Gig worker insurance often focuses on flexible, short-term coverage that protects against liability, health emergencies, and income loss due to inconsistent work schedules. Union worker insurance typically offers comprehensive benefits including health, disability, retirement plans, and collective bargaining protections tailored to long-term employment security. Explore the key differences to choose the insurance best suited for your work arrangement.

Why it is important

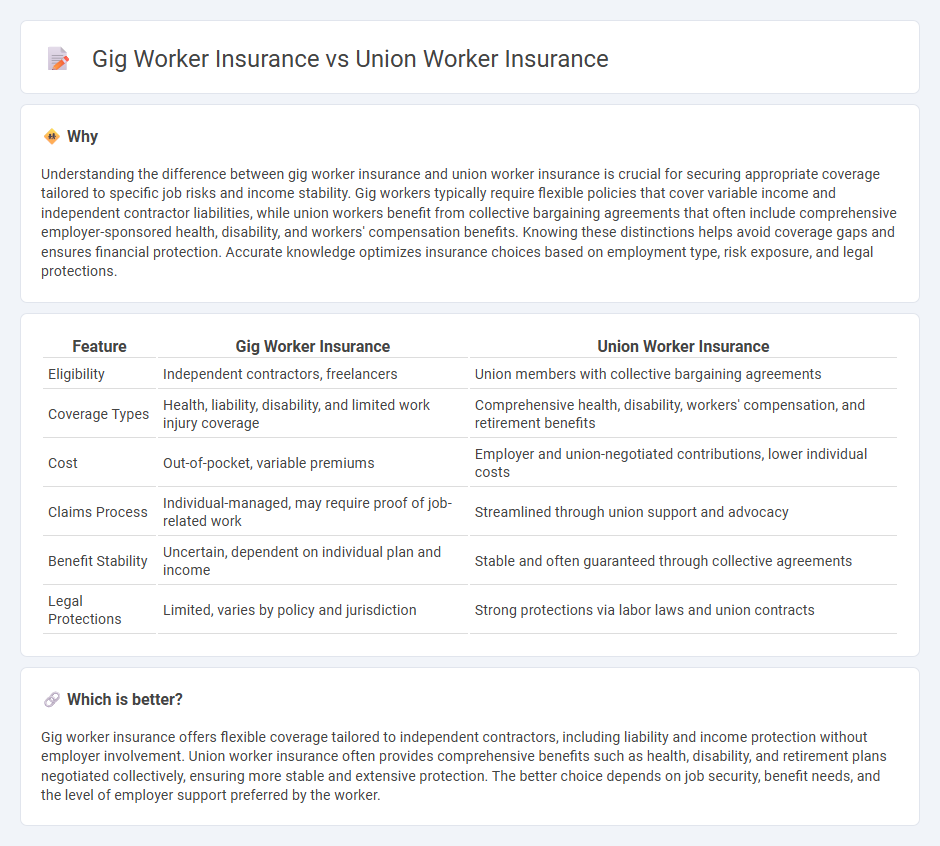

Understanding the difference between gig worker insurance and union worker insurance is crucial for securing appropriate coverage tailored to specific job risks and income stability. Gig workers typically require flexible policies that cover variable income and independent contractor liabilities, while union workers benefit from collective bargaining agreements that often include comprehensive employer-sponsored health, disability, and workers' compensation benefits. Knowing these distinctions helps avoid coverage gaps and ensures financial protection. Accurate knowledge optimizes insurance choices based on employment type, risk exposure, and legal protections.

Comparison Table

| Feature | Gig Worker Insurance | Union Worker Insurance |

|---|---|---|

| Eligibility | Independent contractors, freelancers | Union members with collective bargaining agreements |

| Coverage Types | Health, liability, disability, and limited work injury coverage | Comprehensive health, disability, workers' compensation, and retirement benefits |

| Cost | Out-of-pocket, variable premiums | Employer and union-negotiated contributions, lower individual costs |

| Claims Process | Individual-managed, may require proof of job-related work | Streamlined through union support and advocacy |

| Benefit Stability | Uncertain, dependent on individual plan and income | Stable and often guaranteed through collective agreements |

| Legal Protections | Limited, varies by policy and jurisdiction | Strong protections via labor laws and union contracts |

Which is better?

Gig worker insurance offers flexible coverage tailored to independent contractors, including liability and income protection without employer involvement. Union worker insurance often provides comprehensive benefits such as health, disability, and retirement plans negotiated collectively, ensuring more stable and extensive protection. The better choice depends on job security, benefit needs, and the level of employer support preferred by the worker.

Connection

Gig worker insurance and union worker insurance both address the unique risks faced by non-traditional employment sectors, focusing on income protection, health coverage, and liability. Union worker insurance typically offers collective bargaining power for better benefits, while gig worker insurance often includes specialized policies tailored to freelance job risks. Both types of insurance aim to bridge coverage gaps inherent in flexible or independent work arrangements, enhancing financial security for their members.

Key Terms

Group Coverage

Union worker insurance typically benefits from comprehensive group coverage plans that leverage collective bargaining to secure lower premiums and broader benefits, including health, dental, and disability insurance. In contrast, gig worker insurance often requires individual or tailor-made group policies that may lack the extensive benefits and cost advantages of union-backed plans but offer greater flexibility to meet diverse, non-traditional work arrangements. Explore detailed comparisons to understand how group coverage impacts insurance options and costs for union versus gig workers.

Portability

Union worker insurance typically offers extensive portability benefits, allowing members to maintain coverage across different jobs within the same union or industry. Gig worker insurance, however, often lacks such portability, as coverage is usually tied to a specific platform or contract, limiting continuous protection when switching gigs. Explore comprehensive comparisons to better understand how portability impacts your insurance options.

Employer Contribution

Union worker insurance typically involves substantial employer contributions negotiated through collective bargaining agreements, ensuring comprehensive coverage and lower out-of-pocket costs for employees. In contrast, gig worker insurance often lacks employer contributions, requiring independent workers to secure and finance their own health plans, leading to higher variability in coverage and expense. Explore detailed comparisons of insurance options and employer roles for union versus gig workers to make informed decisions.

Source and External Links

Union Health Benefits - This page discusses how union workers, such as those in the UFCW, have access to comprehensive and affordable healthcare benefits.

Union Plus Benefits - Offers a range of benefits, including supplemental insurance plans, credit cards, and discounts on services like wireless and auto insurance.

Union Plus Auto Insurance - Provides union members with discounted auto insurance through the Farmers GroupSelect program, offering savings by bundling policies.

dowidth.com

dowidth.com