Short term rental insurance provides coverage specifically tailored for property owners renting out their homes or units on a short-term basis, protecting against tenant-related damages, liability, and loss of rental income. Dwelling fire insurance, on the other hand, focuses on protecting the physical structure of a residential property from fire and related perils, typically excluding tenant-related liabilities and personal property coverage. Explore the key differences to determine the best insurance solution for your rental property needs.

Why it is important

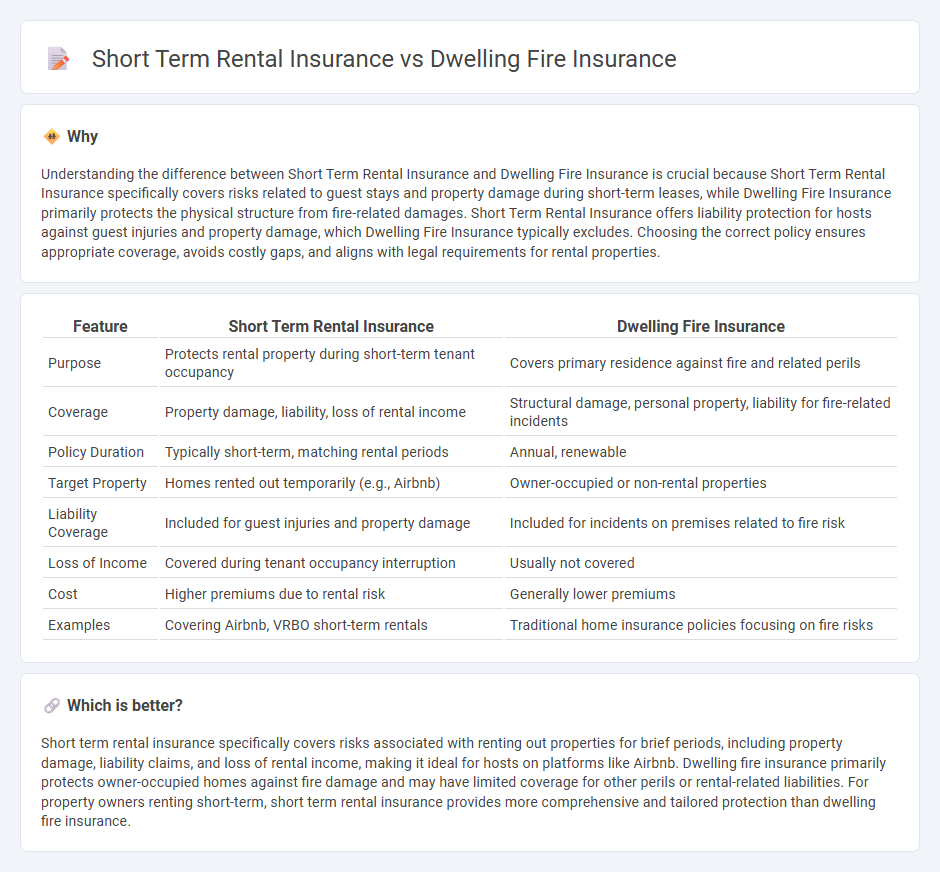

Understanding the difference between Short Term Rental Insurance and Dwelling Fire Insurance is crucial because Short Term Rental Insurance specifically covers risks related to guest stays and property damage during short-term leases, while Dwelling Fire Insurance primarily protects the physical structure from fire-related damages. Short Term Rental Insurance offers liability protection for hosts against guest injuries and property damage, which Dwelling Fire Insurance typically excludes. Choosing the correct policy ensures appropriate coverage, avoids costly gaps, and aligns with legal requirements for rental properties.

Comparison Table

| Feature | Short Term Rental Insurance | Dwelling Fire Insurance |

|---|---|---|

| Purpose | Protects rental property during short-term tenant occupancy | Covers primary residence against fire and related perils |

| Coverage | Property damage, liability, loss of rental income | Structural damage, personal property, liability for fire-related incidents |

| Policy Duration | Typically short-term, matching rental periods | Annual, renewable |

| Target Property | Homes rented out temporarily (e.g., Airbnb) | Owner-occupied or non-rental properties |

| Liability Coverage | Included for guest injuries and property damage | Included for incidents on premises related to fire risk |

| Loss of Income | Covered during tenant occupancy interruption | Usually not covered |

| Cost | Higher premiums due to rental risk | Generally lower premiums |

| Examples | Covering Airbnb, VRBO short-term rentals | Traditional home insurance policies focusing on fire risks |

Which is better?

Short term rental insurance specifically covers risks associated with renting out properties for brief periods, including property damage, liability claims, and loss of rental income, making it ideal for hosts on platforms like Airbnb. Dwelling fire insurance primarily protects owner-occupied homes against fire damage and may have limited coverage for other perils or rental-related liabilities. For property owners renting short-term, short term rental insurance provides more comprehensive and tailored protection than dwelling fire insurance.

Connection

Short term rental insurance and dwelling fire insurance both provide crucial protection for property owners against fire-related damages, covering different aspects of risk associated with rental properties. Short term rental insurance typically includes liability and property coverage tailored for temporary guests, while dwelling fire insurance focuses on safeguarding the physical structure from fire, explosions, and related perils. Combined, these insurance types ensure comprehensive coverage for landlords managing short term rental properties by addressing both structural damage and tenant liabilities.

Key Terms

Property Coverage

Dwelling fire insurance primarily covers damages to the residential structure caused by fire, smoke, and related perils, ensuring the building itself is protected. Short term rental insurance extends this coverage by including liability protection for guest-related incidents and often covers contents and loss of rental income during property repairs. Explore more to understand which policy best safeguards your property and rental business effectively.

Loss of Rental Income

Loss of rental income coverage under dwelling fire insurance typically limits claims to physical damage caused by fire or covered perils, whereas short term rental insurance offers broader protection, including income loss from cancellations or property damage beyond fires. Short term rental policies often address unique risks associated with guest stays, providing financial security if unforeseen events disrupt rental cash flow. Explore detailed policy options to ensure comprehensive loss of rental income protection tailored to your rental property needs.

Liability Protection

Dwelling fire insurance typically provides coverage for property damage caused by fire, but its liability protection is limited and mainly covers accidents occurring on the property owner's premises. Short term rental insurance offers enhanced liability protection tailored for hosts, covering incidents such as guest injuries and property damage during rental periods. Explore the differences further to ensure you choose the right liability coverage for your rental property needs.

Source and External Links

Dwelling Fire Insurance - Dwelling fire policies provide customizable coverage for single-family or duplex rental properties, owner-occupied homes, and vacant dwellings, with options to add liability or loss of rent coverages, and are typically updated annually to reflect property changes.

Dwelling Fire Insurance - Cajun Underwriters - There are three main forms (DP1, DP2, DP3), with DP1 offering basic named-peril coverage, DP2 adding extra perils like vandalism and windstorm, and DP3 providing open-peril coverage suitable for rental properties.

Dwelling Fire Insurance vs Homeowners Insurance - Dwelling fire insurance is designed for properties you own but do not live in, such as vacation homes or rentals, covering structural damage but generally excluding liability and personal possessions.

dowidth.com

dowidth.com