Climate risk insurance offers financial protection against natural disasters such as floods, hurricanes, and droughts, targeting large-scale climate-related losses for governments and businesses. Microinsurance focuses on low-income individuals, providing affordable coverage tailored to specific risks like health, crop failure, or property damage in vulnerable communities. Explore how these distinct insurance types address climate challenges and support resilience in diverse populations.

Why it is important

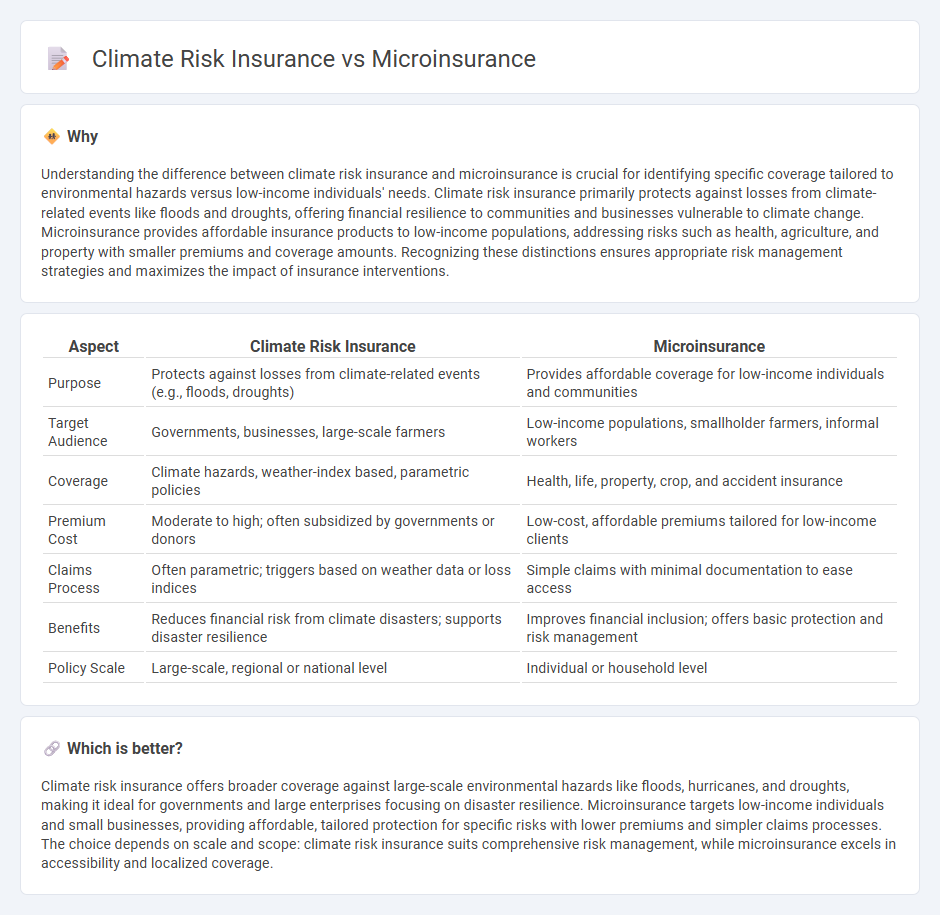

Understanding the difference between climate risk insurance and microinsurance is crucial for identifying specific coverage tailored to environmental hazards versus low-income individuals' needs. Climate risk insurance primarily protects against losses from climate-related events like floods and droughts, offering financial resilience to communities and businesses vulnerable to climate change. Microinsurance provides affordable insurance products to low-income populations, addressing risks such as health, agriculture, and property with smaller premiums and coverage amounts. Recognizing these distinctions ensures appropriate risk management strategies and maximizes the impact of insurance interventions.

Comparison Table

| Aspect | Climate Risk Insurance | Microinsurance |

|---|---|---|

| Purpose | Protects against losses from climate-related events (e.g., floods, droughts) | Provides affordable coverage for low-income individuals and communities |

| Target Audience | Governments, businesses, large-scale farmers | Low-income populations, smallholder farmers, informal workers |

| Coverage | Climate hazards, weather-index based, parametric policies | Health, life, property, crop, and accident insurance |

| Premium Cost | Moderate to high; often subsidized by governments or donors | Low-cost, affordable premiums tailored for low-income clients |

| Claims Process | Often parametric; triggers based on weather data or loss indices | Simple claims with minimal documentation to ease access |

| Benefits | Reduces financial risk from climate disasters; supports disaster resilience | Improves financial inclusion; offers basic protection and risk management |

| Policy Scale | Large-scale, regional or national level | Individual or household level |

Which is better?

Climate risk insurance offers broader coverage against large-scale environmental hazards like floods, hurricanes, and droughts, making it ideal for governments and large enterprises focusing on disaster resilience. Microinsurance targets low-income individuals and small businesses, providing affordable, tailored protection for specific risks with lower premiums and simpler claims processes. The choice depends on scale and scope: climate risk insurance suits comprehensive risk management, while microinsurance excels in accessibility and localized coverage.

Connection

Climate risk insurance provides financial protection against losses caused by climate-related events such as floods, hurricanes, and droughts, targeting large-scale risks. Microinsurance, often designed for low-income individuals and small businesses, plays a crucial role by offering affordable coverage against localized climate risks, enhancing resilience for vulnerable populations. Both insurance types complement each other by addressing different scales of climate exposure and promoting adaptive capacity within communities.

Key Terms

**Microinsurance:**

Microinsurance provides low-cost insurance solutions designed for low-income populations, offering coverage for health, life, property, and agriculture with flexible premium payments. It emphasizes accessibility and affordability, often using mobile technology to reach underserved communities vulnerable to everyday risks and climate uncertainties. Explore how microinsurance innovations are transforming financial resilience for vulnerable populations.

Affordability

Microinsurance offers low-cost, accessible coverage tailored to protect low-income populations against specific risks, making it affordable for vulnerable communities. Climate risk insurance focuses on providing financial protection against environmental hazards such as floods, droughts, and storms, often at higher premiums due to the complexity and scale of climate-related disasters. Explore more about how affordability impacts access and effectiveness in both insurance models.

Accessibility

Microinsurance improves accessibility by offering affordable, low-premium coverage tailored to low-income individuals, often with simplified enrollment processes and minimal documentation requirements. Climate risk insurance primarily targets larger-scale, high-value assets vulnerable to climate events, posing barriers to access for smallholders due to higher premiums and complex claim procedures. Explore more about how these insurance models differ in accessibility and impact on vulnerable communities.

Source and External Links

Microinsurance - Microinsurance provides low-cost insurance to low-income individuals, offering protection against specific risks with low premiums and coverage limits.

Background on Microinsurance and Emerging Markets - Microinsurance projects offer affordable insurance in developing countries, extending protection to those not covered by traditional insurance or government programs.

Microinsurance | Milliman - Microinsurance is designed for low-income individuals and families, focusing on price, terms, coverage, and delivery mechanisms to protect against risks like health issues and natural disasters.

dowidth.com

dowidth.com