Artificial intelligence underwriting leverages machine learning algorithms to analyze complex data patterns, improving accuracy and efficiency in evaluating insurance applications. Automated risk assessment uses predefined rules and statistical models to quantify risk factors, streamlining decision-making but potentially lacking adaptability to novel scenarios. Explore the differences to understand how these technologies transform insurance underwriting.

Why it is important

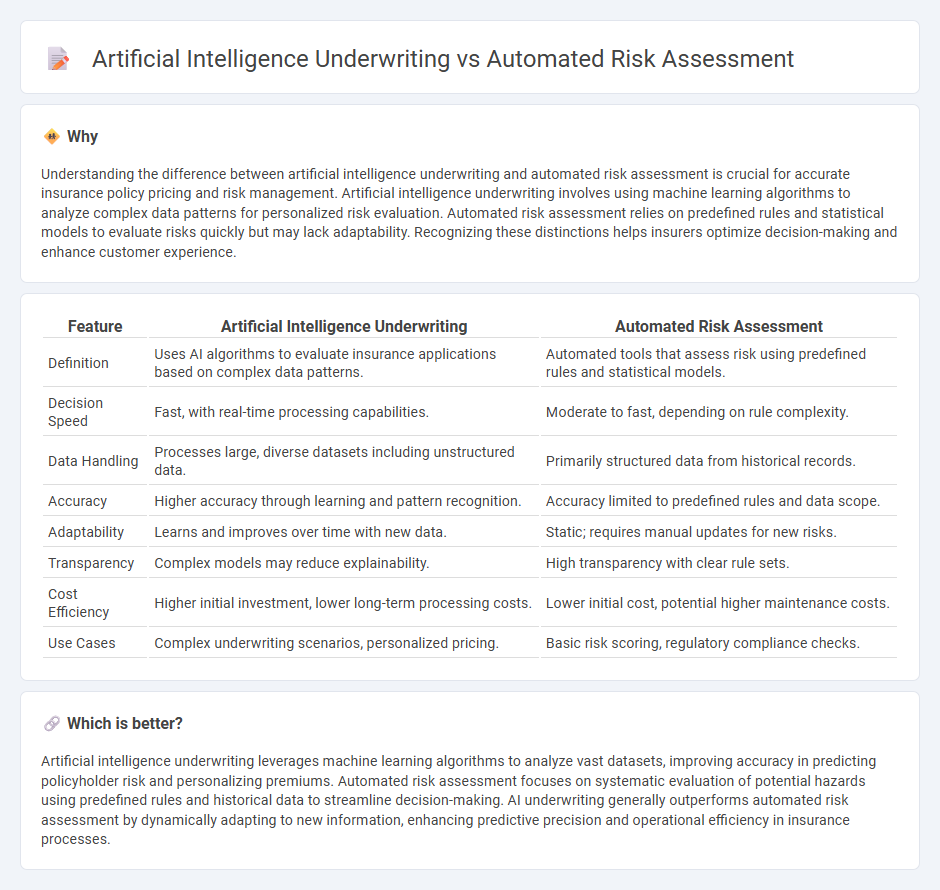

Understanding the difference between artificial intelligence underwriting and automated risk assessment is crucial for accurate insurance policy pricing and risk management. Artificial intelligence underwriting involves using machine learning algorithms to analyze complex data patterns for personalized risk evaluation. Automated risk assessment relies on predefined rules and statistical models to evaluate risks quickly but may lack adaptability. Recognizing these distinctions helps insurers optimize decision-making and enhance customer experience.

Comparison Table

| Feature | Artificial Intelligence Underwriting | Automated Risk Assessment |

|---|---|---|

| Definition | Uses AI algorithms to evaluate insurance applications based on complex data patterns. | Automated tools that assess risk using predefined rules and statistical models. |

| Decision Speed | Fast, with real-time processing capabilities. | Moderate to fast, depending on rule complexity. |

| Data Handling | Processes large, diverse datasets including unstructured data. | Primarily structured data from historical records. |

| Accuracy | Higher accuracy through learning and pattern recognition. | Accuracy limited to predefined rules and data scope. |

| Adaptability | Learns and improves over time with new data. | Static; requires manual updates for new risks. |

| Transparency | Complex models may reduce explainability. | High transparency with clear rule sets. |

| Cost Efficiency | Higher initial investment, lower long-term processing costs. | Lower initial cost, potential higher maintenance costs. |

| Use Cases | Complex underwriting scenarios, personalized pricing. | Basic risk scoring, regulatory compliance checks. |

Which is better?

Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets, improving accuracy in predicting policyholder risk and personalizing premiums. Automated risk assessment focuses on systematic evaluation of potential hazards using predefined rules and historical data to streamline decision-making. AI underwriting generally outperforms automated risk assessment by dynamically adapting to new information, enhancing predictive precision and operational efficiency in insurance processes.

Connection

Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets for precise risk evaluation and policy pricing. Automated risk assessment uses AI-driven tools to identify potential hazards and predict claim probabilities, enhancing decision accuracy. Together, these technologies streamline insurance underwriting by improving efficiency and reducing human error.

Key Terms

**Automated Risk Assessment:**

Automated risk assessment uses algorithms and data analytics to evaluate potential risks by processing large datasets for accurate risk scoring. This method enhances efficiency and consistency in identifying risk factors across various industries, particularly in insurance and finance. Explore how automated risk assessment transforms decision-making processes and minimizes human error.

Risk Scoring

Automated risk assessment utilizes algorithm-driven models to analyze data inputs and generate risk scores for insurance underwriting, improving speed and consistency. Artificial intelligence underwriting leverages machine learning and advanced analytics to refine risk scoring by identifying complex patterns and predictive factors beyond traditional methods. Explore how integrating AI can enhance risk scoring accuracy and decision-making in underwriting.

Data Analytics

Automated risk assessment employs rule-based algorithms that analyze historical data to identify potential risks, providing consistent and fast evaluations in insurance processes. In contrast, artificial intelligence underwriting leverages advanced machine learning models and predictive analytics to interpret complex data patterns, enhancing decision accuracy and personalized risk profiling. Explore how integrating these technologies revolutionizes data analytics for smarter underwriting strategies.

Source and External Links

Risk Management Automation: What it is and how it can improve ... - Automated risk assessment uses technology and algorithms to automatically identify, analyze, and evaluate risks by collecting data, prioritizing risks, and providing dashboards for continuous monitoring, making risk evaluation faster and more consistent than manual methods.

What is Automated Risk Assessment? Key Steps & Best Practices - Automated risk assessment leverages AI, data analytics, and rule-based systems to evaluate risk exposures in real time with human oversight, especially useful in monitoring third-party risks through constant anomaly detection and dynamic risk scoring.

What is automated risk assessment? - Cognizant - In insurance underwriting, automated risk assessment replaces manual processes with robotic process automation and AI, improving operational efficiency, productivity, and customer experience by digitizing and swiftly analyzing applicant data.

dowidth.com

dowidth.com