - Provides protection for business vehicles, including cars, vans, and trucks, covering accidents and unexpected expenses while on the job

Commercial Auto Insurance - Covers injuries and damages related to vehicles used for business purposes, including those owned, borrowed, leased, or rented

dowidth.com

dowidth.com