Pet health insurance provides coverage for veterinary expenses, including accidents, illnesses, and routine care, ensuring pets receive timely medical attention. Flood insurance protects property owners from financial losses due to flood damage, covering repairs and replacements often excluded from standard homeowner policies. Explore the distinct benefits and coverage details of pet health and flood insurance to make an informed decision.

Why it is important

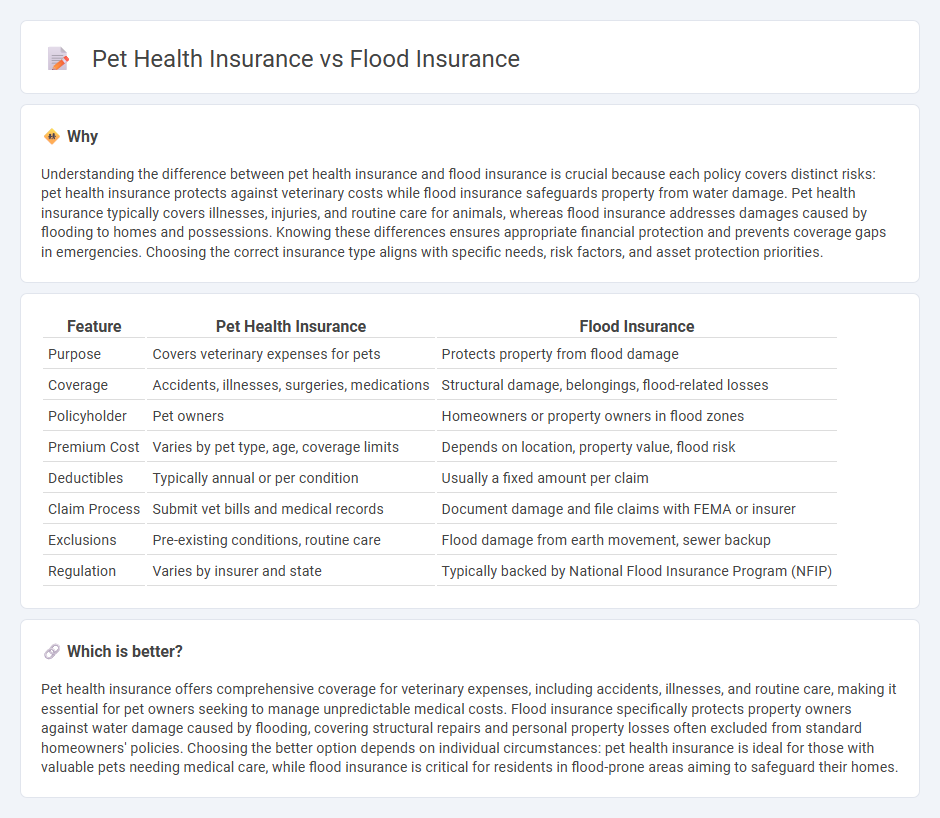

Understanding the difference between pet health insurance and flood insurance is crucial because each policy covers distinct risks: pet health insurance protects against veterinary costs while flood insurance safeguards property from water damage. Pet health insurance typically covers illnesses, injuries, and routine care for animals, whereas flood insurance addresses damages caused by flooding to homes and possessions. Knowing these differences ensures appropriate financial protection and prevents coverage gaps in emergencies. Choosing the correct insurance type aligns with specific needs, risk factors, and asset protection priorities.

Comparison Table

| Feature | Pet Health Insurance | Flood Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Protects property from flood damage |

| Coverage | Accidents, illnesses, surgeries, medications | Structural damage, belongings, flood-related losses |

| Policyholder | Pet owners | Homeowners or property owners in flood zones |

| Premium Cost | Varies by pet type, age, coverage limits | Depends on location, property value, flood risk |

| Deductibles | Typically annual or per condition | Usually a fixed amount per claim |

| Claim Process | Submit vet bills and medical records | Document damage and file claims with FEMA or insurer |

| Exclusions | Pre-existing conditions, routine care | Flood damage from earth movement, sewer backup |

| Regulation | Varies by insurer and state | Typically backed by National Flood Insurance Program (NFIP) |

Which is better?

Pet health insurance offers comprehensive coverage for veterinary expenses, including accidents, illnesses, and routine care, making it essential for pet owners seeking to manage unpredictable medical costs. Flood insurance specifically protects property owners against water damage caused by flooding, covering structural repairs and personal property losses often excluded from standard homeowners' policies. Choosing the better option depends on individual circumstances: pet health insurance is ideal for those with valuable pets needing medical care, while flood insurance is critical for residents in flood-prone areas aiming to safeguard their homes.

Connection

Pet health insurance and flood insurance both mitigate financial risks by covering unexpected expenses resulting from unforeseen events. Each policy addresses specific vulnerabilities--pet health insurance covers veterinary costs from accidents or illnesses, while flood insurance protects property owners against water damage caused by flooding. Together, they exemplify specialized insurance plans designed to provide targeted financial security in distinct areas of personal risk management.

Key Terms

**Flood Insurance:**

Flood insurance provides financial protection against property damage caused by flooding, covering structural repairs and personal belongings within homes located in high-risk flood zones. Offered primarily through the National Flood Insurance Program (NFIP) in the United States, flood insurance is essential for homeowners in flood-prone areas to mitigate the significant costs associated with water damage. Explore comprehensive guides to understand how flood insurance can safeguard your property and ensure peace of mind.

National Flood Insurance Program (NFIP)

The National Flood Insurance Program (NFIP) provides federally backed flood insurance to homeowners, renters, and businesses in participating communities, covering direct physical losses caused by flooding. Pet health insurance protects against veterinary costs for illness or injury but does not cover flood-related damages to property or pets themselves. Explore detailed comparisons to understand how NFIP flood coverage differs fundamentally from pet health policies and what each policy entails.

Flood Zone

Flood insurance is essential for properties located in designated flood zones, providing financial protection against water damage caused by rising water levels and heavy rainfall. Pet health insurance, by contrast, covers veterinary care and medical expenses for pets but does not offer any protection related to property or flood risks. Explore detailed comparisons to determine which insurance suits your specific needs and location.

Source and External Links

Flood Insurance - FEMA's National Flood Insurance Program provides flood coverage to property owners, renters, and businesses, but it must be purchased separately from your homeowners insurance.

Flood Insurance Resources - NFIP policies cover direct physical losses from flooding, including overflow and runoff of water, but typically exclude losses caused by earth movement, even if triggered by floodwaters.

Get a Flood Insurance Quote Now! - GEICO offers NFIP policies backed by the federal government, with rates tailored to your area and service managed alongside your existing GEICO accounts.

dowidth.com

dowidth.com